Question: It is all one question please help me solve it, the middle photo is the beginning of the journal entry sheet prompt Fit for Life

It is all one question please help me solve it, the middle photo is the beginning of the journal entry sheet prompt

It is all one question please help me solve it, the middle photo is the beginning of the journal entry sheet prompt

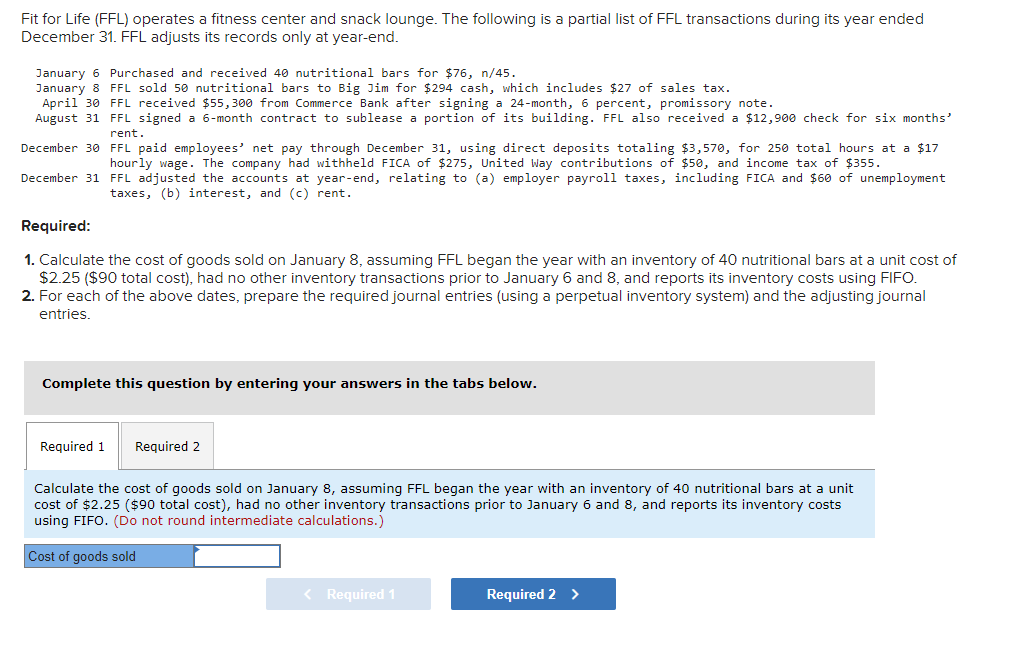

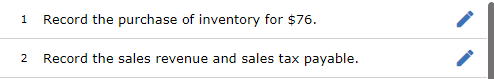

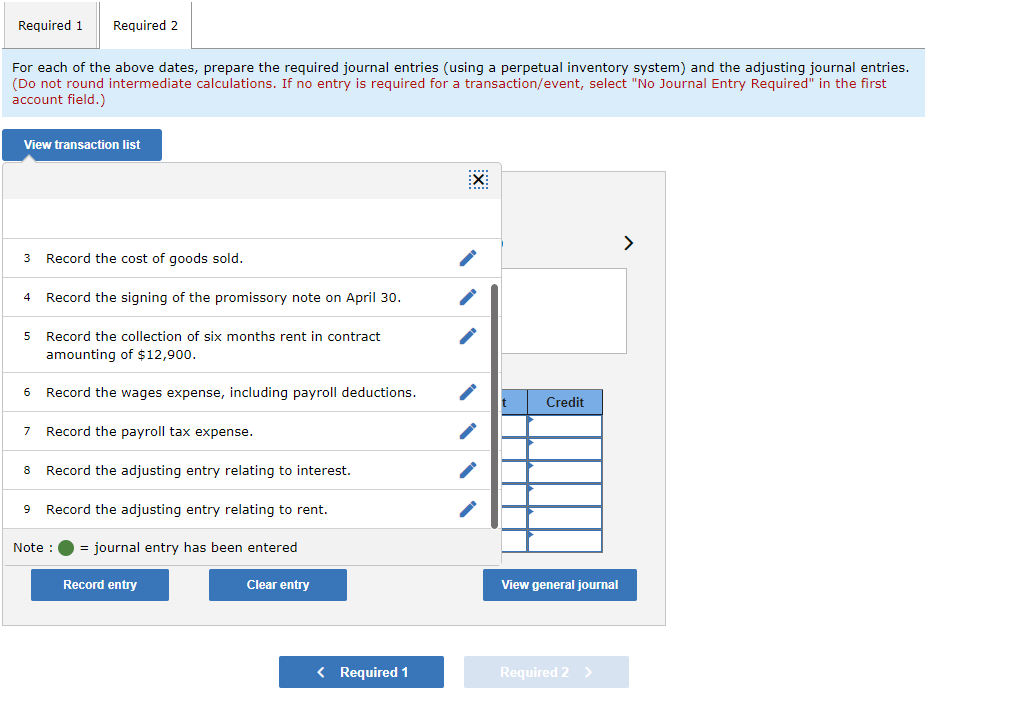

Fit for Life (FFL) operates a fitness center and snack lounge. The following is a partial list of FFL transactions during its year ended December 31 . FFL adjusts its records only at year-end. January 6 Purchased and received 40 nutritional bars for $76,n/45. January 8 FFL sold 50 nutritional bars to Big Jim for $294 cash, which includes $27 of sales tax. April 30FFL received $55,300 from Commerce Bank after signing a 24 -month, 6 percent, promissory note. August 31 FFL signed a 6 -month contract to sublease a portion of its building. FFL also received a $12,900 check for six months' rent. December 30 FFL paid employees' net pay through December 31 , using direct deposits totaling $3,570, for 250 total hours at a $17 hourly wage. The company had withheld FICA of $275, United Way contributions of $50, and income tax of $355. December 31FFL adjusted the accounts at year-end, relating to (a) employer payroll taxes, including FICA and $60 of unemployment taxes, (b) interest, and (c) rent. Required: 1. Calculate the cost of goods sold on January 8 , assuming FFL began the year with an inventory of 40 nutritional bars at a unit cost of $2.25 ( $90 total cost), had no other inventory transactions prior to January 6 and 8 , and reports its inventory costs using FIFO. 2. For each of the above dates, prepare the required journal entries (using a perpetual inventory system) and the adjusting journal entries. Complete this question by entering your answers in the tabs below. Calculate the cost of goods sold on January 8, assuming FFL began the year with an inventory of 40 nutritional bars at a cost of $2.25 ( $90 total cost), had no other inventory transactions prior to January 6 and 8 , and reports its inventory costs using FIFO. (Do not round intermediate calculations.) 1 Record the purchase of inventory for $76. 2 Record the sales revenue and sales tax payable. For each of the above dates, prepare the required journal entries (using a perpetual inventory system) and the adjusting journal entries. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 3 Record the cost of goods sold. 4 Record the signing of the promissory note on April 30. 5 Record the collection of six months rent in contract amounting of $12,900. Fit for Life (FFL) operates a fitness center and snack lounge. The following is a partial list of FFL transactions during its year ended December 31 . FFL adjusts its records only at year-end. January 6 Purchased and received 40 nutritional bars for $76,n/45. January 8 FFL sold 50 nutritional bars to Big Jim for $294 cash, which includes $27 of sales tax. April 30FFL received $55,300 from Commerce Bank after signing a 24 -month, 6 percent, promissory note. August 31 FFL signed a 6 -month contract to sublease a portion of its building. FFL also received a $12,900 check for six months' rent. December 30 FFL paid employees' net pay through December 31 , using direct deposits totaling $3,570, for 250 total hours at a $17 hourly wage. The company had withheld FICA of $275, United Way contributions of $50, and income tax of $355. December 31FFL adjusted the accounts at year-end, relating to (a) employer payroll taxes, including FICA and $60 of unemployment taxes, (b) interest, and (c) rent. Required: 1. Calculate the cost of goods sold on January 8 , assuming FFL began the year with an inventory of 40 nutritional bars at a unit cost of $2.25 ( $90 total cost), had no other inventory transactions prior to January 6 and 8 , and reports its inventory costs using FIFO. 2. For each of the above dates, prepare the required journal entries (using a perpetual inventory system) and the adjusting journal entries. Complete this question by entering your answers in the tabs below. Calculate the cost of goods sold on January 8, assuming FFL began the year with an inventory of 40 nutritional bars at a cost of $2.25 ( $90 total cost), had no other inventory transactions prior to January 6 and 8 , and reports its inventory costs using FIFO. (Do not round intermediate calculations.) 1 Record the purchase of inventory for $76. 2 Record the sales revenue and sales tax payable. For each of the above dates, prepare the required journal entries (using a perpetual inventory system) and the adjusting journal entries. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 3 Record the cost of goods sold. 4 Record the signing of the promissory note on April 30. 5 Record the collection of six months rent in contract amounting of $12,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts