Question: it is a 5 part question, please show me how you did it! Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face

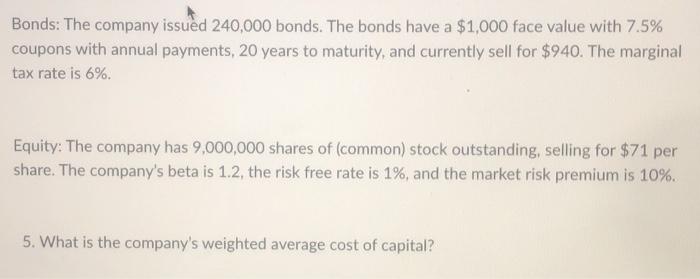

Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face value with 7.5% coupons with annual payments, 20 years to maturity, and currently sell for $940. The marginal tax rate is 6%. Equity: The company has 9,000,000 shares of (common) stock outstanding, selling for $71 per share. The company's beta is 1.2, the risk free rate is 1%, and the market risk premium is 10%. 1. What is the total market value of this firm? Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face value with 7.5% coupons with annual payments, 20 years to maturity, and currently sell for $940. The marginal tax rate is 6%. Equity: The company has 9,000,000 shares of (common) stock outstanding, selling for $71 per share. The company's beta is 1.2, the risk free rate is 1%, and the market risk premium is 10%. 2a. What percent of the company's financing is debt? 2b. What percent of the company's financing is equity? Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face value with 7.5% coupons with annual payments, 20 years to maturity, and currently sell for $940. The marginal tax rate is 6%. Equity: The company has 9,000,000 shares of (common) stock outstanding, selling for $71 per share. The company's beta is 1.2, the risk free rate is 1%, and the market risk premium is 10%. 3. What is the after-tax cost of debt? Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face value with 7.5% coupons with annual payments, 20 years to maturity, and currently sell for $940. The marginal tax rate is 6% Equity: The company has 9,000,000 shares of (common) stock outstanding, selling for $71 per share. The company's beta is 1.2, the risk free rate is 1%, and the market risk premium is 10%. 4. What is the cost of equity? Bonds: The company issued 240,000 bonds. The bonds have a $1,000 face value with 7.5% coupons with annual payments, 20 years to maturity, and currently sell for $940. The marginal tax rate is 6% Equity: The company has 9,000,000 shares of (common) stock outstanding, selling for $71 per share. The company's beta is 1.2, the risk free rate is 1%, and the market risk premium is 10%. 5. What is the company's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts