Question: it is clear on my screen. here is added word version EPS and postmerger priceData for Henry Company and Mayer Services are given in the

it is clear on my screen. here is added word version

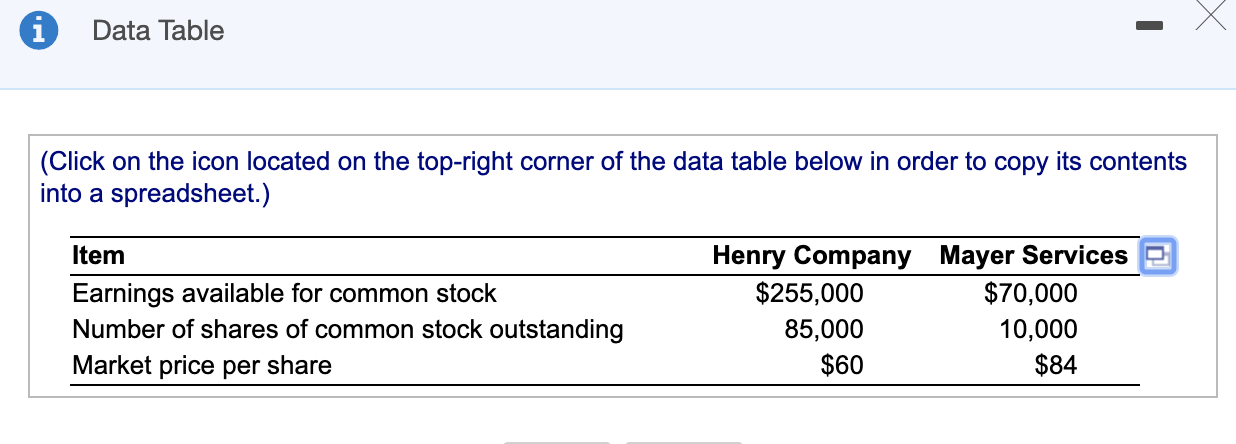

EPS and postmerger priceData for Henry Company and Mayer Services are given in the following table,

LOADING...

. Henry Company is considering merging with Mayer by swapping

1.311.31

shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same

price/earnings

(P/E) multiple after the merger as before merging.

a.Calculate the ratio of exchange in market price.

b.Calculate the earnings per share (EPS) and price/earnings (P/E) ratio for each company.

c.Calculate the price/earnings (P/E) ratio used to purchase Mayer Services.

d.Calculate the post-merger earnings per share (EPS) for Henry Company.

e. Calculate the expected market price per share of the merged firm.

a.The ratio of exchange in market price is

nothing.

(Round to two decimal places.)b. The EPS for Henry Company is

$nothing.

(Round to the nearest cent.)The EPS for Mayer Services is

$nothing.

(Round to the nearest cent.)The P/E for Henry Company is

nothing.

(Round to two decimal places.)The P/E for Mayer Services is

nothing.

(Round to two decimal places.)c. The P/E used to purchase Mayer Services is

nothing.

(Round to two decimal places.)d. The post-merger EPS is

$nothing.

(Round to the nearest cent.)e. The expected market price per share of the merged firm is

$nothing.

(Round to the nearest cent.)

EPS and postmerger price Data for Henry Company and Mayer Services are given in the following table, B. Henry Company is considering merging with Mayer by swapping 1.31 shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same pricelearnings (P/E) multiple after the merger as before merging. a. Calculate the ratio of exchange in market price. b. Calculate the earnings per share (EPS) and pricelearnings (P/E) ratio for each company. c. Calculate the pricelearnings (P/E) ratio used to purchase Mayer Services. d. Calculate the post-merger earnings per share (EPS) for Henry Company. e. Calculate the expected market price per share of the merged firm. a. The ratio of exchange in market price is . (Round to two decimal places.) b. The EPS for Henry Company is $ . (Round to the nearest cent.) The EPS for Mayer Services is $ . (Round to the nearest cent.) The P/E for Henry Company is . (Round to two decimal places.) The P/E for Mayer Services is . (Round to two decimal places.) c. The P/E used to purchase Mayer Services is . (Round to two decimal places.) d. The post-merger EPS is $ . (Round to the nearest cent.) e. The expected market price per share of the merged firm is $ . (Round to the nearest cent.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Item Earnings available for common stock Number of shares of common stock outstanding Market price per share Henry Company Mayer Services 2 $255,000 $70,000 85,000 10,000 $60 $84 35,000 10,000Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts