Question: It is only expected within those 6 years that there will be further investments, and there is exact year of when they will invest. 6.

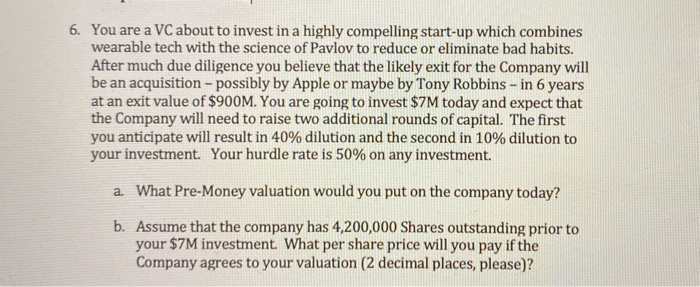

6. You are a VC about to invest in a highly compelling start-up which combines wearable tech with the science of Pavlov to reduce or eliminate bad habits. After much due diligence you believe that the likely exit for the Company will be an acquisition - possibly by Apple or maybe by Tony Robbins - in 6 years at an exit value of $900M. You are going to invest $7M today and expect that the Company will need to raise two additional rounds of capital. The first you anticipate will result in 40% dilution and the second in 10% dilution to your investment. Your hurdle rate is 50% on any investment. a. What Pre-Money valuation would you put on the company today? b. Assume that the company has 4,200,000 Shares outstanding prior to your $7M investment. What per share price will you pay if the Company agrees to your valuation (2 decimal places, please)? 6. You are a VC about to invest in a highly compelling start-up which combines wearable tech with the science of Pavlov to reduce or eliminate bad habits. After much due diligence you believe that the likely exit for the Company will be an acquisition - possibly by Apple or maybe by Tony Robbins - in 6 years at an exit value of $900M. You are going to invest $7M today and expect that the Company will need to raise two additional rounds of capital. The first you anticipate will result in 40% dilution and the second in 10% dilution to your investment. Your hurdle rate is 50% on any investment. a. What Pre-Money valuation would you put on the company today? b. Assume that the company has 4,200,000 Shares outstanding prior to your $7M investment. What per share price will you pay if the Company agrees to your valuation (2 decimal places, please)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts