Question: It is April 1 5 th , 2 0 2 5 , in the future. Also known as Tax Day 2 0 2 5 .

It is April th in the future. Also known as Tax Day

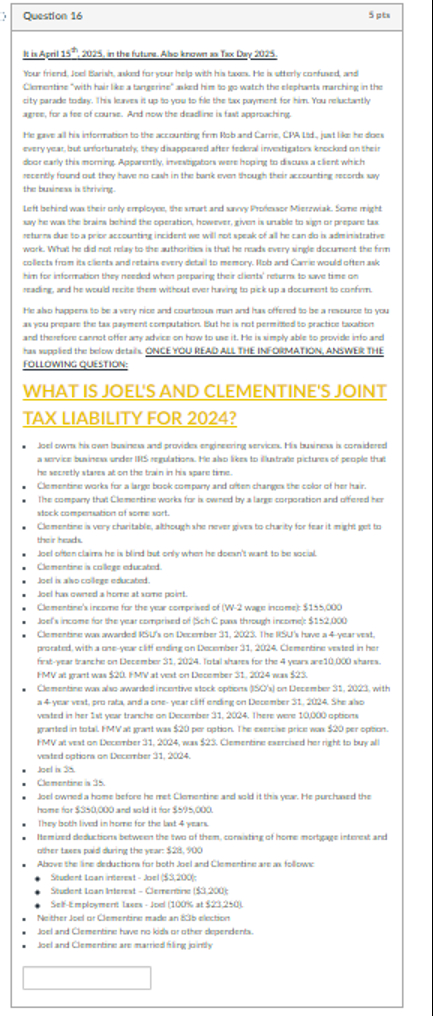

Your friend, Joel Barish, asked for your help with his taxes. He is utterly confused, and Clementine with hair like a tangerine asked him to go watch the elephants marching in the city parade today. This leaves it up to you to file the tax payment for him. You reluctantly agree, for a fee of course. And now the deadline is fast approaching.

He gave all his information to the accounting firm Rob and Carrie, CPA Ltd just like he does every year, but unfortunately, they disappeared after federal investigators knocked on their door early this morning. Apparently, investigators were hoping to discuss a client which recently found out they have no cash in the bank even though their accounting records say the business is thriving.

Left behind was their only employee, the smart and savvy Professor Mierzwiak. Some might say he was the brains behind the operation, however, given is unable to sign or prepare tax returns due to a prior accounting incident we will not speak of all he can do is administrative work. What he did not relay to the authorities is that he reads every single document the firm collects from its clients and retains every detail to memory. Rob and Carrie would often ask him for information they needed when preparing their clients returns to save time on reading, and he would recite them without ever having to pick up a document to confirm.

He also happens to be a very nice and courteous man and has offered to be a resource to you as you prepare the tax payment computation. But he is not permitted to practice taxation and therefore cannot offer any advice on how to use it He is simply able to provide info and has supplied the below details. ONCE YOU READ ALL THE INFORMATION, ANSWER THE FOLLOWING QUESTION:

WHAT IS JOEL'S AND CLEMENTINE'S JOINT TAX LIABILITY FOR

Joel owns his own business and provides engineering services. His business is considered a service business under IRS regulations. He also likes to illustrate pictures of people that he secretly stares at on the train in his spare time.

Clementine works for a large book company and often changes the color of her hair.

The company that Clementine works for is owned by a large corporation and offered her stock compensation of some sort.

Clementine is very charitable, although she never gives to charity for fear it might get to their heads.

Joel often claims he is blind but only when he doesnt want to be social.

Clementine is college educated.

Joel is also college educated.

Joel has owned a home at some point.

Clementines income for the year comprised of W wage income: $

Joels income for the year comprised of Sch C pass through income: $

Clementine was awarded RSUs on December The RSUs have a year vest, prorated, with a oneyear cliff ending on December Clementine vested in her firstyear tranche on December Total shares for the years are shares. FMV at grant was $ FMV at vest on December was $

Clementine was also awarded incentive stock options ISOs on December with a year vest, pro rata, and a one year cliff ending on December She also vested in her st year tranche on December There were options granted in total. FMV at grant was $ per option. The exercise price was $ per option. FMV at vest on December was $ Clementine exercised her right to buy all vested options on December

Joel is

Clementine is

Joel owned a home before he met Clementine and sold it this year. He purchased the home for $ and sold it for $

They both lived in home for the last years.

Itemized deductions between the two of them, consisting of home mortgage interest and other taxes paid during the year: $

Above the line deductions for both Joel and Clementine are as follows:

Student Loan interest Joel $;Student Loan Interest Clementine $;SelfEmployment Taxes Joel at $

Neither Joel or Clementine made an b election

Joel and Clementine have no kids or other dependents.

Joel and Clementine are married filing jointly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock