Question: it is a 15 part question Homework: Chapter 6 Homework Score: 0 of 15 pts Problem 6-14 (similar to) 3 of 8 (0 complete) HW

it is a 15 part question

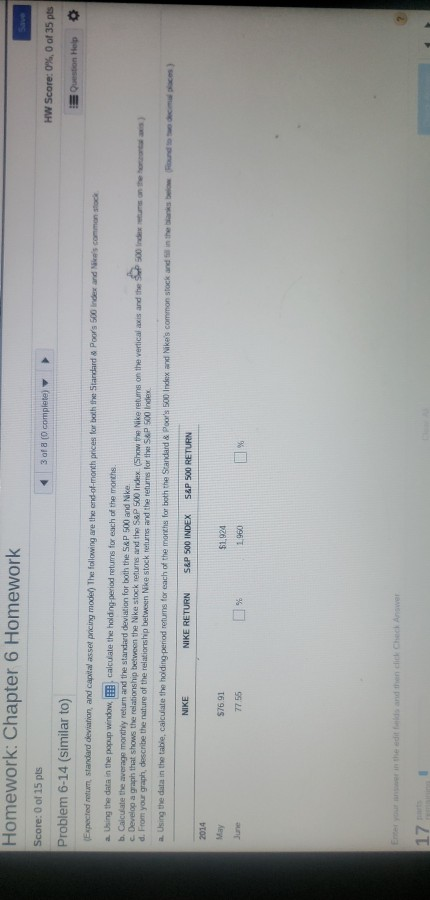

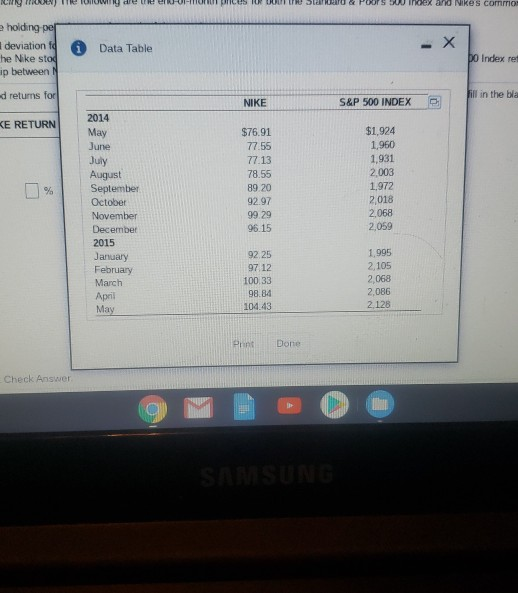

Homework: Chapter 6 Homework Score: 0 of 15 pts Problem 6-14 (similar to) 3 of 8 (0 complete) HW Score: 0% 0 of 35 pts Question Help (Expected retum, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 index and i s common stock a. Using the data in the popup window, calculate the holding period retums for each of the months. b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nike Develop a graph that shows the relationship between the Nike stock retums and the S&P 500 Index Show the Nike retums on the vertical axis and the SW d. From your graph, describe the nature of the relationship between Nike stock returns and the return for the S&P 500 Index 500 inde r s on the hors a. Using the data in the table, calculate the holding period retums for each of the months for both the Standard & Poor's 500 Index and Nike's common stock and fill in the banks b o und to aces) NIKE NIKE RETURN S&P 500 INDEX S&P 500 RETURN 2014 $1.924 S76.91 7756 June % 1.960 1,960 % Enter the edits and then click Check Answer 17 UUUUUUUUUUUUUUURT S UR DE NOS CONG holding per deviation he Nike stog ip between N Data Table -X bo Index re d returns for NIKE S&P 500 INDEX All in the bila KE RETURN 2014 May June July August September October November December 2015 January February March April May $76.91 77.55 77 13 78.55 89.20 92.97 99.29 96.15 $1,924 1,960 1,931 2.003 1.972 2,018 2.068 2059 92 25 97 12 100:33 98.84 104.43 1.995 2 105 2,068 2,086 2.128 Print Done Check Answer Homework: Chapter 6 Homework Score: 0 of 15 pts Problem 6-14 (similar to) 3 of 8 (0 complete) HW Score: 0% 0 of 35 pts Question Help (Expected retum, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 index and i s common stock a. Using the data in the popup window, calculate the holding period retums for each of the months. b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nike Develop a graph that shows the relationship between the Nike stock retums and the S&P 500 Index Show the Nike retums on the vertical axis and the SW d. From your graph, describe the nature of the relationship between Nike stock returns and the return for the S&P 500 Index 500 inde r s on the hors a. Using the data in the table, calculate the holding period retums for each of the months for both the Standard & Poor's 500 Index and Nike's common stock and fill in the banks b o und to aces) NIKE NIKE RETURN S&P 500 INDEX S&P 500 RETURN 2014 $1.924 S76.91 7756 June % 1.960 1,960 % Enter the edits and then click Check Answer 17 UUUUUUUUUUUUUUURT S UR DE NOS CONG holding per deviation he Nike stog ip between N Data Table -X bo Index re d returns for NIKE S&P 500 INDEX All in the bila KE RETURN 2014 May June July August September October November December 2015 January February March April May $76.91 77.55 77 13 78.55 89.20 92.97 99.29 96.15 $1,924 1,960 1,931 2.003 1.972 2,018 2.068 2059 92 25 97 12 100:33 98.84 104.43 1.995 2 105 2,068 2,086 2.128 Print Done Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts