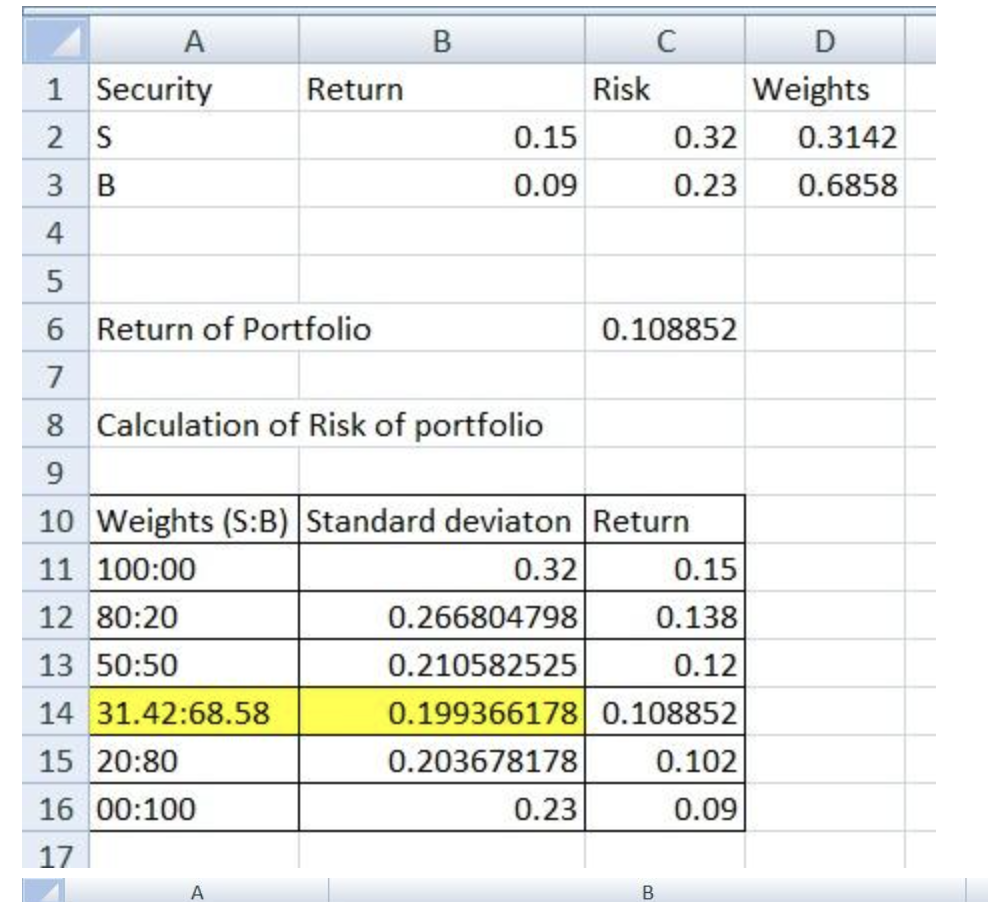

Question: it is a risk-free opportunity set B Return 1 Security 2 S 3 B D Risk Weights 0.15 0.32 0.3142 0.09 0.23 0.6858 4 5

it is a risk-free opportunity set

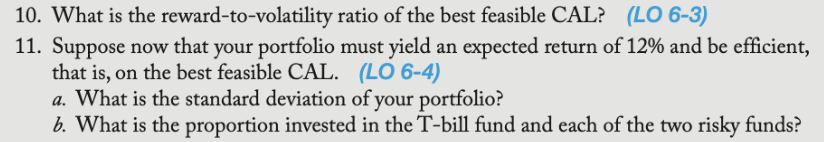

B Return 1 Security 2 S 3 B D Risk Weights 0.15 0.32 0.3142 0.09 0.23 0.6858 4 5 6 Return of Portfolio 0.108852 7 8 Calculation of Risk of portfolio 9 10 Weights (S:B) Standard deviaton Return 11 100:00 0.32 0.15 12 80:20 0.266804798 0.138 13 50:50 0.210582525 0.12 14 31.42:68.58 0.199366178 0.108852 15 20:80 0.203678178 0.102 16 00:100 0.23 0.09 17 A B 10. What is the reward-to-volatility ratio of the best feasible CAL? (LO 6-3) 11. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL. (LO 6-4) a. What is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky funds? B Return 1 Security 2 S 3 B D Risk Weights 0.15 0.32 0.3142 0.09 0.23 0.6858 4 5 6 Return of Portfolio 0.108852 7 8 Calculation of Risk of portfolio 9 10 Weights (S:B) Standard deviaton Return 11 100:00 0.32 0.15 12 80:20 0.266804798 0.138 13 50:50 0.210582525 0.12 14 31.42:68.58 0.199366178 0.108852 15 20:80 0.203678178 0.102 16 00:100 0.23 0.09 17 A B 10. What is the reward-to-volatility ratio of the best feasible CAL? (LO 6-3) 11. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL. (LO 6-4) a. What is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts