Question: It doesn't give me a year it is calculated in. I'm guessing either 2019 or 2020. Can you get an answer in both years? Tax

It doesn't give me a year it is calculated in. I'm guessing either 2019 or 2020. Can you get an answer in both years?

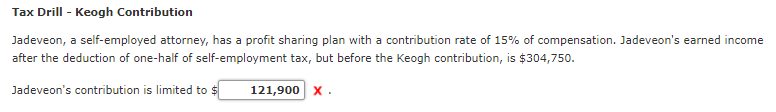

Tax Drill - Keogh Contribution Jadeveon, a self-employed attorney, has a profit sharing plan with a contribution rate of 15% of compensation. Jadeveon's earned income after the deduction of one-half of self-employment tax, but before the Keogh contribution, is $304,750. Jadeveon's contribution is limited to $ 121,900 X Tax Drill - Keogh Contribution Jadeveon, a self-employed attorney, has a profit sharing plan with a contribution rate of 15% of compensation. Jadeveon's earned income after the deduction of one-half of self-employment tax, but before the Keogh contribution, is $304,750. Jadeveon's contribution is limited to $ 121,900 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts