Question: It must be solved using a business calculator. (N, I, PMT, PV, etc) Black Widow is offered an investment that will pay her $120,000 every

It must be solved using a business calculator. (N, I, PMT, PV, etc)

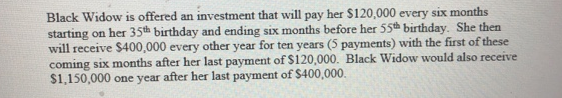

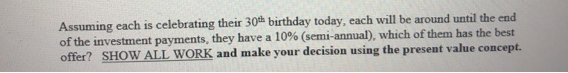

Black Widow is offered an investment that will pay her $120,000 every six months starting on her 35th birthday and ending six months before her 55th birthday. She then will receive $400,000 every other year for ten years (5 payments) with the first of these coming six months after her last payment of $120,000. Black Widow would also receive 0,000 one year after her last payment of $400,000 Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value concept. Black Widow is offered an investment that will pay her $120,000 every six months starting on her 35th birthday and ending six months before her 55th birthday. She then will receive $400,000 every other year for ten years (5 payments) with the first of these coming six months after her last payment of $120,000. Black Widow would also receive 0,000 one year after her last payment of $400,000 Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value concept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts