Question: it has a B part also Flounder Spa shows a general Yedger balance for the Cash account of $4,002.35 on June 30 and the bank

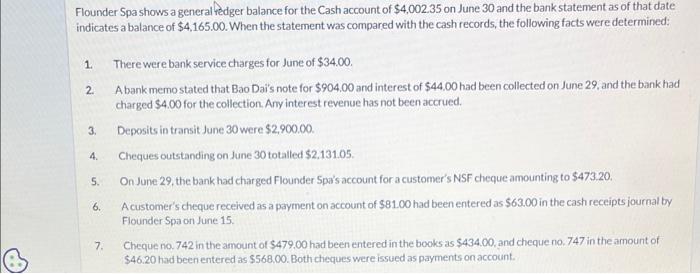

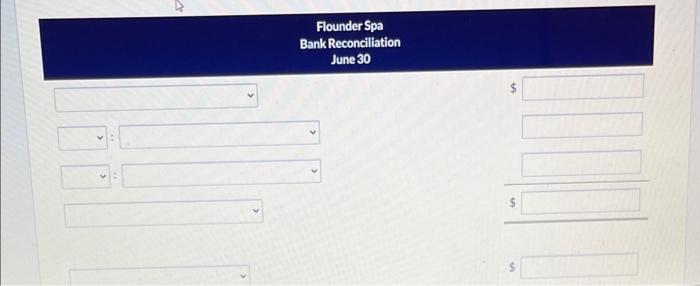

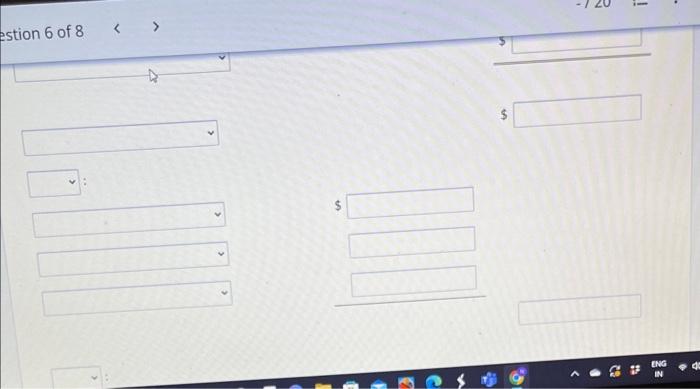

Flounder Spa shows a general Yedger balance for the Cash account of $4,002.35 on June 30 and the bank statement as of that date indicates a balance of $4,165.00. When the statement was compared with the cash records, the following facts were determined: 1. There were bank service charges for June of $34.00. 2. A bank memostated that Bao Dais note for $904,00 and interest of $44,00 had been collected on June 29 , and the bank had charged $4.00 for the collection. Any interest revenue has not been accrued. 3. Deposits in transit June 30 were $2,900.00. 4. Cheques outstanding on June 30 totalled $2,131.05. 5. On June 29, the bank had charged Flounder Spa's account for a customer's NSF cheque amounting to \$473.20. 6. Acustomer's cheque received as a payment on account of $81.00 had been entered as $63.00 in the cash receipts journal by Flounder Spa on June 15. 7. Cheque no. 742 in the amount of $479.00 had been entered in the books as $434.00, and cheque no. 747 in the amount of $46.20 had been entered as $568.00. Both cheques were issued as payments on account. 6. A customer's cheque received as a payment on account of $81.00 had been entered as $63.00 in the cash receipts journal by Flounder Spa on June 15. 7. Cheque no. 742 in the amount of $479.00 had been entered in the books as $434.00, and cheque no. 747 in the amount of $46.20 had been entered as $568.00. Both cheques were issued as payments on account. 8. In May, the bank had charged a $20.50 Wella Spa cheque against the Flounder Spa account. The June bank statement indicated that the bank had reversed this charge and corrected its error. $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts