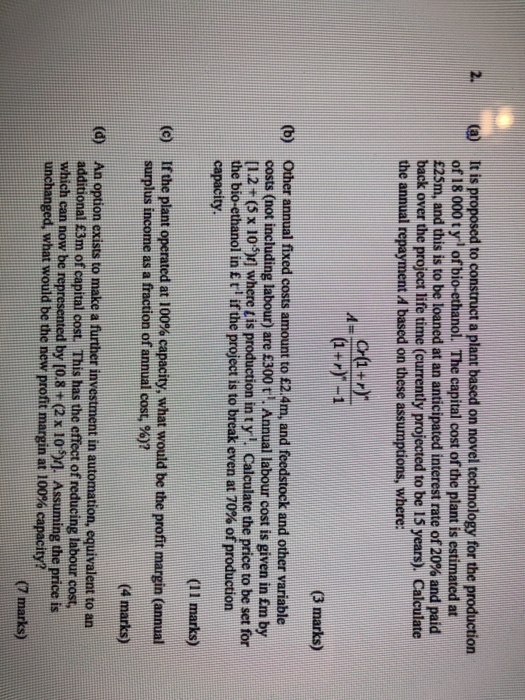

Question: It is proposed to construct a plant based on novel technology for the production of 18 000ty of bio ethanol. The capital cost of the

It is proposed to construct a plant based on novel technology for the production of 18 000ty of bio ethanol. The capital cost of the plant is estimated at 25m and this is to be loaned at an anticipated interest rate of 20% and paid back over the project life time (currently projected to be 15 years). Calculate the annual repayment A based on these assumptions, where: 2 (g) r)1 (3 marks) Other annual fixed costs amount to 2.4m, and feedstock and other variable costs (not including labour) are 300 t1. Annual labour cost is given in Em by [1.2+(5x 10 )n where tis production intyl. Calculate the price to be set for the bio-ethanol in ri ifthe project is to break even at 70% of production capacity (b) (11 marks) If the plant operated at 100% capacity, what would be the profit margin (annual surplus income as a fraction of annual cost, %)? (c) (4 marks) (d) An option exists to make a further investment in automation, equivalent to an additional 3m of capital cost. This has the effect of reducing labour cost, which can now be represented by [0.8 + (2 x 10sm Assuming the price is unchanged, what would be the new profit margin at 100% capacity? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts