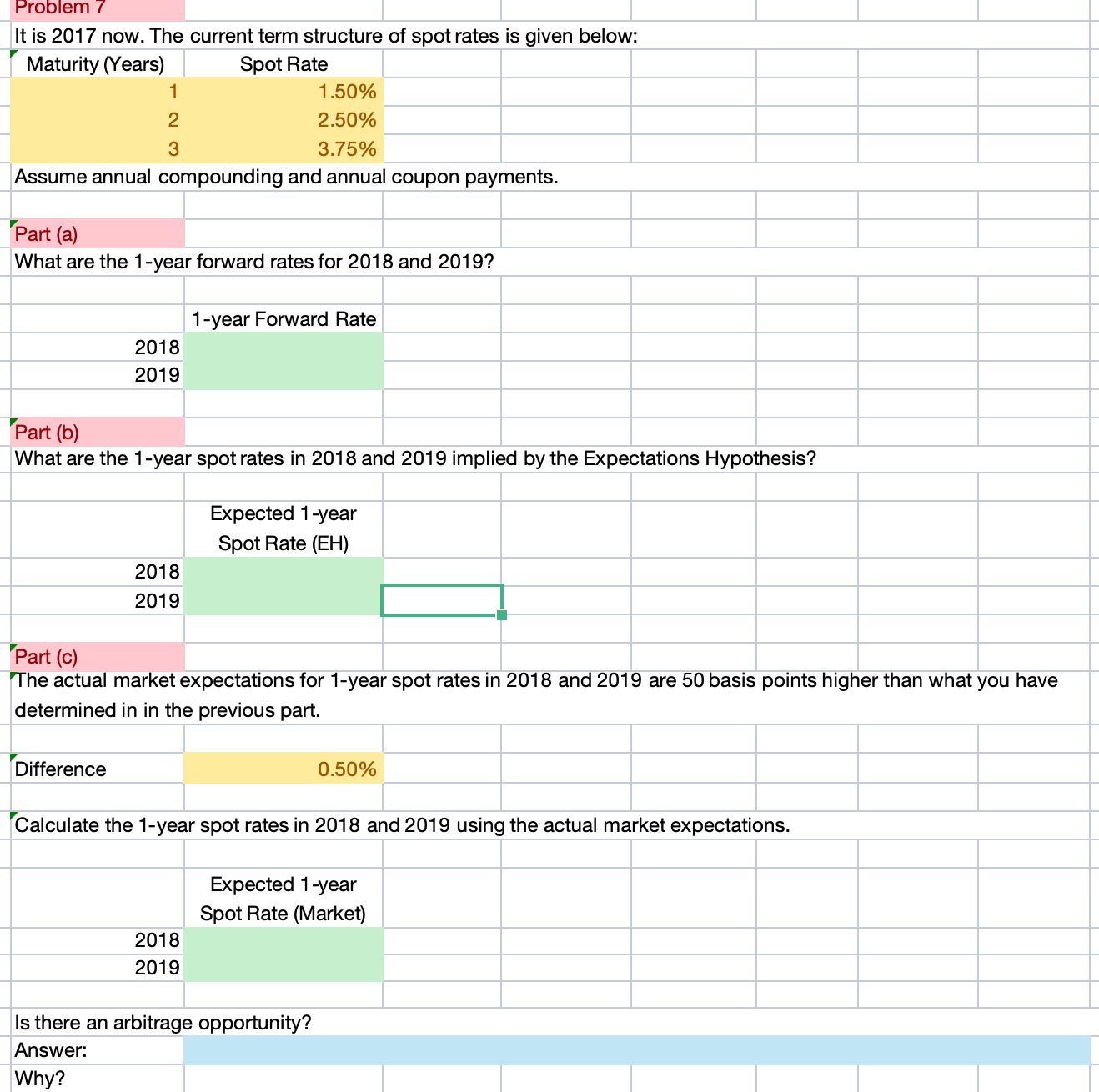

Question: It is 2 0 1 7 now. The current term structure of spot rates is given below: Assume annual compounding and annual coupon payments. Part

It is now. The current term structure of spot rates is given below:

Assume annual compounding and annual coupon payments.

Part a

What are the year forward rates for and

Part b

What are the year spot rates in and implied by the Expectations Hypothesis?

The actual market expectations for year spot rates in and are basis points higher than what you have

determined in in the previous part.

Difference

Calculate the year spot rates in and using the actual market expectations.

Expected year

Spot Rate Market

Is there an arbitrage opportunity?

Answer:

Why?

Calculate the forward premium at and year horizons by comparing the forward rates to the expected future short

term spot rates use the actual market expectations

Calculate the risk premium at and year horizons by comparing longterm spot rates and expected shortterm spot

rates use the actual market expectations

Is the risk premium negativezeropositive

Answer:

Why?

Answer:

Part e

You are going to buy a year zerocoupon bond with a face value of $ now in and sell it in one year.

Compute the expected total return on your investment strategy use the actual market expectations

Compute the term premium by comparing the expected return on the longterm bond and the current shortterm spot rat

Term premium

Is the expected total return greater thanequal tosmaller than the current year spot rate?

Answer:

Why?

Answer: please solve each part of problem

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock