Question: It is now May 1 , 2 0 3 1 and Hudsle Motors is preparing to introduce a new car. The following information is relevant

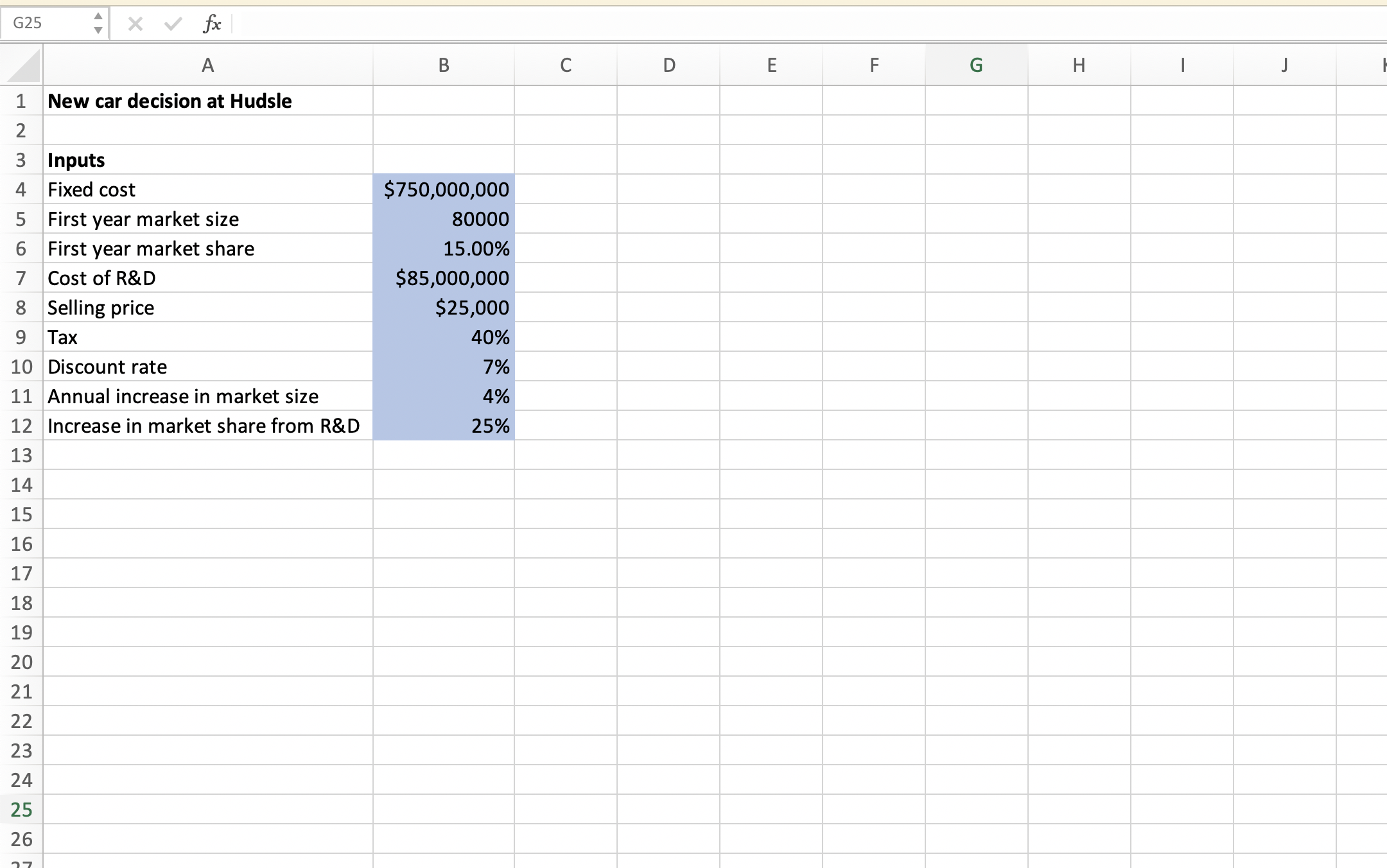

It is now May and Hudsle Motors is preparing to introduce a new car. The following information is relevant and some inputs are provided in hudsle data.xlsx Download hudsle data.xlsx

The fixed cost of developing the new car is incurred on January and is assumed to be $ million. It is depreciated on a straightline basis during the years to

The tax rate is but no taxes are paid when before tax profit is negative.

The car will come to market in and sell for years at a unit price of $

The market size during will be cars and Hudsles market share will be After the market size is expected to grow by per year.

A design improvement is envisioned for the year that they believe will make their market share in that year will be times what it had been previously. The R&D cost of $ million for this design improvement will be incurred fully at the end of prior year. The market share will stay at that new level.

The cost of producing the first x cars is x dollars. This builds a learning curve into the cost structure. eg If they make cars in year it costs a total of $ for those first cars. If they make cars in year then they have made a total of but the year production cost is

Unless otherwise stated, cash flows are assumed to occur at the end of the year.

Hudsel discounts its cash flows at per year.

a Develop a spreadsheet model that ultimately determines the NPV on Jan. of the cash flows generated by this car. points

b Hudsle is concerned whether $ is the right price. What is the lowest price they should consider for the car? points

c Going back to the original price, use a data table to show how the NPV changes if the design improvement envisioned for the year actually happens in or Determine the financial consequence of each year of delay in the introduction of the design improvement. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock