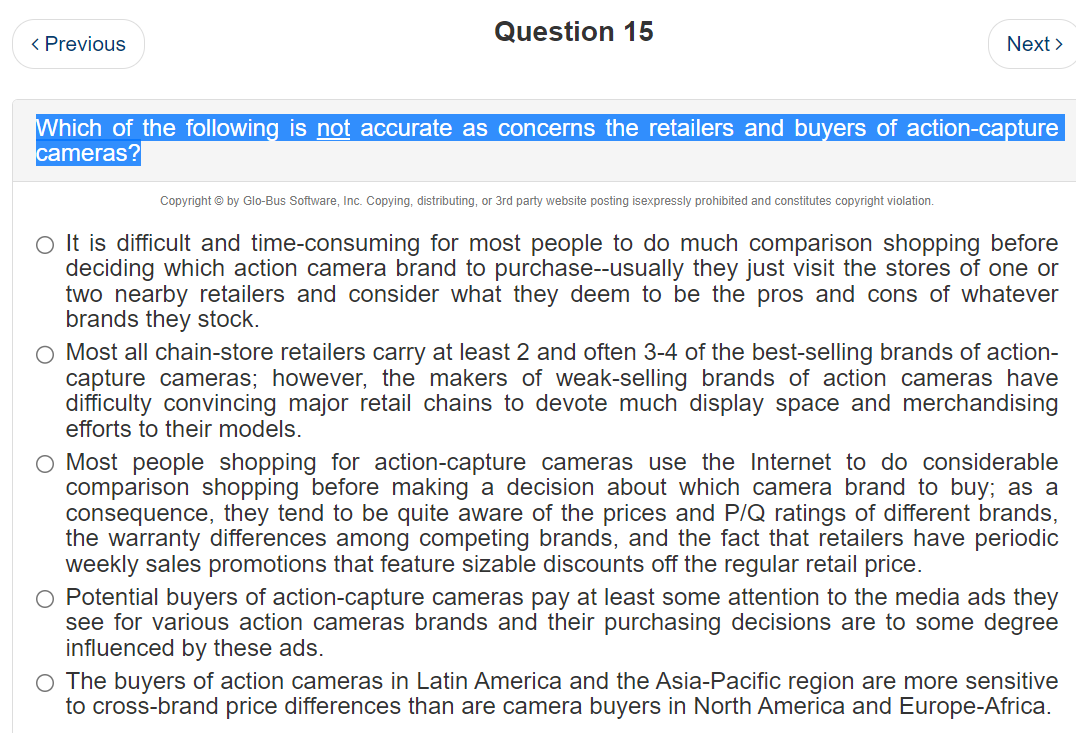

Question: It is difficult and time-consuming for most people to do much comparison shopping before deciding which action camera brand to purchase--usually they just visit the

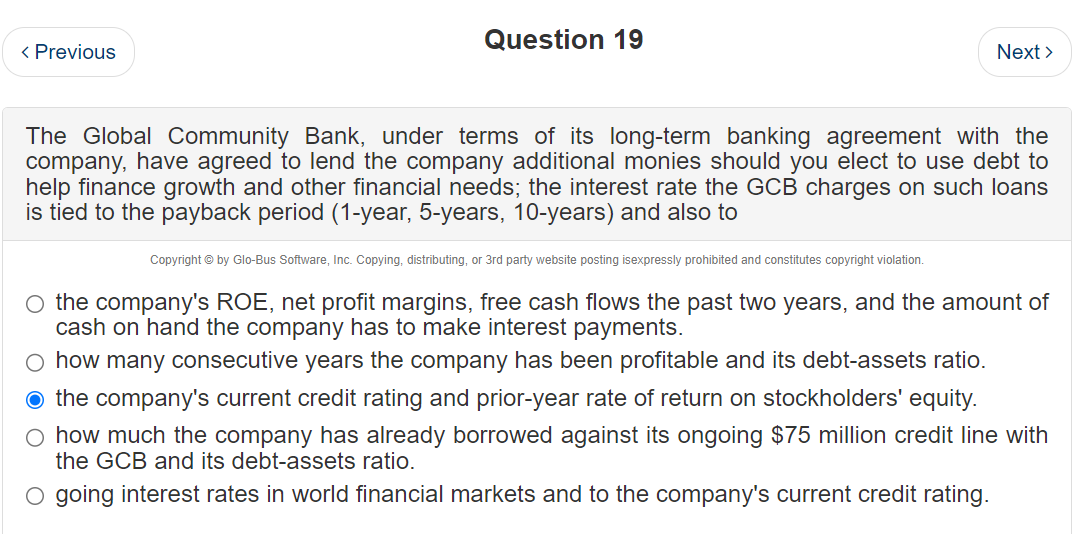

It is difficult and time-consuming for most people to do much comparison shopping before deciding which action camera brand to purchase--usually they just visit the stores of one or two nearby retailers and consider what they deem to be the pros and cons of whatever brands they stock. Most all chain-store retailers carry at least 2 and often 3-4 of the best-selling brands of actioncapture cameras; however, the makers of weak-selling brands of action cameras have difficulty convincing major retail chains to devote much display space and merchandising efforts to their models. Most people shopping for action-capture cameras use the Internet to do considerable comparison shopping before making a decision about which camera brand to buy; as a consequence, they tend to be quite aware of the prices and P/Q ratings of different brands, the warranty differences among competing brands, and the fact that retailers have periodic weekly sales promotions that feature sizable discounts off the regular retail price. Potential buyers of action-capture cameras pay at least some attention to the media ads they see for various action cameras brands and their purchasing decisions are to some degree influenced by these ads. The buyers of action cameras in Latin America and the Asia-Pacific region are more sensitive to cross-brand price differences than are camera buyers in North America and Europe-Africa. The Global Community Bank, under terms of its long-term banking agreement with the company, have agreed to lend the company additional monies should you elect to use debt to help finance growth and other financial needs; the interest rate the GCB charges on such loans is tied to the payback period (1-year, 5-years, 10-years) and also to Copyright @ by Glo-Bus Software, Inc. Copying, distributing, or 3rd party website posting isexpressly prohibited and constitutes copyright violation. the company's ROE, net profit margins, free cash flows the past two years, and the amount of cash on hand the company has to make interest payments. how many consecutive years the company has been profitable and its debt-assets ratio. the company's current credit rating and prior-year rate of return on stockholders' equity. how much the company has already borrowed against its ongoing $75 million credit line with the GCB and its debt-assets ratio. going interest rates in world financial markets and to the company's current credit rating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts