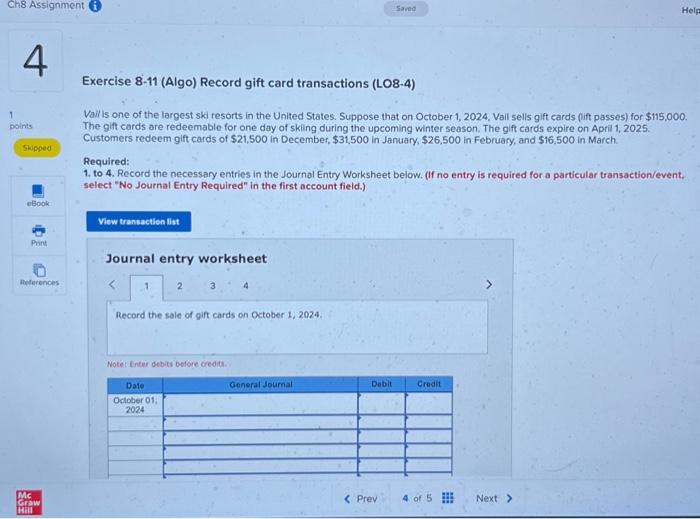

Question: it is two different problems, question 1 has parts 1-3 and question 2 has parts 1-4 Exercise 8-11 (Algo) Record gift card transactions (LO8-4) Vail

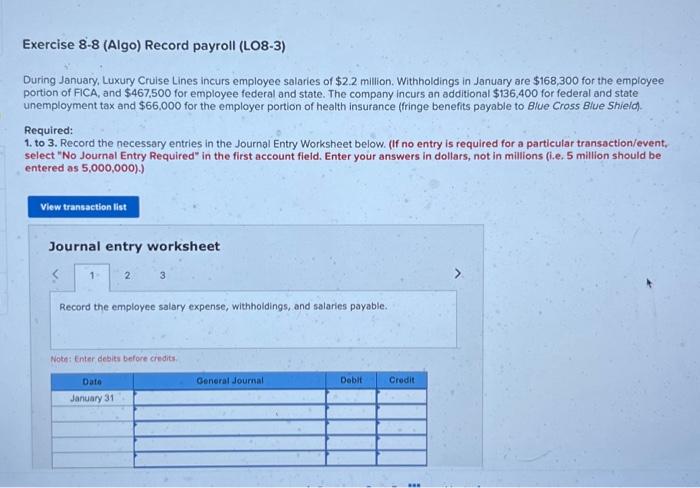

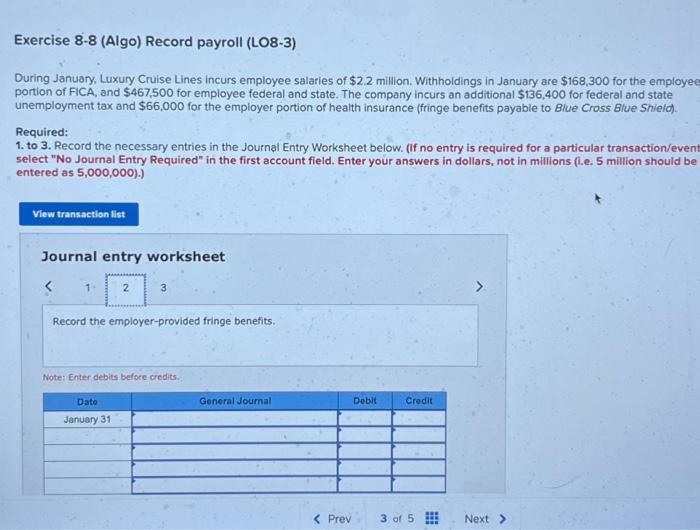

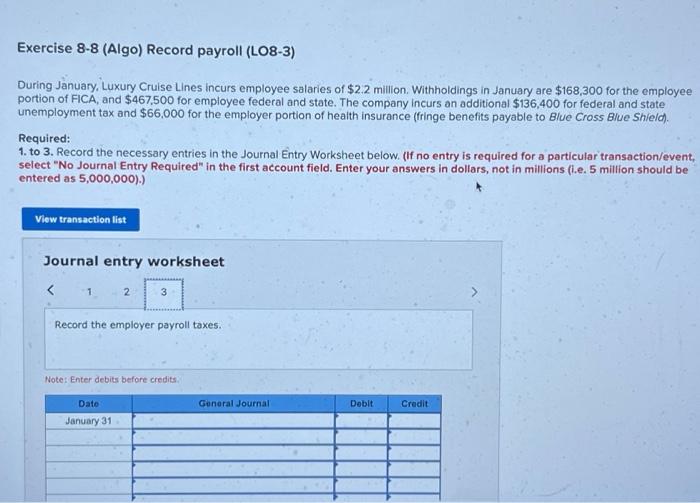

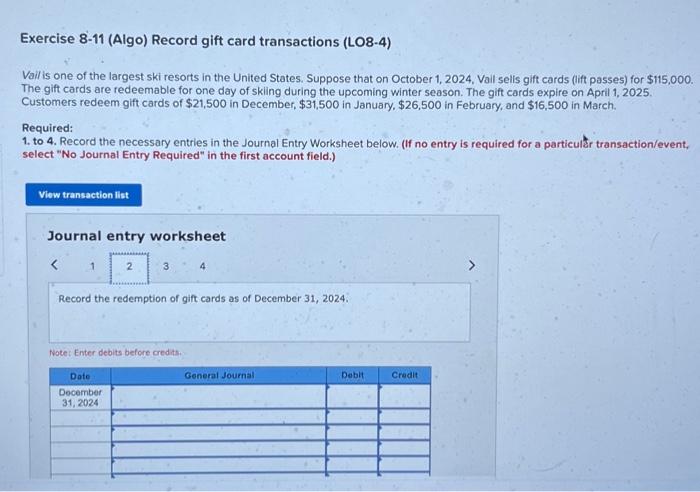

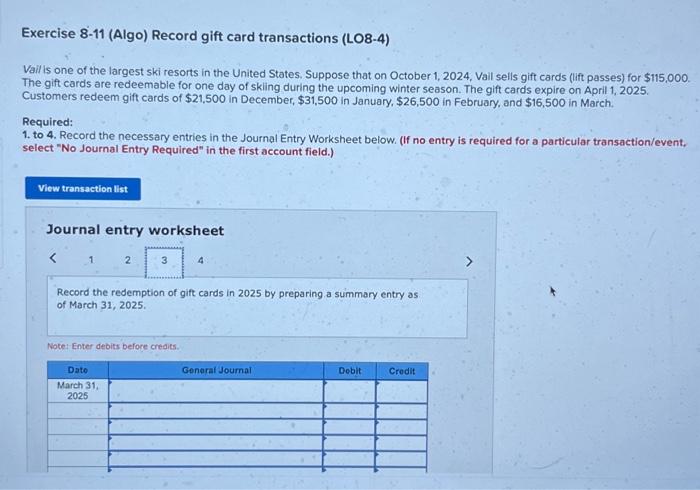

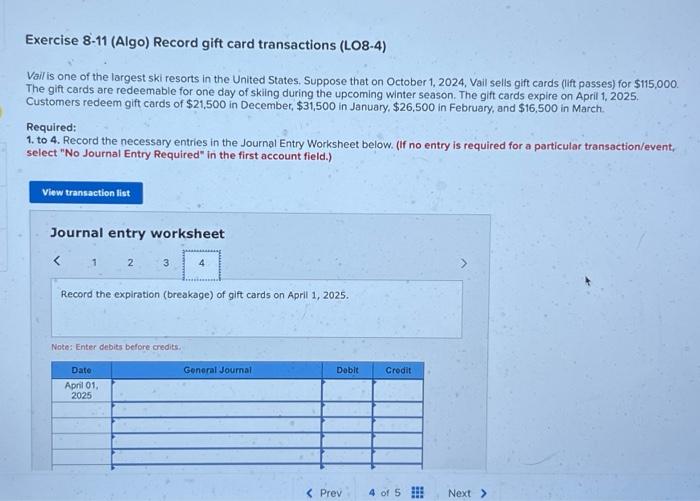

Exercise 8-11 (Algo) Record gift card transactions (LO8-4) Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vail sells gift cards (lift passes) for $115,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2025. Customers redeem gift cards of $21,500 in December, $31,500 in January, $26,500 in February, and $16,500 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particultr transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 4 Record the redemption of gift cards as of December 31,2024. Note: Enter debits before credits. Exercise 8-11 (Algo) Record gift card transactions (LO8-4) Vall is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vall sells gift cards (lift passes) for $115,000. The gift cards are redeemable for one day of skling during the upcoming winter season. The gift cards expire on April 1,2025. Customers redeem gift cards of $21,500 in December, $31,500 in January, $26,500 in February, and $16,500 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the redemption of gift cards in 2025 by preparing a summary entry as of March 31, 2025. Note: Enter debits before creaits. Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Luxury Cruise Lines incurs employee salaries of $2.2 million. Withholdings in January are $168,300 for the employe portion of FICA, and $467,500 for employee federal and state. The company incurs an additional $136,400 for federal and state unemployment tax and $66,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shielo). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/even select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entry worksheet Record the employer-provided fringe benefits. Note: Enter debits before credits. Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Luxury Cruise Lines incurs employee salaries of $2.2 million. Withholdings in January are $168,300 for the employee portion of FICA, and $467,500 for employee federal and state. The company incurs an additional $136,400 for federal and state unemployment tax and $66,000 for the employer portion of health insurance (fringe benefits payable to B/ve Cross B/ve Shie/d). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entry worksheet Exercise 8-11 (Algo) Record gift card transactions (LO8-4) Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vall sells gift cards (lift passes) for $115,000. The gift cards are redeemable for one day of skiling during the upcoming winter season. The gift cards expire on April 1, 2025. Customers redeem gift cards of $21,500 in December, $31,500 in January, $26,500 in February, and $16,500 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event. select "No Journal Entry Required" in the first account field.) Exercise 8-11 (Algo) Record gift card transactions (LO8-4) Vail is one of the largest ski resorts in the United States, Suppose that on October 1, 2024, Vail sells gift cards (lift passes) for $115,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1,2025. Customers redeem gift cards of $21,500 in December, $31,500 in January, $26,500 in February, and $16,500 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the expiration (breakage) of gift cards on April 1, 2025. Note: Enter debits before credits. During January, Luxury Cruise Lines incurs employee salaries of $2.2 million. Withholdings in January are $168,300 for the employee portion of FICA, and $467,500 for employee federal and state. The company incurs an additional $136,400 for federal and state unemployment tax and $66.000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shielch. Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account fleld. Enter your answers in dollars, not in millions (i.e, 5 million should be entered as 5,000,000).) Journal entry worksheet 3 Record the employee salary expense, withholdings, and salaries payable. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts