Question: It has already been established that the project requires a return of at least 12% in order to be viable. The business currently has an

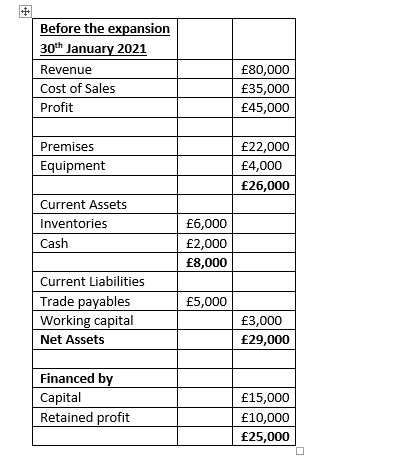

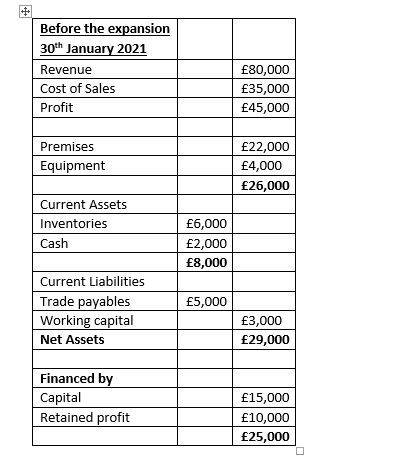

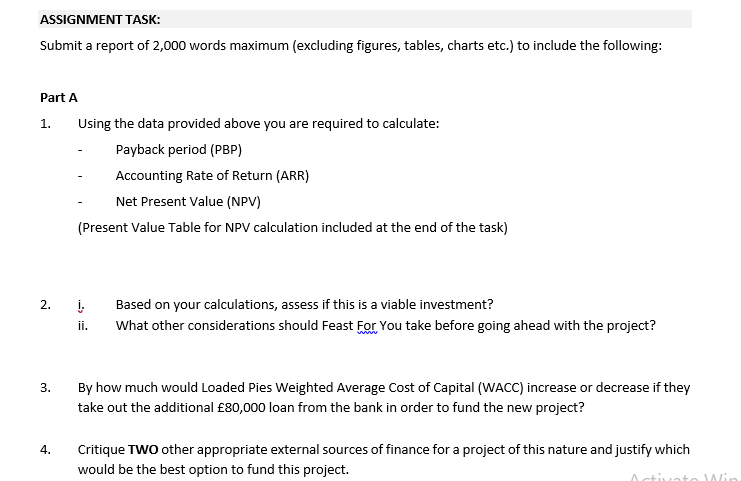

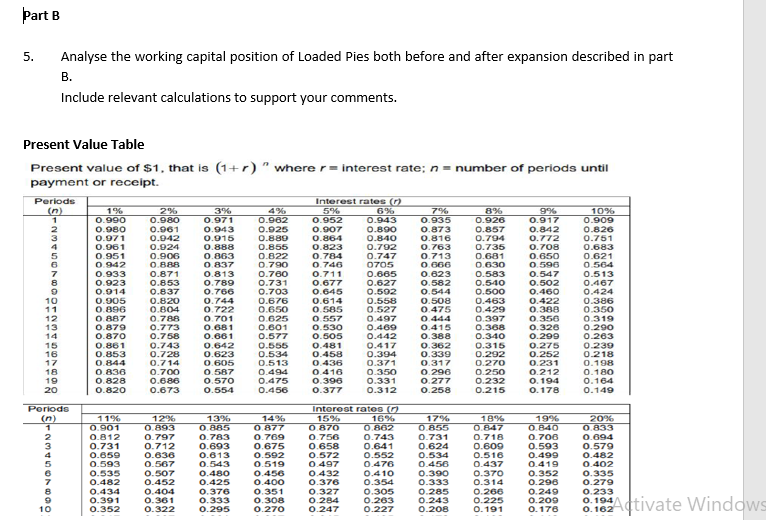

It has already been established that the project requires a return of at least 12% in order to be viable. The business currently has an existing bank loan of 40,000 at an interest rate of 3% and an overdraft of 11,000 on which they pay interest of 7%. The management team of Loaded Pies established that the cost of borrowing an additional 80,000 from the bank to fund the expansion project would be 5%. Part B One year later... The take away outlet opened and after a successful year of trading, Loaded Pies decide to expand the locations of their takeaway outlets across the UK even further by: Acquiring additional premises Purchasing more stock Hiring more staff An extract from their financial statements before the expansion (30th January 2021) and after the expansion (30th January 2022) is shown below: + Before the expansion 30th January 2021 Revenue Cost of Sales Profit 80,000 35,000 45,000 Premises Equipment 22,000 4,000 26,000 Current Assets Inventories Cash 6,000 2,000 8,000 Current Liabilities Trade payables Working capital Net Assets 5,000 3,000 29,000 Financed by Capital Retained profit 15,000 10,000 25,000 + Before the expansion 30th January 2021 Revenue Cost of Sales Profit 80,000 35,000 45,000 Premises Equipment 22,000 4,000 26,000 Current Assets Inventories Cash 6,000 2,000 8,000 Current Liabilities Trade payables Working capital Net Assets 5,000 3,000 29,000 Financed by Capital Retained profit 15,000 10,000 25,000 ASSIGNMENT TASK: Submit a report of 2,000 words maximum (excluding figures, tables, charts etc.) to include the following: 1. Part A Using the data provided above you are required to calculate: Payback period (PBP) Accounting Rate of Return (ARR) Net Present Value (NPV) (Present Value Table for NPV calculation included at the end of the task) 2. i ii. Based on your calculations, assess if this is a viable investment? What other considerations should Feast For You take before going ahead with the project? 3. 3 By how much would Loaded Pies Weighted Average cost of Capital (WACC) increase or decrease if they take out the additional 80,000 loan from the bank in order to fund the new project? 4. Critique TWO other appropriate external sources of finance for a project of this nature and justify which would be the best option to fund this project. Actinte Part B 5. Analyse the working capital position of Loaded Pies both before and after expansion described in part B. Include relevant calculations to support your comments. Present Value Table Present value of $1, that is (1+r)" where r= interest rate; n = number of periods until payment or receipt. Periods Interest rates (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.980 0.961 0.943 0.025 0.007 0.800 0.873 0.857 0.842 0.826 0.971 0.942 0.915 0.889 0.8644 0.840 0.816 0.794 0.772 0.751 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0942 0.888 0.837 0.790 0.740 0705 0.000 0.630 0.596 0504 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0 887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.350 0.319 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 14 0.870 0.290 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.203 15 0.861 0.743 0.642 0.556 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.390 0.331 0.277 0.232 0.194 0.164 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 Periods intorost ratos (n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.650 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.593 0.507 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.200 10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 1 2 3 # sungsBT23HBBBB 20 MOONWOO 18944tivate Windows It has already been established that the project requires a return of at least 12% in order to be viable. The business currently has an existing bank loan of 40,000 at an interest rate of 3% and an overdraft of 11,000 on which they pay interest of 7%. The management team of Loaded Pies established that the cost of borrowing an additional 80,000 from the bank to fund the expansion project would be 5%. Part B One year later... The take away outlet opened and after a successful year of trading, Loaded Pies decide to expand the locations of their takeaway outlets across the UK even further by: Acquiring additional premises Purchasing more stock Hiring more staff An extract from their financial statements before the expansion (30th January 2021) and after the expansion (30th January 2022) is shown below: + Before the expansion 30th January 2021 Revenue Cost of Sales Profit 80,000 35,000 45,000 Premises Equipment 22,000 4,000 26,000 Current Assets Inventories Cash 6,000 2,000 8,000 Current Liabilities Trade payables Working capital Net Assets 5,000 3,000 29,000 Financed by Capital Retained profit 15,000 10,000 25,000 + Before the expansion 30th January 2021 Revenue Cost of Sales Profit 80,000 35,000 45,000 Premises Equipment 22,000 4,000 26,000 Current Assets Inventories Cash 6,000 2,000 8,000 Current Liabilities Trade payables Working capital Net Assets 5,000 3,000 29,000 Financed by Capital Retained profit 15,000 10,000 25,000 ASSIGNMENT TASK: Submit a report of 2,000 words maximum (excluding figures, tables, charts etc.) to include the following: 1. Part A Using the data provided above you are required to calculate: Payback period (PBP) Accounting Rate of Return (ARR) Net Present Value (NPV) (Present Value Table for NPV calculation included at the end of the task) 2. i ii. Based on your calculations, assess if this is a viable investment? What other considerations should Feast For You take before going ahead with the project? 3. 3 By how much would Loaded Pies Weighted Average cost of Capital (WACC) increase or decrease if they take out the additional 80,000 loan from the bank in order to fund the new project? 4. Critique TWO other appropriate external sources of finance for a project of this nature and justify which would be the best option to fund this project. Actinte Part B 5. Analyse the working capital position of Loaded Pies both before and after expansion described in part B. Include relevant calculations to support your comments. Present Value Table Present value of $1, that is (1+r)" where r= interest rate; n = number of periods until payment or receipt. Periods Interest rates (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.980 0.961 0.943 0.025 0.007 0.800 0.873 0.857 0.842 0.826 0.971 0.942 0.915 0.889 0.8644 0.840 0.816 0.794 0.772 0.751 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0942 0.888 0.837 0.790 0.740 0705 0.000 0.630 0.596 0504 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0 887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.350 0.319 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 14 0.870 0.290 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.203 15 0.861 0.743 0.642 0.556 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.390 0.331 0.277 0.232 0.194 0.164 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 Periods intorost ratos (n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.650 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.593 0.507 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.200 10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 1 2 3 # sungsBT23HBBBB 20 MOONWOO 18944tivate Windows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts