Question: It is only 3 easy questions please help me 9) Which one of the following sets of dividend payments best meets the definition of two-stage

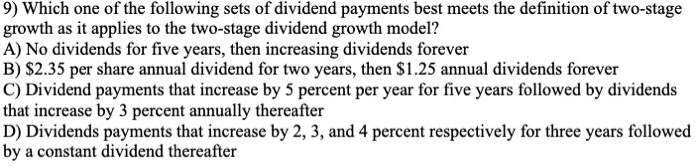

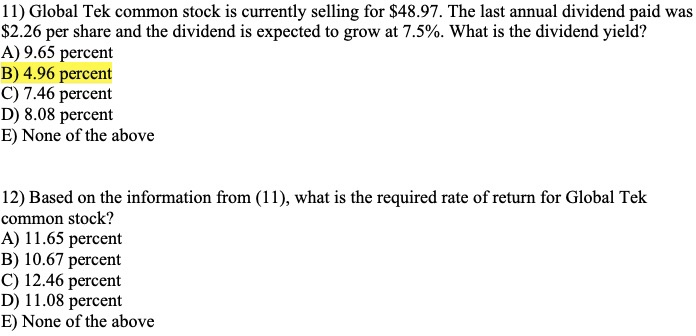

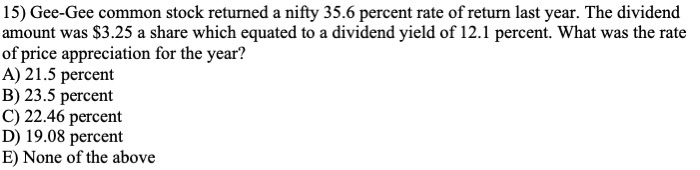

9) Which one of the following sets of dividend payments best meets the definition of two-stage growth as it applies to the two-stage dividend growth model? A) No dividends for five years, then increasing dividends forever B) $2.35 per share annual dividend for two years, then $1.25 annual dividends forever C) Dividend payments that increase by 5 percent per year for five years followed by dividends that increase by 3 percent annually thereafter D) Dividends payments that increase by 2, 3, and 4 percent respectively for three years followed by a constant dividend thereafter 11) Global Tek common stock is currently selling for $48.97. The last annual dividend paid was $2.26 per share and the dividend is expected to grow at 7.5%. What is the dividend yield? A) 9.65 percent B) 4.96 percent C) 7.46 percent D) 8.08 percent E) None of the above 12) Based on the information from (11), what is the required rate of return for Global Tek common stock? A) 11.65 percent B) 10.67 percent C) 12.46 percent D) 11.08 percent E) None of the above 15) Gee-Gee common stock returned a nifty 35.6 percent rate of return last year. The dividend amount was $3.25 a share which equated to a dividend yield of 12.1 percent. What was the rate of price appreciation for the year? A) 21.5 percent B) 23.5 percent C) 22.46 percent D) 19.08 percent E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts