Question: It is the correct answer but I need a detail step-by-step for the computation. Thanks! Salter Ltd has completed its 205 financial statements which reveal,

It is the correct answer but I need a detail step-by-step for the computation. Thanks!

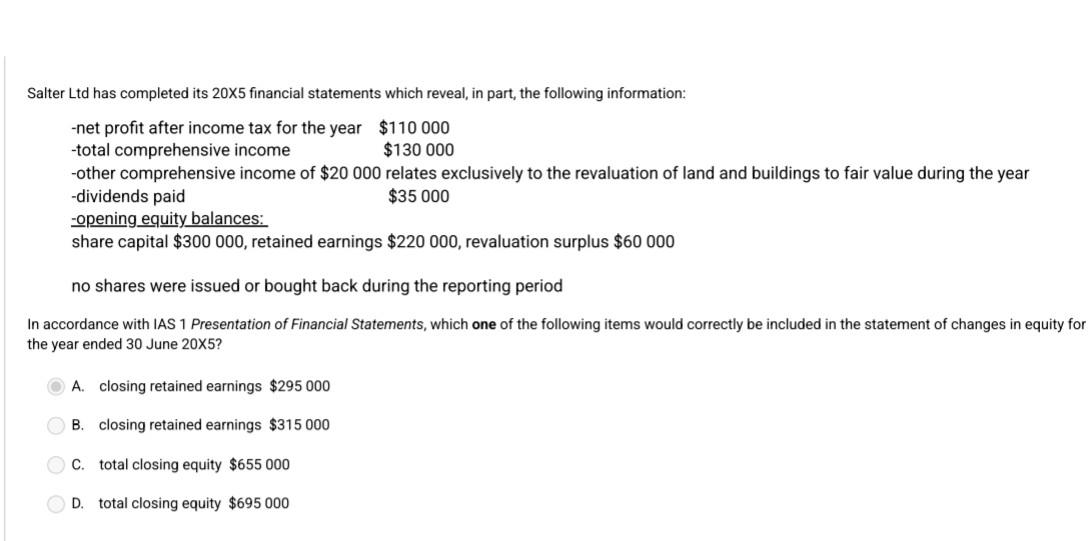

Salter Ltd has completed its 205 financial statements which reveal, in part, the following information: -net profit after income tax for the year $110000 -total comprehensive income $130000 -other comprehensive income of $20000 relates exclusively to the revaluation of land and buildings to fair value during the year -dividends paid $35000 -opening equity balances: share capital $300000, retained earnings $220000, revaluation surplus $60000 no shares were issued or bought back during the reporting period In accordance with IAS 1 Presentation of Financial Statements, which one of the following items would correctly be included in the statement of changes in equity for the year ended 30 June 205 ? A. closing retained earnings $295000 B. closing retained earnings $315000 C. total closing equity $655000 D. total closing equity $695000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts