Question: It is after January 1 , 2 0 2 4 . Collaborative Corp. is reviewing an investment in a new product line. The cost of

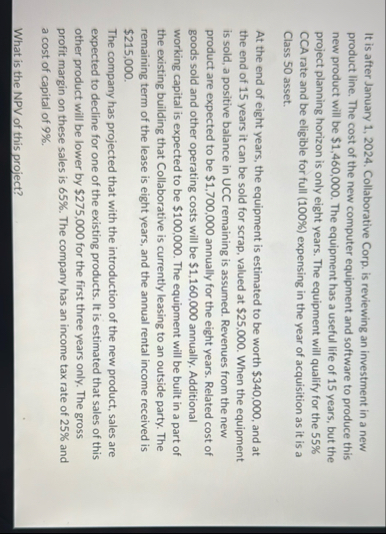

It is after January Collaborative Corp. is reviewing an investment in a new product line. The cost of the new computer equipment and software to produce this new product will be $ The equipment has a useful life of years, but the project planning horizon is only eight years. The equipment will qualify for the CCA rate and be eligible for full expensing in the year of acquisition as it is a Class asset.

At the end of eight years, the equipment is estimated to be worth $ and at the end of years it can be sold for scrap, valued at $ When the equipment is sold, a positive balance in UCC remaining is assumed. Revenues from the new product are expected to be $ annually for the eight years. Related cost of goods sold and other operating costs will be $ annually. Additional working capital is expected to be $ The equipment will be built in a part of the existing building that Collaborative is currently leasing to an outside party. The remaining term of the lease is eight years, and the annual rental income received is $

The company has projected that with the introduction of the new product, sales are expected to decline for one of the existing products. It is estimated that sales of this other product will be lower by $ for the first three years only. The gross profit margin on these sales is The company has an income tax rate of and a cost of capital of

What is the NPV of this project?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock