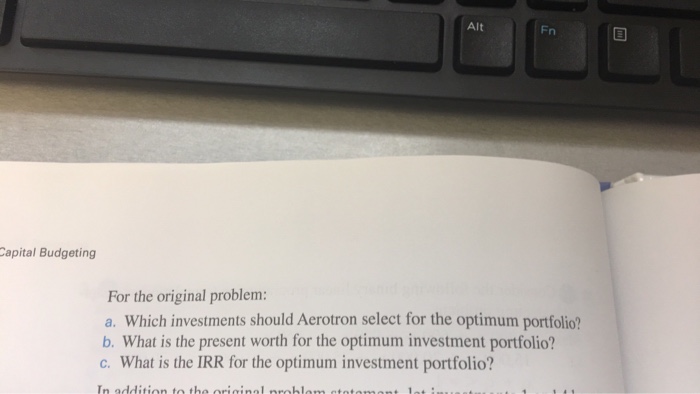

Question: It is the second question. The answers are a) 2,4, and 5 B) $43,617.79 C) 16.94% I am not sure how to get these answers.

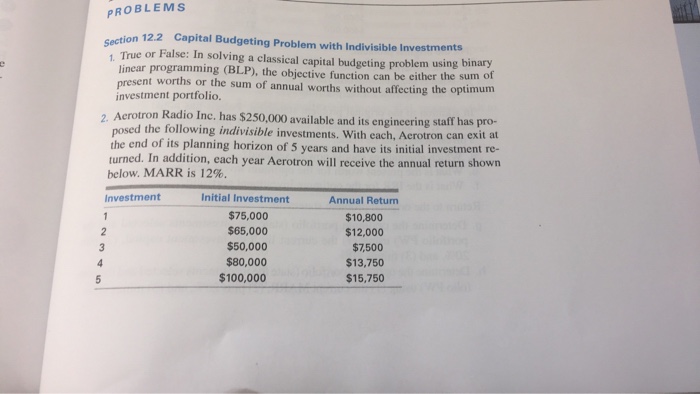

PROBLEMS Section 12.2 Capital Budgeting Problem with Indivisible Investments 1. True or False: In solving a classical capital budgeting problem using binary linear programming (BLP), the objective function can be either the sum o investment portfolio. Acrotron Radio Inc. has $250,000 available and its engineering staff has pro- nt worths or the sum of annual worths without affecting the optimum 2. sed the following indivisible investments. With each, Acrotron can exit at po the end of its planning horizon of 5 years and have its initial investment re- turned. In addition, each year Aerotron will receive the annual return shown below. MARR is 12%. Initial Investment $75,000 $65,000 $50,000 $80,000 Investment Annual Return $10,800 $12,000 $7,500 $13,750 $15,750 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts