Question: It is Friday evening, May 18 th , 2021. Max Win is the Chief Financial Officer at Johnson&Johnson, a British publicly listed online pharmacy company.

It is Friday evening, May 18th, 2021. Max Win is the Chief Financial Officer at Johnson&Johnson, a British publicly listed online pharmacy company. Johnson&Johnson is an all-equity financed firm with zero debt. As a financial advisor to Johnson&Johnson, you have a dinner reservation with Max Win at 7 pm at the Canary Wharf, London.

"I must take the recapitalisation plan seriously" says Max. "We are considering a recapitalisation plan that would convert Johnson&Johnson from its all-equity capital structure to one including substantial financial leverage" adds Max.

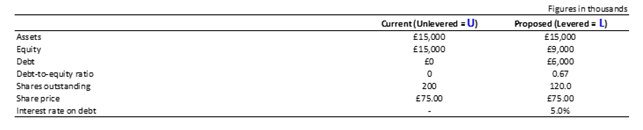

Johnson&Johnson is an unlevered firm operates in perfect markets and has net operating income (EBIT) of 1.50 million per year for the foreseeable future. Assume that the required rate of return on assets for firms in this industry is 8 per cent. The firm issues 6 million worth of debt, with a required rate of return of 5 per cent, and uses the proceeds to repurchase outstanding shares. There are no corporate or personal taxes. Max shares the following information with you so that you can evaluate the effect of financial leverage.

Table 1: Current and Proposed Capital Structure of PharmaTech

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts