Question: It is possible to solve the necessary assignment 1. Task 2: learning outcome 2 Problem 2: In this task your line manager wants to assess

It is possible to solve the necessary assignment

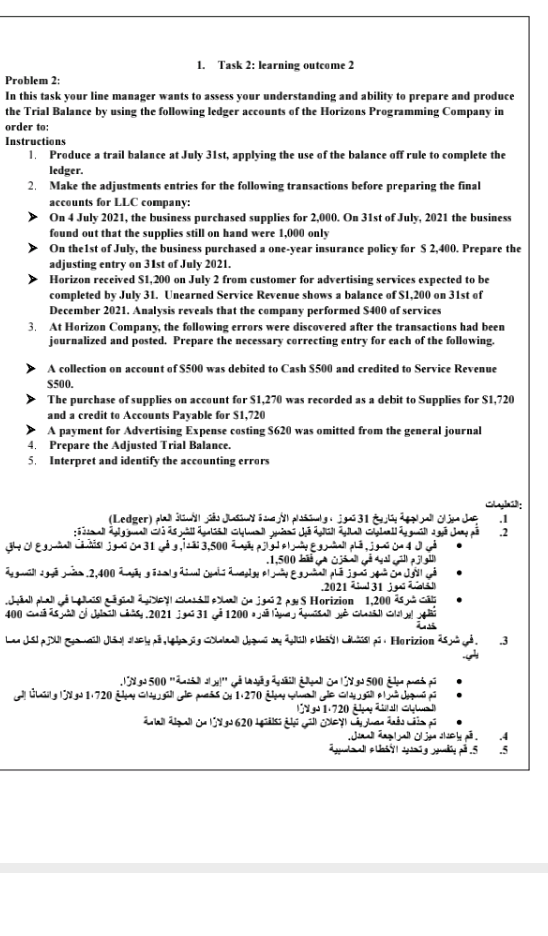

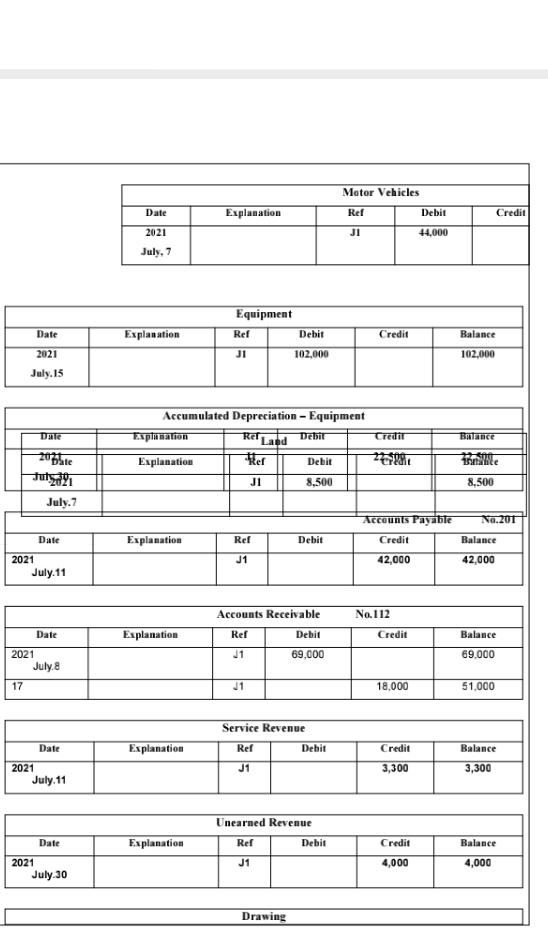

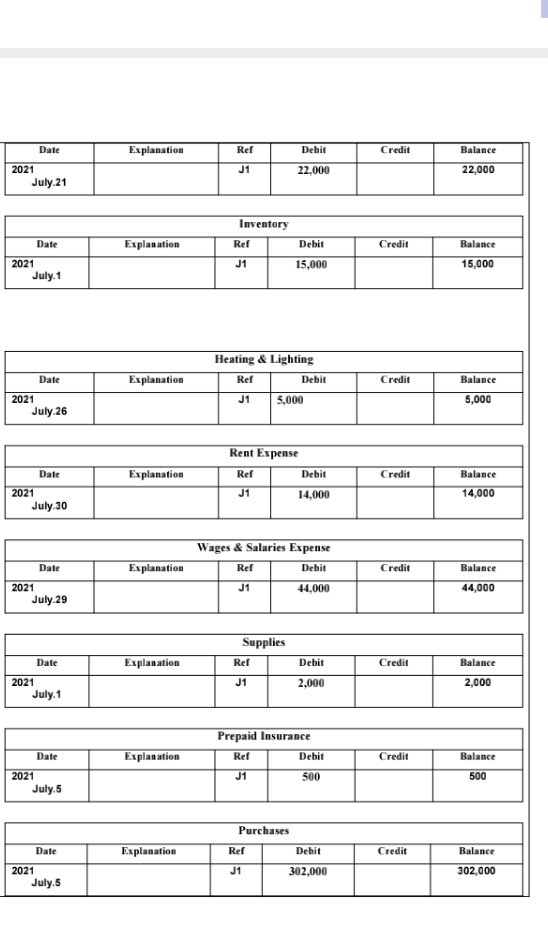

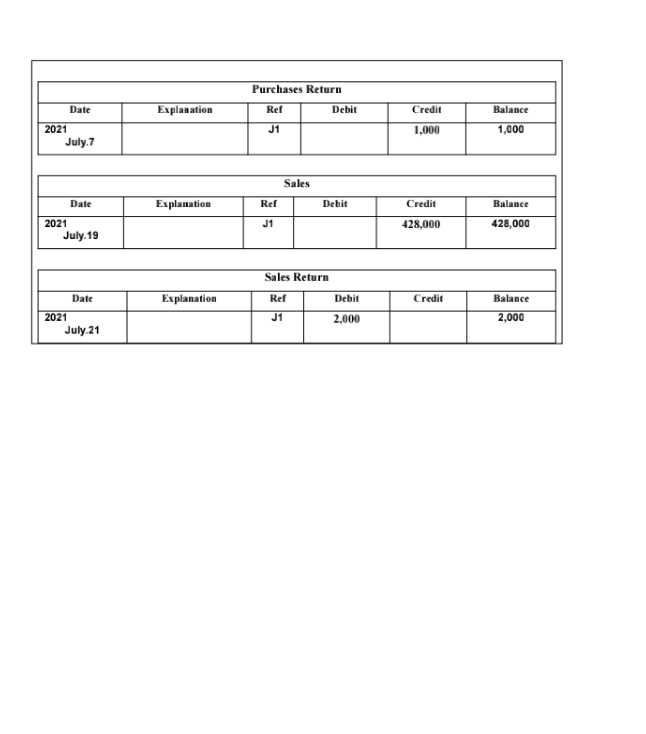

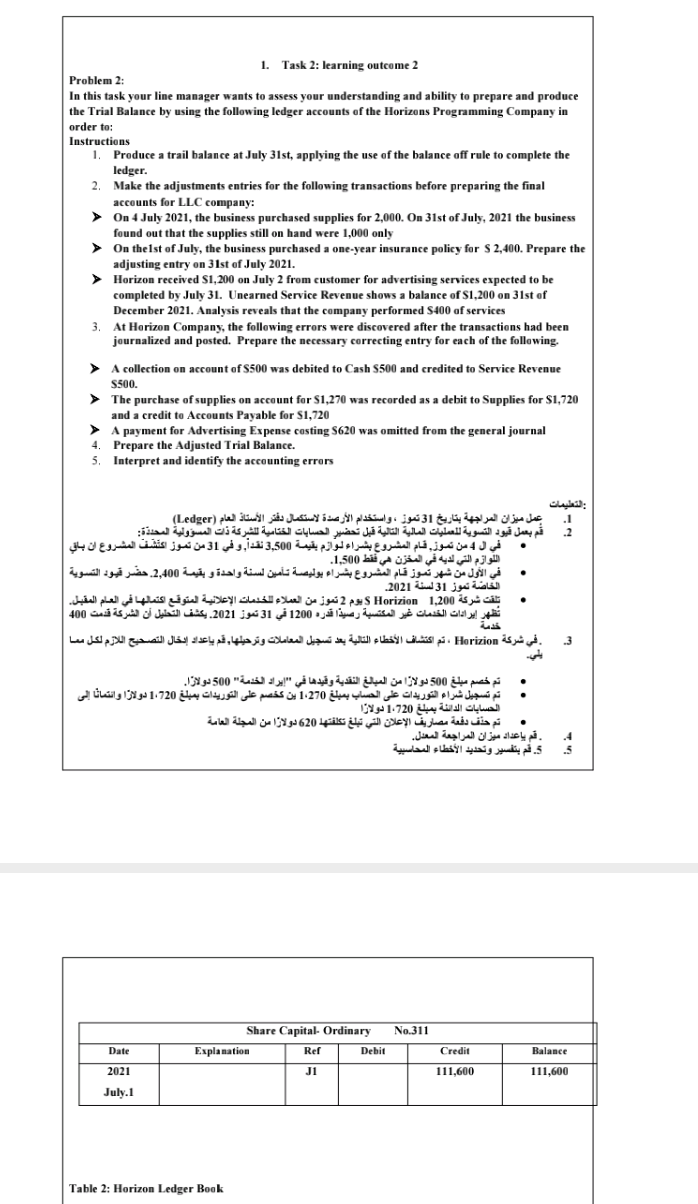

1. Task 2: learning outcome 2 Problem 2: In this task your line manager wants to assess your understanding and ability to prepare and produce the Trial Balance by using the following ledger accounts of the Horizons Programming Company in order to: Instructions 1. Produce a trail balance at July 31st, applying the use of the balance off rule to complete the ledger. 2. Make the adjustments entries for the following transactions before preparing the final accounts for LLC company: On 4 July 2021, the business purchased supplies for 2,000. On 31st of July, 2021 the business found out that the supplies still on hand were 1,000 only > On thelst of July, the business purchased a one-year insurance policy for $ 2,400. Prepare the adjusting entry on 31st of July 2021. Horizon received S1,200 on July 2 from customer for advertising services expected to be completed by July 31. Unearned Service Revenue shows a balance of S1,200 on 31st of December 2021. Analysis reveals that the company performed S400 of services 3. At Horizon Company, the following errors were discovered after the transactions had been journalized and posted. Prepare the necessary correcting entry for each of the following ) A collection on account of S500 was debited to Cash s500 and credited to Service Revenue S500. The purchase of supplies on account for $1,270 was recorded as a debit to Supplies for $1,720 and a credit to Accounts Payable for $1,720 A payment for Advertising Expense casting S620 was omitted from the general journal 4. Prepare the Adjusted Trial Balance. 3. Interpret and identify the accounting errors .1 .2 31 (Ledger) 4 , 3,500 . 31 1,500. 2,400. 31 2021 1,200 Horizion 5 2 1200 31 2021. 400 . Horizion . 500 " " 500 . 1270 1720 1720 620 . . 5. .3 Motor Vehicles Date Explanation Rel Debit Credit 2021 JI 44,000 July, 7 Date Explanation Equipment Ref Debit J1 102,000 Credit Balance 102,000 2021 July. 15 Dale Accumulated Depreciation - Equipment Explanation Rer Land Debil Credit Explanation tter Debit 2498 Balance 207 ale J1 8,500 8.500 Jul 20 21 July 7 Accounts Payable No.201 Date Explanation Ref Debit Credit Balance J1 42,000 42,000 2021 July 11 Accounts Receivable No.112 Date Explanation Ref Debit Credit Balance 69.000 J1 69,000 2021 July 17 J1 18.000 51.000 Service Revenue Date Explanation Ref Debit Credit Balance J1 3,300 3,300 2021 July 11 Unearned Revenue Date Explanation Ref Debit Credit Balance J1 4,000 4,000 2021 July 30 Drawing Date Explanation Ref Credit Balance Debit 22.000 J1 22,000 2021 July 21 Inventory Ref Date Explanation Debit Credit Balance J1 15,000 15,000 2021 July. 1 Date Explanation Heating & Lighting Ref Debit J1 5,000 Credit Balance 5,000 2021 July 26 Date Explanation Rent Expense Ref Debit J1 14,000 Credit Balance 14,000 2021 July 30 Wages & Salaries Expense Rer Debit Date Explanation Credit Balance J1 44,000 44,000 2021 July 29 Supplies Ref Date Explanation Debit Credit Balance J1 2021 July 1 2,000 2,000 Date Explanation Prepaid Insurance Ref Debit J1 500 Credit Balance 500 2021 Julys Purchases Date Explanation Ref Debit Credit Balance J1 2021 July.5 302,000 302,000 Purchases Return Date Explanation Ref Debit Credit Balance J1 1,000 1,000 2021 July.7 Sales Date Explanation Ref Debit Credit Balance 2021 J1 428,000 428,000 July 19 Sales Return Explanation Rer Debit Credit Balance Date 2021 July 21 J1 2.000 2,000 1. Task 2: learning outcome 2 Problem 2: In this task your line manager wants to assess your understanding and ability to prepare and produce the Trial Balance by using the following ledger accounts of the Horizons Programming Company in order to: Instructions 1. Produce a trail balance at July 31st, applying the use of the balance off rule to complete the ledger. 2. Make the adjustments entries for the following transactions before preparing the final accounts for LLC company: > On 4 July 2021, the business purchased supplies for 2,000. On 31st of July, 2021 the business found out that the supplies still on hand were 1,000 only Onthelst of July, the business purchased a one-year insurance policy for $ 2,400. Prepare the adjusting entry on 31st of July 2021. Horizon received S1,200 on July 2 from customer for advertising services expected to be completed by July 31. Unearned Service Revenue shows a balance of S1,200 on 31st of December 2021. Analysis reveals that the company performed S400 of services 3. At Horizon Company, the following errors were discovered after the transactions had been journalized and posted. Prepare the necessary correcting entry for each of the following. > A collection on account of S500 was debited to Cash S500 and credited to Service Revenue $500. The purchase of supplies on account for $1,270 was recorded as a debit to Supplies for $1,720 and a credit to Accounts Payable for $1,720 A payment for Advertising Expense casting S620 was omitted from the general journal 4. Prepare the Adjusted Trial Balance. 5. Interpret and identify the accounting errors . 31 (Ledger) , 3,500 . 31 1,500 2,400. 31 2021. 1,200 Horizon 5 2 1200 31 2021. 400 Harizion . 500 " " 500 . : 1270 1720 (1720 620 . . : 3 No. 311 Share Capital- Ordinary Explanation Ref Debit Date Credit Balance 2021 J1 111,600 111,600 July.1 Table 2: Horizon Ledger Book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts