Question: It is expected that you prepare a report based on information provided below. You should approach this from the perspective of upper-level managers. Included in

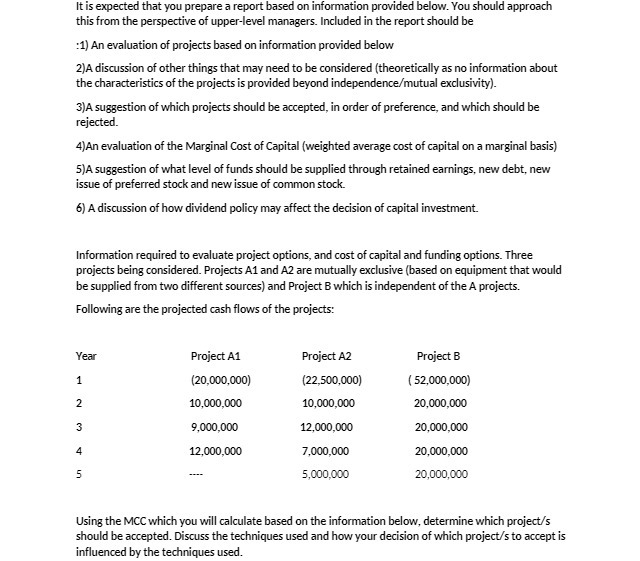

It is expected that you prepare a report based on information provided below. You should approach this from the perspective of upper-level managers. Included in the report should be :1) An evaluation of projects based on information provided below 2)A discussion of other things that may need to be considered (theoretically as no information about the characteristics of the projects is provided beyond independence/mutual exclusivity). 3)A suggestion of which projects should be accepted, in order of preference, and which should be rejected. 4)An evaluation of the Marginal Cost of Capital (weighted average cost of capital on a marginal basis) 5)A suggestion of what level of funds should be supplied through retained earnings, new debt, new issue of preferred stock and new issue of common stock. 6) A discussion of how dividend policy may affect the decision of capital investment. Information required to evaluate project options, and cost of capital and funding options. Three projects being considered. Projects A1 and A2 are mutually exclusive (based on equipment that would be supplied from two different sources) and Project B which is independent of the A projects. Following are the projected cash flows of the projects: Year Project A1 Project A2 Project B 1 (20,000,000) (22,500,000) (52,000,000) 2 10,000,000 10,000,000 20,000.000 3 9,000,000 12,000,000 20,000,000 A 12,000,000 7,000,000 20,000,000 in 5,000,000 20,000,000 Using the MCC which you will calculate based on the information below, determine which project/s should be accepted. Discuss the techniques used and how your decision of which project/s to accept is influenced by the techniques used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts