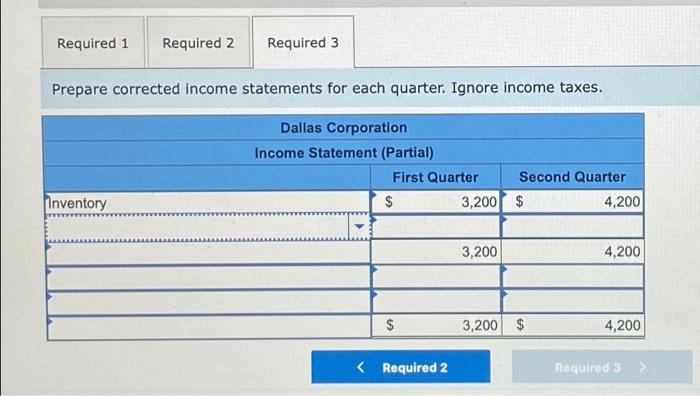

Question: it is a partial income statement and boxes 3 and 5 cant be edited they are the totals of boxes 1 and 2 and then

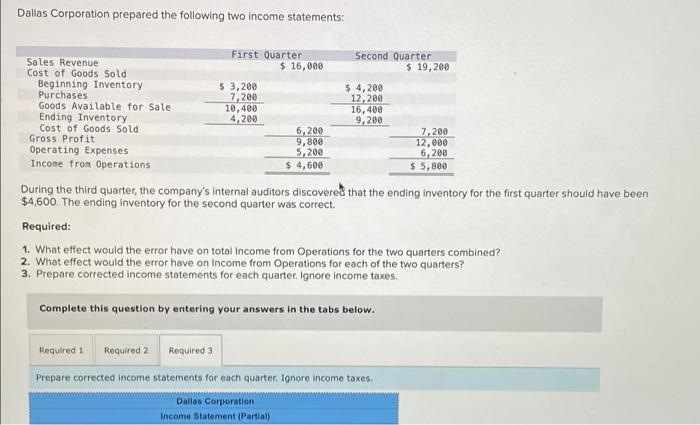

Dallas Corporation prepared the following two income statements: First Quarter Second Quarter Sales Revenue $ 16,000 $ 19, 200 Cost of Goods Sold Beginning Inventory $ 3,200 $ 4,200 Purchases 7,200 12,200 Goods Available for Sale 10,400 16,400 Ending Inventory 4,200 9,200 Cost of Goods Sold 6,200 7,200 Gross Profit 9,800 12, 200 Operating Expenses 5,200 6,280 Income from Operations $ 4,600 $ 5,800 During the third quarter, the company's Internal auditors discovered that the ending inventory for the first quarter should have been $4,600. The ending Inventory for the second quarter was correct. Required: 1. What effect would the error have on total income from Operations for the two quarters combined? 2. What effect would the error have on Income from Operations for each of the two quarters? 3. Prepare corrected income statements for each quarter. Ignore income taxes. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Prepare corrected income statements for each quarter. Ignore income taxes, Dallas Corporation Income Statement (Partial) Required 1 Required 2 Required 3 Prepare corrected Income statements for each quarter. Ignore income taxes. Dallas Corporation Income Statement (Partial) First Quarter Second Quarter $ 3,200 $ 4,200 Inventory 3,200 4,200 $ 3,200 $ 4,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts