Question: It is all a connecting question I'm just not sure I'm doing it right. Parent Company acquired 25% of Son Inc. on January 1, 20XI

It is all a connecting question I'm just not sure I'm doing it right.

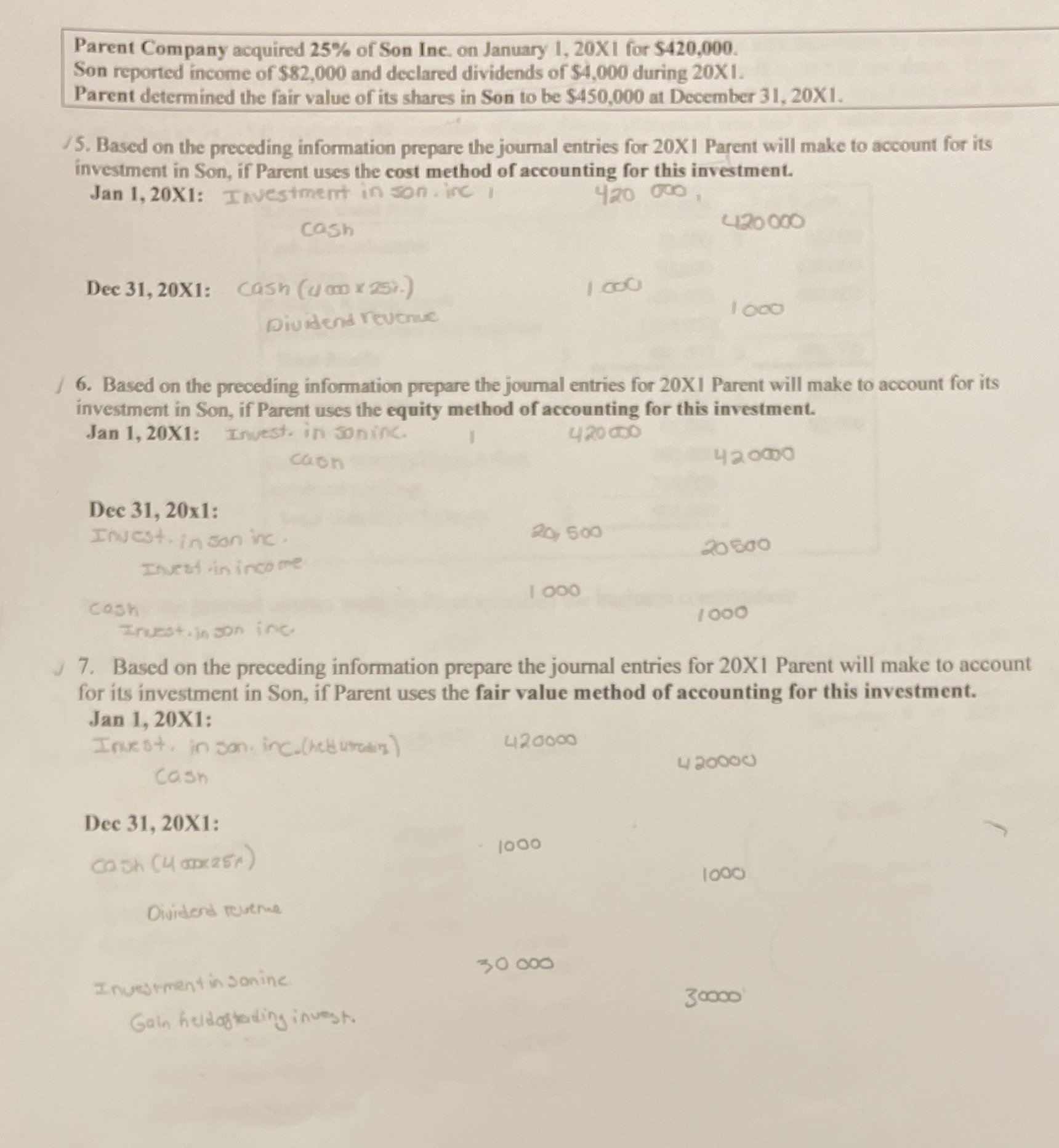

Parent Company acquired 25% of Son Inc. on January 1, 20XI for $420,000. Son reported income of $82,000 and declared dividends of $4,000 during 20X 1. Parent determined the fair value of its shares in Son to be $450,000 at December 31, 20X1. 5. Based on the preceding information prepare the journal entries for 20X | Parent will make to account for its investment in Son, if Parent uses the cost method of accounting for this investment. Jan 1, 20X1: Investment in son . inc 420 090 cash 4120 000 Dec 31, 20X1: cash (u an x 25).) Dividend revenue 1 Ooo 6. Based on the preceding information prepare the journal entries for 20X | Parent will make to account for its investment in Son, if Parent uses the equity method of accounting for this investment. Jan 1, 20X1: Invest. in soninc. 420 0DO caon 42 0000 Dec 31, 20x1: Invest. inson inc 20 500 20 600 Invest in income 1 0oo cash Invest. in son inc 1000 7. Based on the preceding information prepare the journal entries for 20X1 Parent will make to account for its investment in Son, if Parent uses the fair value method of accounting for this investment. Jan 1, 20X1: Invest. in san. inc.(held utrading ) 420000 cash 4/ 20000 Dec 31, 20X1: 1000 cash (4 (D( 25/ ) 1000 Dividend Ruthie 30 000 Investment in sonine 30000 Gain heldopteding invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts