Question: it is the full image and the full question... Transatlantic Arbitrage. A corporate treasury working out of Vienna with operations in New York simultaneously calls

it is the full image and the full question...

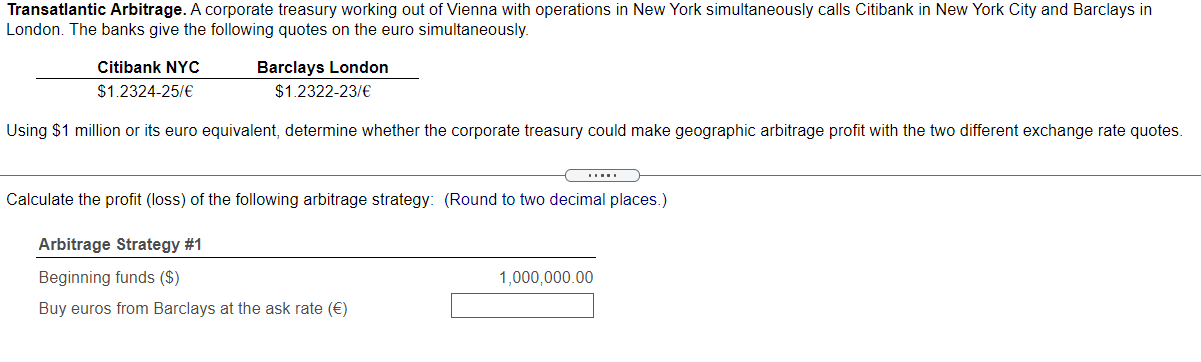

Transatlantic Arbitrage. A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously. Citibank NYC $1.2324-25/ Barclays London $1.2322-23/8 Using $1 million or its euro equivalent determine whether the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. Calculate the profit (loss) of the following arbitrage strategy: (Round to two decimal places.) Arbitrage Strategy #1 Beginning funds ($) Buy euros from Barclays at the ask rate () 1,000,000.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock