Question: It is 2-3 pages report please do it. I have no idea how to do Prompts: You are submitting a recommendation to the Investment Committee

It is 2-3 pages report please do it. I have no idea how to do

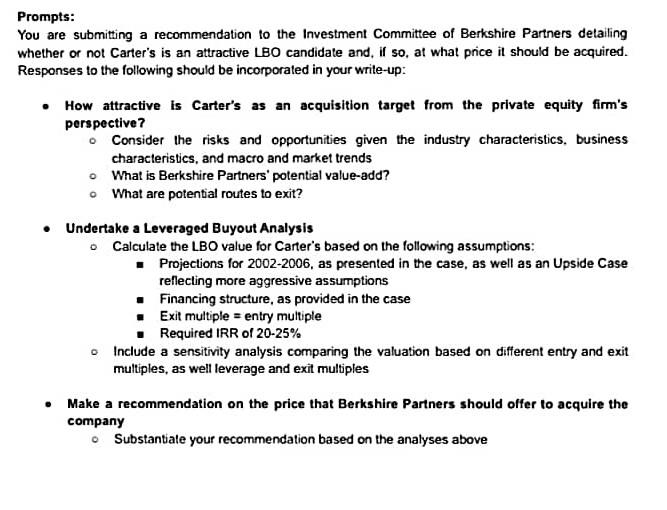

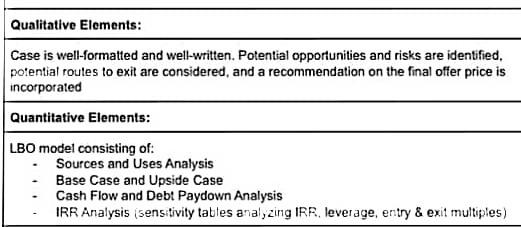

Prompts: You are submitting a recommendation to the Investment Committee of Berkshire Partners detailing whether or not Carter's is an attractive LBO candidate and, if so, at what price it should be acquired. Responses to the following should be incorporated in your write-up: How attractive is Carter's as an acquisition target from the private equity firm's perspective ? Consider the risks and opportunities given the industry characteristics, business characteristics, and macro and market trends What is Berkshire Partners' potential value-add? What are potential routes to exit? Undertake a Leveraged Buyout Analysis Calculate the LBO value for Carter's based on the following assumptions: Projections for 2002-2006, as presented in the case, as well as an Upside Case reflecting more aggressive assumptions Financing structure, as provided in the case Exit multiple = entry multiple Required IRR of 20-25% Include a sensitivity analysis comparing the valuation based on different entry and exit multiples, as well leverage and exit multiples Make a recommendation on the price that Berkshire Partners should offer to acquire the company Substantiate your recommendation based on the analyses above Qualitative Elements: Case is well-formatted and well-written. Potential opportunities and risks are identified, potential routes to exit are considered, and a recommendation on the final offer price is incorporated Quantitative Elements: LBO model consisting of: Sources and Uses Analysis Base Case and Upside Case Cash Flow and Debt Paydown Analysis IRR Analysis (sensitivity tables analyzing IRR leverage, entry & exit multiples) Prompts: You are submitting a recommendation to the Investment Committee of Berkshire Partners detailing whether or not Carter's is an attractive LBO candidate and, if so, at what price it should be acquired. Responses to the following should be incorporated in your write-up: How attractive is Carter's as an acquisition target from the private equity firm's perspective ? Consider the risks and opportunities given the industry characteristics, business characteristics, and macro and market trends What is Berkshire Partners' potential value-add? What are potential routes to exit? Undertake a Leveraged Buyout Analysis Calculate the LBO value for Carter's based on the following assumptions: Projections for 2002-2006, as presented in the case, as well as an Upside Case reflecting more aggressive assumptions Financing structure, as provided in the case Exit multiple = entry multiple Required IRR of 20-25% Include a sensitivity analysis comparing the valuation based on different entry and exit multiples, as well leverage and exit multiples Make a recommendation on the price that Berkshire Partners should offer to acquire the company Substantiate your recommendation based on the analyses above Qualitative Elements: Case is well-formatted and well-written. Potential opportunities and risks are identified, potential routes to exit are considered, and a recommendation on the final offer price is incorporated Quantitative Elements: LBO model consisting of: Sources and Uses Analysis Base Case and Upside Case Cash Flow and Debt Paydown Analysis IRR Analysis (sensitivity tables analyzing IRR leverage, entry & exit multiples)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts