Question: it is a four part question so pls help! Book value versus market value components The CFO of Mi is trying to determine the company's

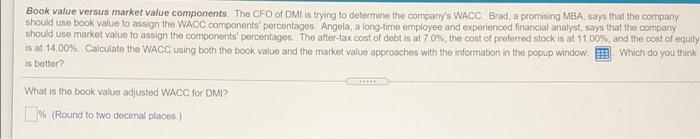

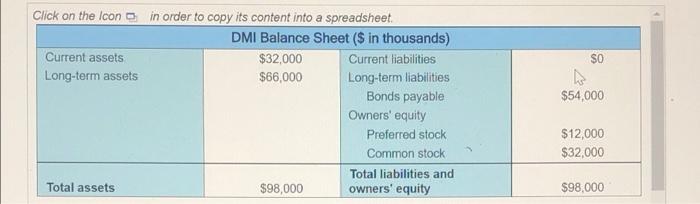

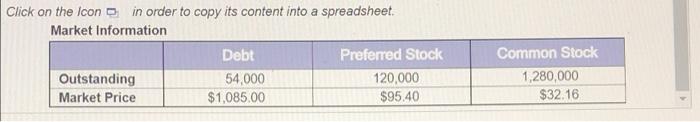

Book value versus market value components The CFO of Mi is trying to determine the company's WACC Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentagos Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 70%, the cost of preferred stock is at 11.00%, and the cost of equity is at 14,00% Calculate the WACC using both the book value and the market value approaches with the information in the popup window. Which do you think is better? What is the book value adjusted WACC for DMI? L% (Round to two decimal places.) $0 Click on the Icon in order to copy its content into a spreadsheet DMI Balance Sheet ($ in thousands) Current assets $32,000 Current liabilities Long-term assets $66,000 Long-term liabilities Bonds payable Owners' equity Preferred stock Common stock Total liabilities and Total assets $98,000 owners' equity $54,000 $12,000 $32,000 $98,000 Click on the icon in order to copy its content into a spreadsheet. Market Information Debt Preferred Stock Outstanding 54,000 120,000 Market Price $1,085.00 $95.40 Common Stock 1,280,000 $32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts