Question: it is a comm 474 fixed income project, only part a, c and d need to be answered, and question c will make use of

it is a comm 474 fixed income project, only part a, c and d need to be answered, and question c will make use of data from question a

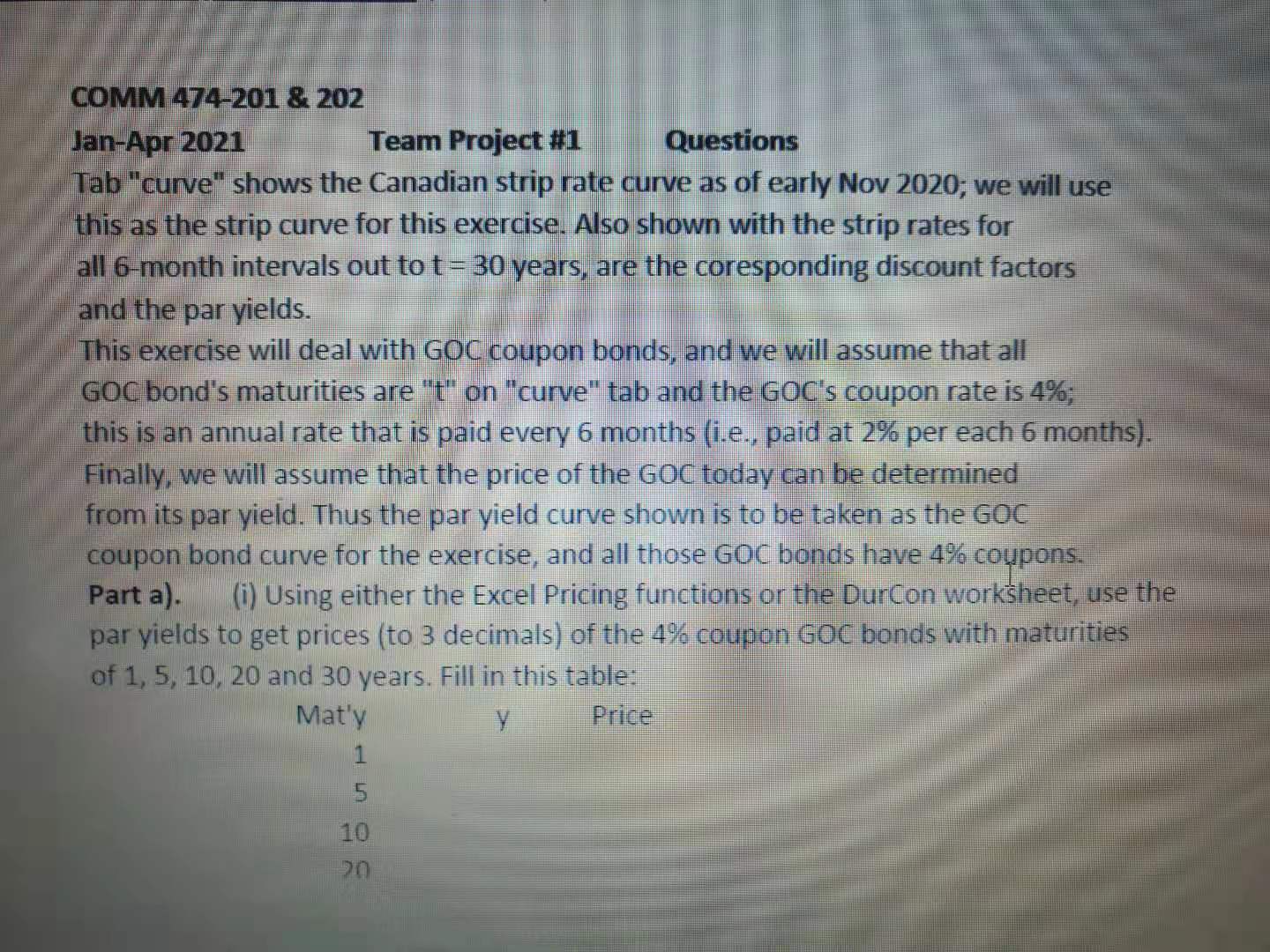

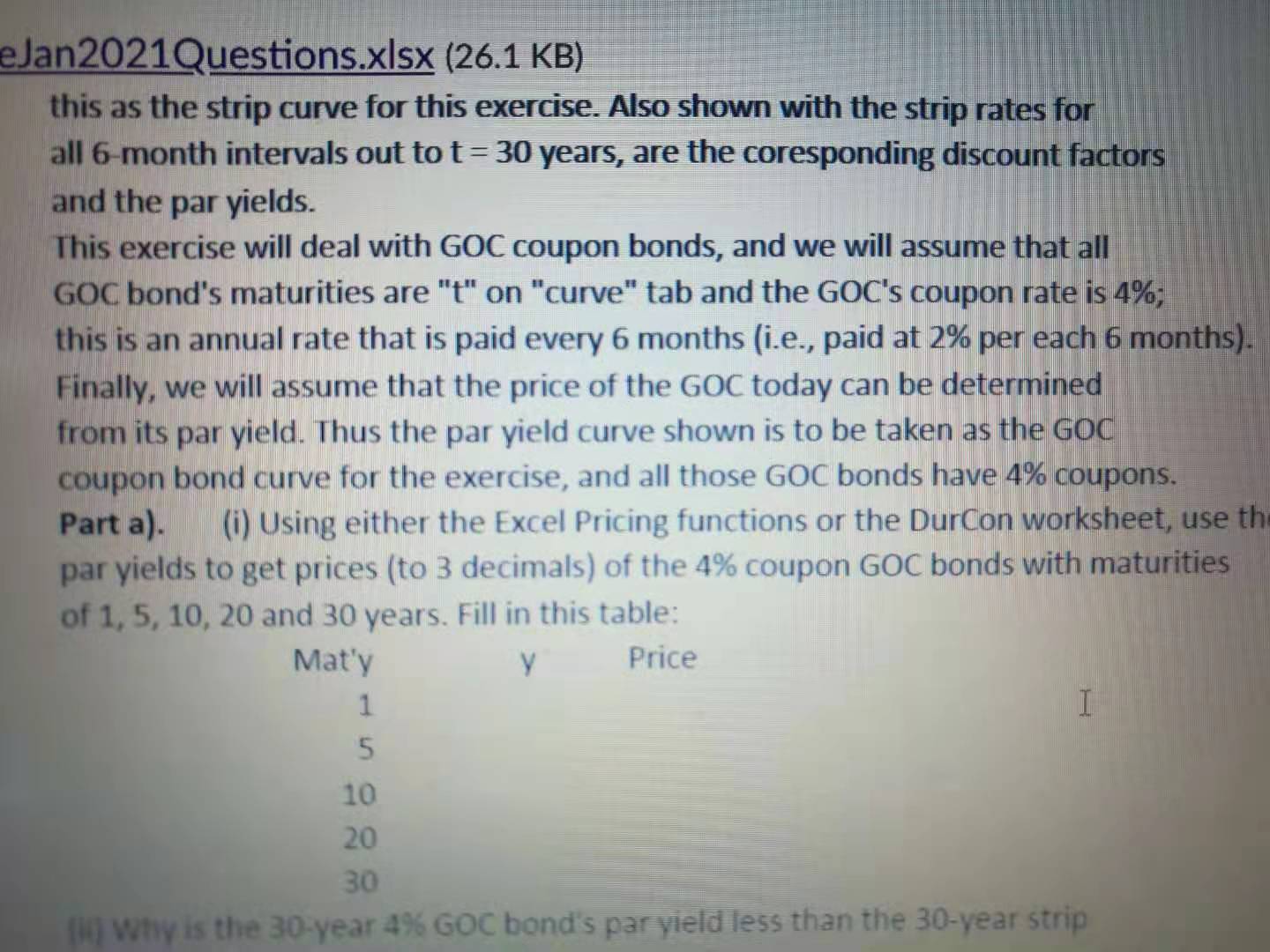

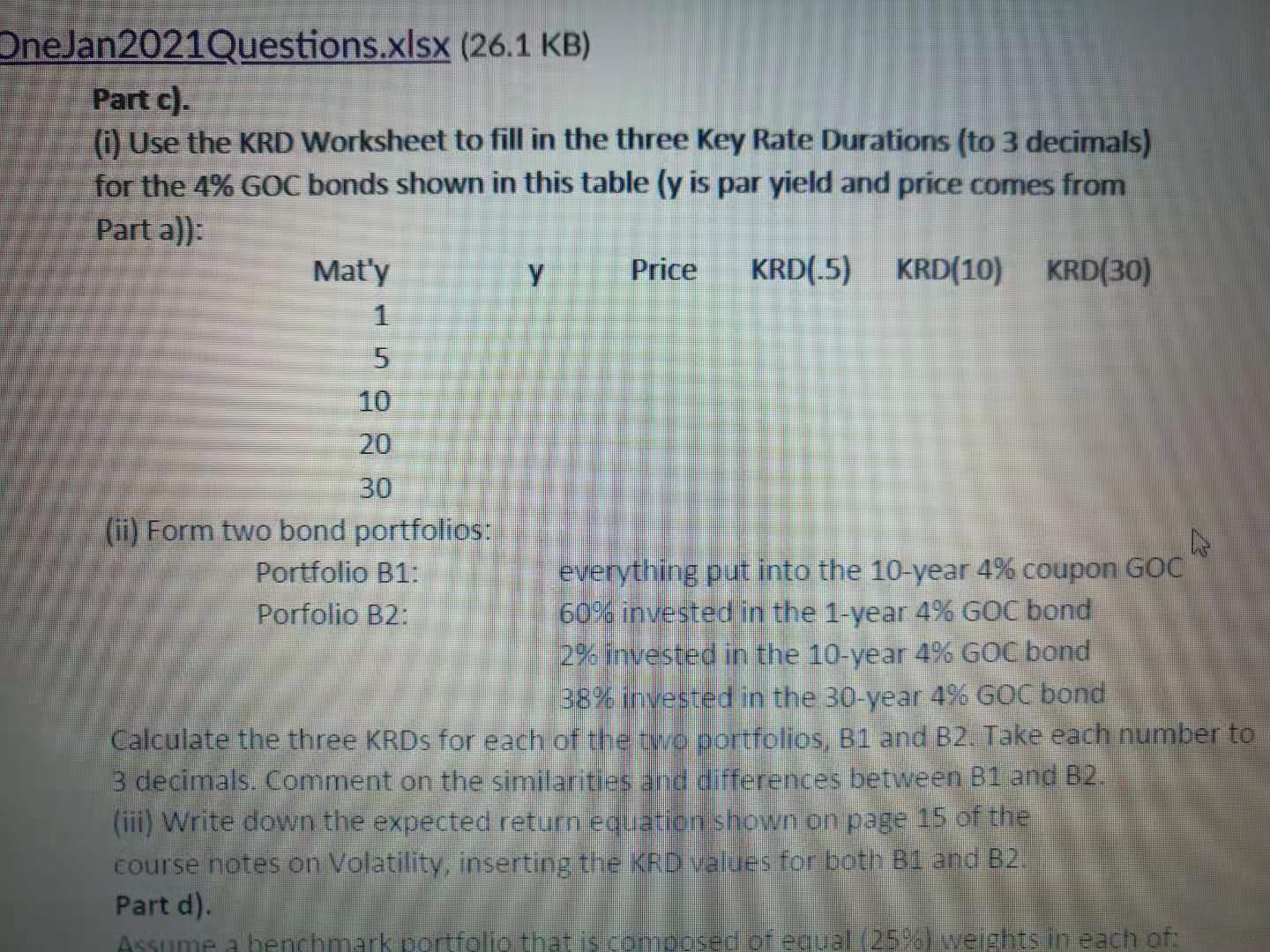

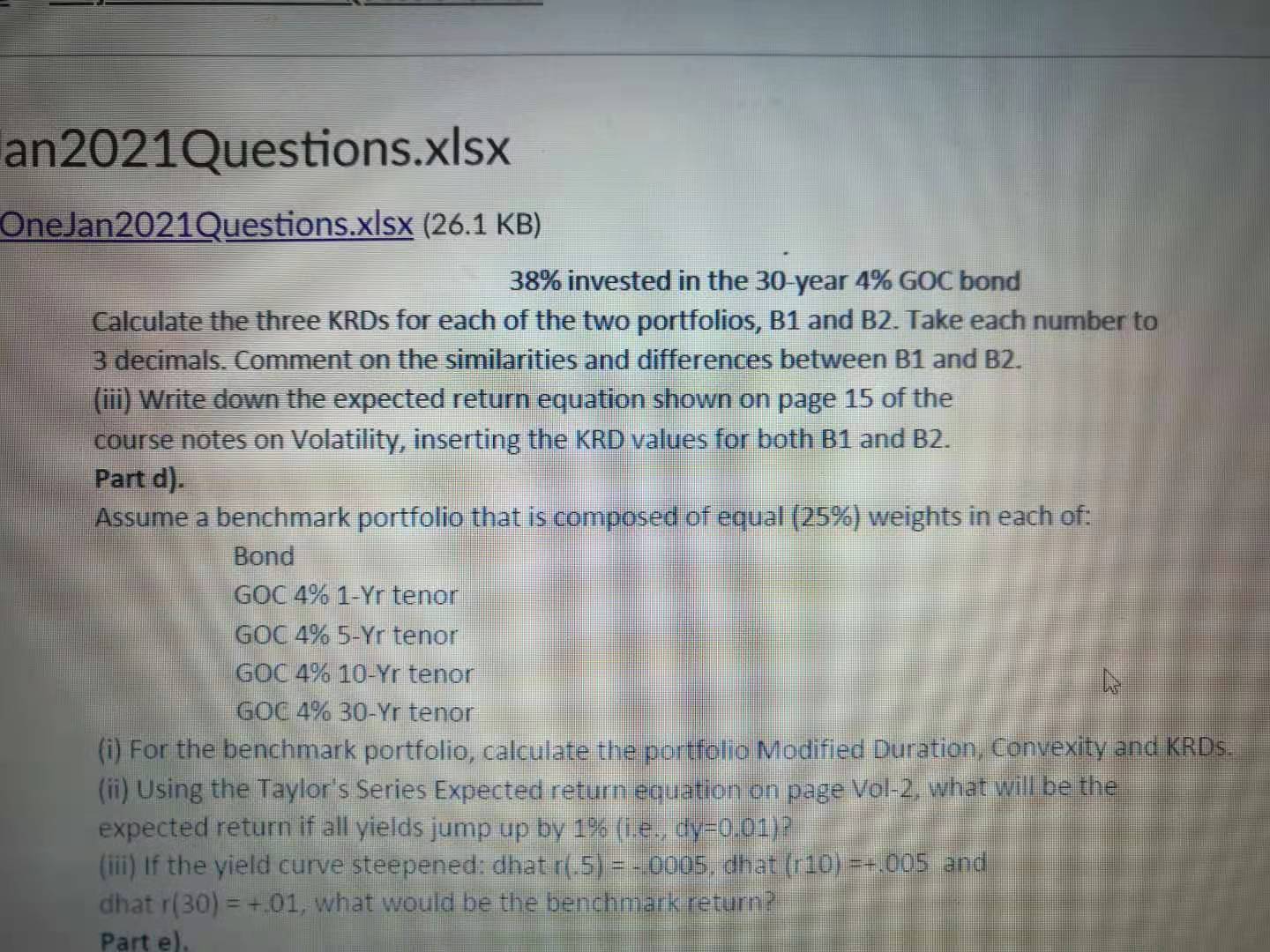

COMM 474-201 & 202 Jan-Apr 2021 Team Project #1 Questions lab "curve" shows the Canadian strip rate curve as of early Nov 2020; we will use this as the strip curve for this exercise. Also shown with the strip rates for all 6 month intervals out to t = 30 years, are the coresponding discount factors and the par yields. This exercise will deal with GOC coupon bonds, and we will assume that all GOC bond's maturities are "t" on "curve" tab and the GOC's coupon rate is 4%; this is an annual rate that is paid every 6 months (i.e., paid at 2% per each 6 months). Finally, we will assume that the price of the GOC today can be determined from its par yield. Thus the par yield curve shown is to be taken as the GOC coupon bond curve for the exercise, and all those GOC bonds have 4% coupons. Part a). (i) Using either the Excel Pricing functions or the DurCon worksheet, use the par yields to get prices (to 3 decimals) of the 4% coupon GOC bonds with maturities of 1, 5, 10, 20 and 30 years. Fill in this table: Matty Price 15 10eJan2021Questions.xIsx (26.1 KB) this as the strip curve for this exercise. Also shown with the strip rates for all 6-month intervals out to t = 30 years, are the coresponding discount factors and the par yields. This exercise will deal with GOC coupon bonds, and we will assume that all GOC bond's maturities are "t" on "curve" tab and the GOC's coupon rate is 4%; this is an annual rate that is paid every 6 months (i.e., paid at 2% per each 6 months). Finally, we will assume that the price of the GOC today can be determined from its par yield. Thus the par yield curve shown is to be taken as the GOC coupon bond curve for the exercise, and all those GOC bonds have 4% coupons. Part a). (i) Using either the Excel Pricing functions or the DurCon worksheet, use th par yields to get prices (to 3 decimals) of the 4% coupon GOC bonds with maturities of 1, 5, 10, 20 and 30 years. Fill in this table: Mat'y Price 5 10 20 30 (i) Why is the 30-year 4% GOC bond's par yield less than the 30-year stripOneJan2021Questions.xIsx (26.1 KB) Part c). (i) Use the KRD Worksheet to fill in the three Key Rate Durations (to 3 decimals) for the 4% GOC bonds shown in this table (y is par yield and price comes from Part a)): Mat'y y Price KRD(-5) KRD(10) KRD(30) 5 10 20 30 (ii) Form two bond portfolios: Portfolio B1: everything put into the 10-year 4% coupon GOC Porfolio B2: 50% invested in the 1-year 4% GOC bond 2%% invested in the 10-year 4% GOC bond 38% invested in the 30-year 4% GOC bond Calculate the three KRDs for each of the to portfolios, 81 and B2. Take each number to 3 decimals. Comment on the similarities and differences between 81 and B2 (iii) Write down the expected return equation shown on page 15 of the course notes on Volatility, inserting the KRO values for both B1 and B2 Part d). benchmark portfolio that is demoused of equal / 12 5Ba) weights in each onan2021Questions.xIsx OneJan2021Questions.xIsx (26.1 KB) 38% invested in the 30-year 4% GOC bond Calculate the three KRDs for each of the two portfolios, B1 and B2. Take each number to 3 decimals. Comment on the similarities and differences between B1 and B2. (iii) Write down the expected return equation shown on page 15 of the course notes on Volatility, inserting the KRD values for both B1 and B2. Part d). Assume a benchmark portfolio that is composed of equal (25%) weights in each of: Bond GOC 4% 1-Yr tenor GOC 4% 5-Yr tenor GOC 4% 10-Yr tenor GOC 4% 30-Yr tenor (i) For the benchmark portfolio, calculate the portfolio Modified Duration, Convexity and KRDs. (ii) Using the Taylor's Series Expected return equation on page Vol-2, what will be the expected return if all yields jump up by 16 (i.e., dy=0.01) ? (iii) If the yield curve steepened: dhat r(.5) = - 0005, dhat (r10) =+.005 and dhat r(30) = +.01, what would be the benchmark return? Part e)