Question: It mush be done exactly as same the example problem below. Do all the steps with chart and each step. also, explain the answer so

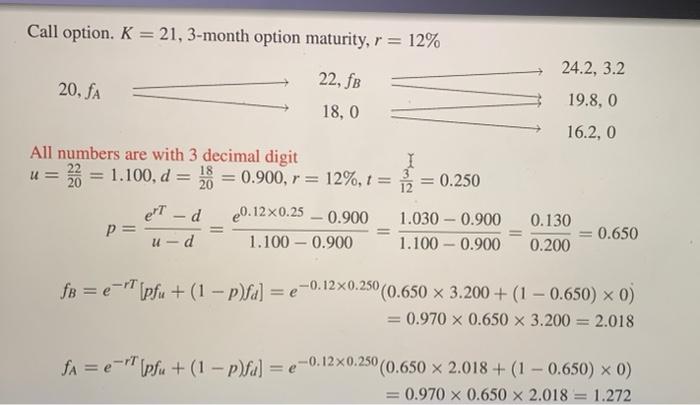

Call option. K = 21, 3-month option maturity, r = 12% 24.2, 3.2 20, fA 22, fB 18,0 19.8,0 16.2, 0 0.250 All numbers are with 3 decimal digit 18 U= 1.100, d = 28 = 0.900, r = r=12%, 1 = 20.12X0.25 -0.900 p= ud 1.100 - 0.900 eT - d 1.030 - 0.900 1.100 - 0.900 0.130 0.200 0.650 fp = e-Tipfu + (1 - p)fa] = e -0.12% 0.250 (0.650 x 3.200 + (1 0.650) x 0) = 0.970 x 0.650 x 3.200 = 2.018 fa = e-pfu + (1 - p)fal = e-0.12X0.250 (0.650 x 2.018 + (1 - 0.650) > 0) = 0.970 x 0.650 X 2.018 = 1.272 Problem 3: A stock price is currently $100. Over each of the next two six-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-year European call option with a strike price of $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts