Question: It has been estimated that it will cost Nike $ 3.0 billion to establish a presence in this business. Of the initial investment of $3

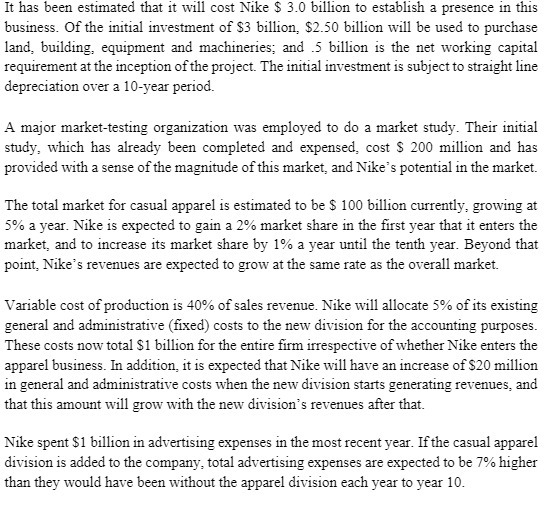

It has been estimated that it will cost Nike $ 3.0 billion to establish a presence in this business. Of the initial investment of $3 billion, $2.50 billion will be used to purchase land, building, equipment and machineries; and .5 billion is the net working capital requirement at the inception of the project. The initial investment is subject to straight line depreciation over a 10-year period. A major market-testing organization was employed to do a market study. Their initial study, which has already been completed and expensed, cost $ 200 million and has provided with a sense of the magnitude of this market, and Nike's potential in the market. The total market for casual apparel is estimated to be $ 100 billion currently, growing at 5% a year. Nike is expected to gain a 2% market share in the first year that it enters the market, and to increase its market share by 1% a year until the tenth year. Beyond that point, Nike's revenues are expected to grow at the same rate as the overall market. Variable cost of production is 40% of sales revenue. Nike will allocate 5% of its existing general and administrative (fixed) costs to the new division for the accounting purposes. These costs now total $1 billion for the entire firm irrespective of whether Nike enters the apparel business. In addition, it is expected that Nike will have an increase of $20 million in general and administrative costs when the new division starts generating revenues, and that this amount will grow with the new division's revenues after that. Nike spent $1 billion in advertising expenses in the most recent year. If the casual apparel division is added to the company, total advertising expenses are expected to be 7% higher than they would have been without the apparel division each year to year 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts