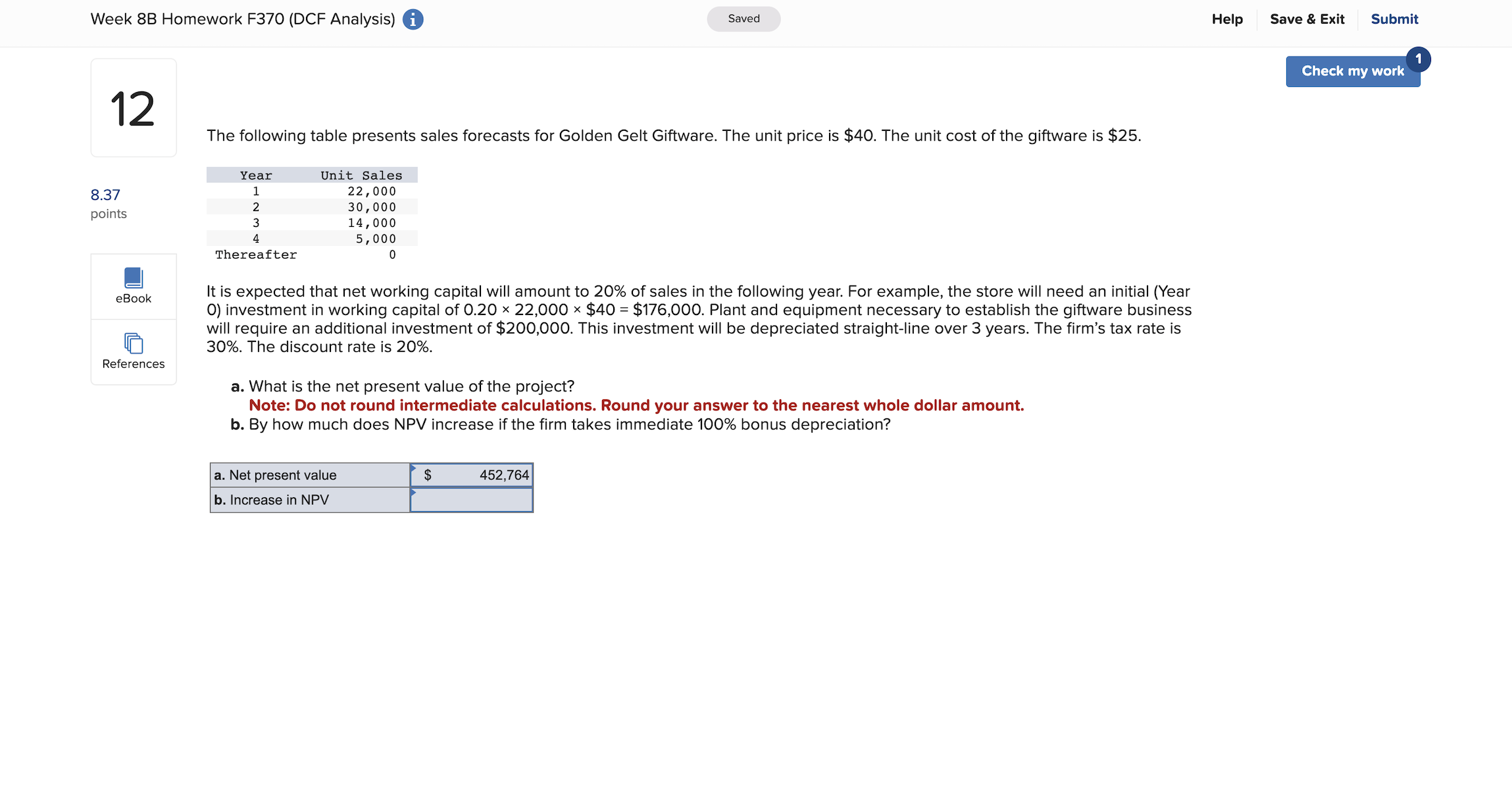

Question: It is expected that net working capital will amount to 20% of sales in the following year. For example, the store will need an initial

It is expected that net working capital will amount to 20% of sales in the following year. For example, the store will need an initial (Year 0 ) investment in working capital of 0.2022,000$40=$176,000. Plant and equipment necessary to establish the giftware business will require an additional investment of $200,000. This investment will be depreciated straight-line over 3 years. The firm's tax rate is 30%. The discount rate is 20%. a. What is the net present value of the project? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. b. By how much does NPV increase if the firm takes immediate 100% bonus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts