Question: It is a python question. uestion 2: You are given the option to invest 1 million dollars in 5 different investments. The returns, risk factors

It is a python question.

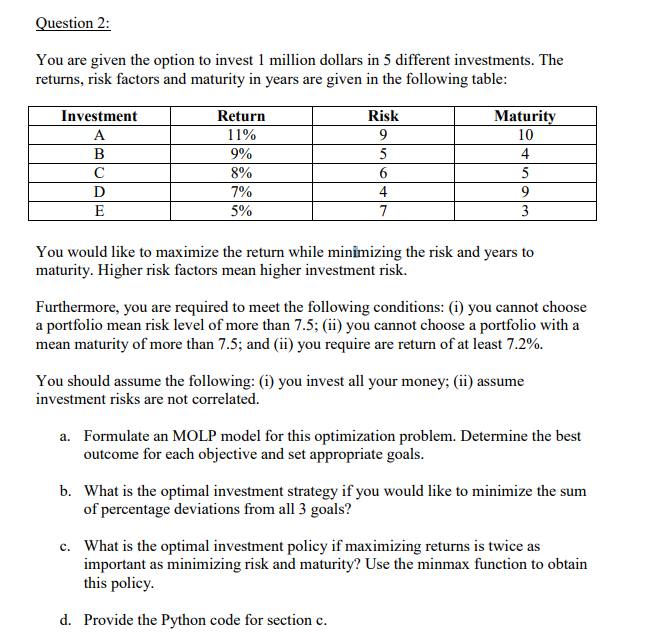

uestion 2: You are given the option to invest 1 million dollars in 5 different investments. The returns, risk factors and maturity in years are given in the following table Risk Maturity Return 11% 9% 8% 7% 5% Investment 4 4 You would like to maximize the return while minimizing the risk and years to maturity. Higher risk factors mean higher investment risk. Furthermore, you are required to meet the following conditions: (i) you cannot choose a portfolio mean risk level of more than 7.5; (ii) you cannot choose a portfolio with a mean maturity of more than 7.5; and (ii) you require are return of at least 7.2%. You should assume the following: (i) you invest all your moneyii) assume investment risks are not correlated. Formulate an MOLP model for this optimization problem. Determine the best outcome for each obiective and se a. t appropriate goals b. What is the optimal investment strategy if you would like to minimize the sum of percentage deviations from all 3 goals'? What is the optimal investment policy if maximizing returns is twice as important as minimizing risk and maturity? Use the minmax function to obtain this policy c. d. Provide the Python code for section c uestion 2: You are given the option to invest 1 million dollars in 5 different investments. The returns, risk factors and maturity in years are given in the following table Risk Maturity Return 11% 9% 8% 7% 5% Investment 4 4 You would like to maximize the return while minimizing the risk and years to maturity. Higher risk factors mean higher investment risk. Furthermore, you are required to meet the following conditions: (i) you cannot choose a portfolio mean risk level of more than 7.5; (ii) you cannot choose a portfolio with a mean maturity of more than 7.5; and (ii) you require are return of at least 7.2%. You should assume the following: (i) you invest all your moneyii) assume investment risks are not correlated. Formulate an MOLP model for this optimization problem. Determine the best outcome for each obiective and se a. t appropriate goals b. What is the optimal investment strategy if you would like to minimize the sum of percentage deviations from all 3 goals'? What is the optimal investment policy if maximizing returns is twice as important as minimizing risk and maturity? Use the minmax function to obtain this policy c. d. Provide the Python code for section c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts