Question: it is an exam please make sure the ans is correct. it is a question from a canadian college. please use canadian tax law. thank

it is an exam please make sure the ans is correct. it is a question from a canadian college. please use canadian tax law. thank you. make it fast please.

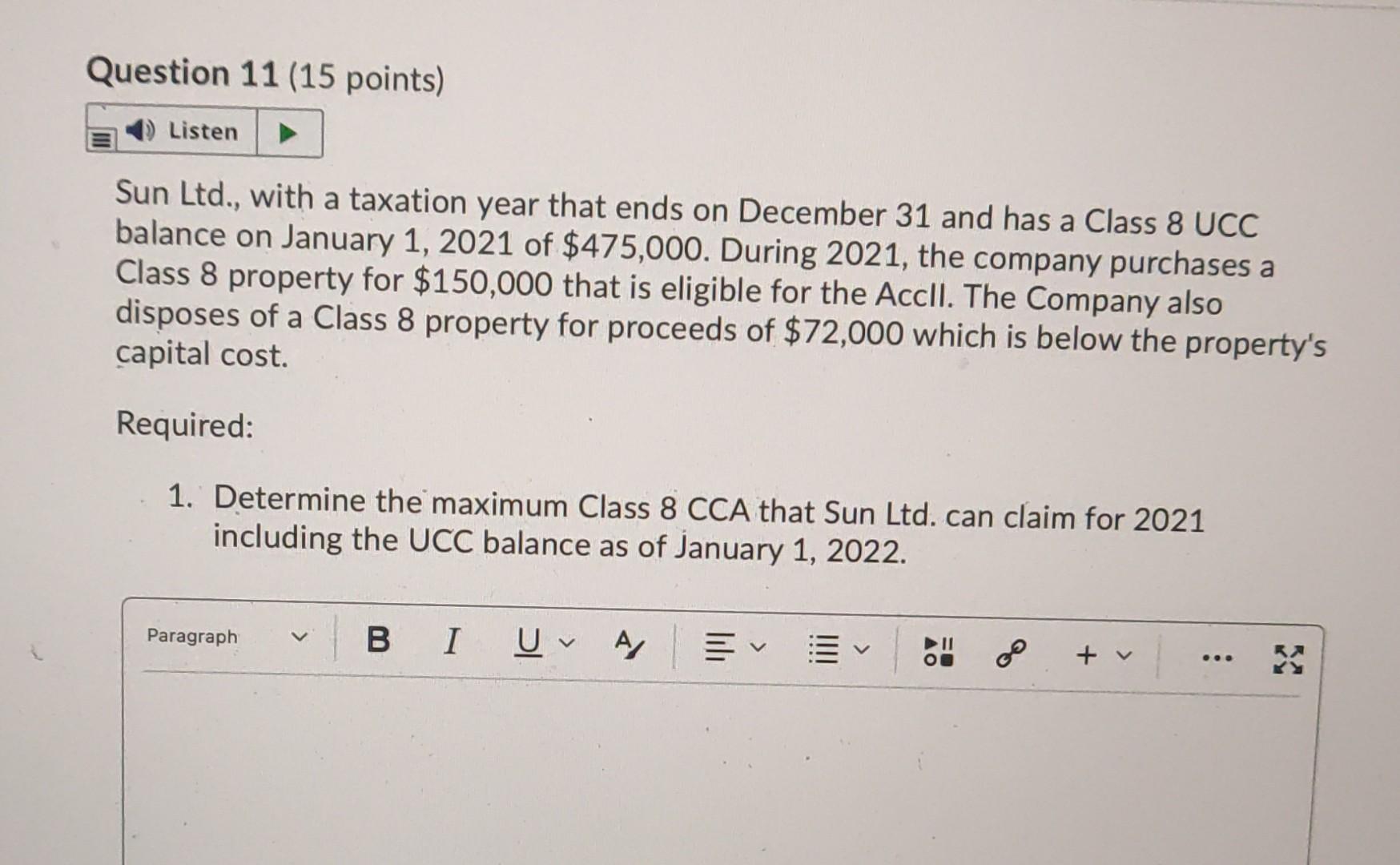

Question 11 (15 points) Listen Sun Ltd., with a taxation year that ends on December 31 and has a Class 8 UCC balance on January 1, 2021 of $475,000. During 2021, the company purchases a Class 8 property for $150,000 that is eligible for the Accll. The Company also disposes of a Class 8 property for proceeds of $72,000 which is below the property's capital cost. Required: 1. Determine the maximum Class 8 CCA that Sun Ltd. can claim for 2021 including the UCC balance as of January 1, 2022. Paragraph V UA o + v ... Question 11 (15 points) Listen Sun Ltd., with a taxation year that ends on December 31 and has a Class 8 UCC balance on January 1, 2021 of $475,000. During 2021, the company purchases a Class 8 property for $150,000 that is eligible for the Accll. The Company also disposes of a Class 8 property for proceeds of $72,000 which is below the property's capital cost. Required: 1. Determine the maximum Class 8 CCA that Sun Ltd. can claim for 2021 including the UCC balance as of January 1, 2022. Paragraph V UA o + v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts