Question: It has been four years since Todd last asked for advice. He has implemented a lot of changes. One of which was not to

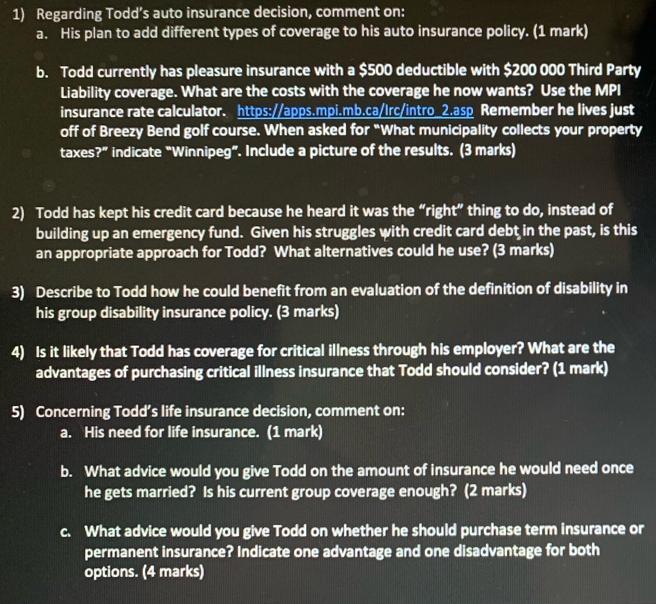

It has been four years since Todd last asked for advice. He has implemented a lot of changes. One of which was not to change his living arrangement. Todd loves living off of the Breezy Bend golf course in Headingly, Manitoba. Since you last spoke, he received a promotion and raise at work, took in a roommate so he could pay off his credit card debt and car loan, and is talking about getting married with his current girlfriend and starting a family. The one thing he has not started doing yet is investing for his future. With his debts paid off the cash flow is now there. Given this new stage in his life he is looking at managing his risk in terms of insurance. He has attached his updated cash flow and net worth statements. He has a credit card with a $10,000 limit for 'emergency use that he hasn't had to use in the past few months. He wants to share his plans to upgrade his auto insurance for his 2013 Honda Accord EX-L V6 (4WD). Specifically, he would like to add several types of coverage to his policy, such as enhancing liability coverage and loss of use coverage. The latter is due to the travel needed with his promotion. Todd is now 39 years old. Unfortunately, he also has a driving record that contains several speeding tickets and two accidents. His last accident was this past spring where he was determined to be at fault. As a result, he does not receive any discount on his insurance with MPI. Given what he has heard from some of his colleagues, he would like to have all purpose coverage with a $200 deductible, increase his Third Party Liability to $2million, and add the maximum Extension Loss of Use coverage. His insurance territory is Winnipeg. He doesn't think he need new vehicle protection or leased vehicle coverage and his vehicle is not worth more than $50,000. Given he is trying to budget better, he wants to know what the monthly payments would be. Todd is currently paying $180 per month, which is included in the Car Expenses amount listed in his current personal cash flow statement (provided below). Todd mentions that he is generally happy with the group insurance benefits that are available to him through his employer. With respect to these benefits. Todd's greatest concern is making sure that he has adequate coverage in the event of a long-term disability. Luckily, Todd's coverage at work provides him with 90% replacement of his after-tax income. When you ask Todd about the definition of disability under his group plan, he has no idea what itmight be. Todd's group life insurance covers one year of his salary. He is not sure if this is enough insurance and is trying to decide between additional term life insurance and permanent life insurance. Todd knows very little about whether he should have insurance, and if so, how much. 1) Regarding Todd's auto insurance decision, comment on: a. His plan to add different types of coverage to his auto insurance policy. (1 mark) b. Todd currently has pleasure insurance with a $500 deductible with $200 000 Third Party Liability coverage. What are the costs with the coverage he now wants? Use the MPI insurance rate calculator. https://apps.mpi.mb.ca/lrc/intro 2.asp Remember he lives just off of Breezy Bend golf course. When asked for "What municipality collects your property taxes?" indicate "Winnipeg". Include a picture of the results. (3 marks) 2) Todd has kept his credit card because he heard it was the "right" thing to do, instead of building up an emergency fund. Given his struggles with credit card debt in the past, is this an appropriate approach for Todd? What alternatives could he use? (3 marks) 3) Describe to Todd how he could benefit from an evaluation of the definition of disability in his group disability insurance policy. (3 marks) 4) Is it likely that Todd has coverage for critical illness through his employer? What are the advantages of purchasing critical illness insurance that Todd should consider? (1 mark) 5) Concerning Todd's life insurance decision, comment on: a. His need for life insurance. (1 mark) b. What advice would you give Todd on the amount of insurance he would need once he gets married? Is his current group coverage enough? (2 marks) c. What advice would you give Todd on whether he should purchase term insurance or permanent insurance? Indicate one advantage and one disadvantage for both options. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Regarding Todds auto insurance decision a Todds plan to add different types of coverage to his auto insurance policy is a responsible approach especially considering his past driving record and the ... View full answer

Get step-by-step solutions from verified subject matter experts