Question: It says Answer is not complete. Please help me find what I am missing. Derrick and Ani Jones are married taxpayers. filing jointly! and have

It says Answer is not complete. Please help me find what I am missing.

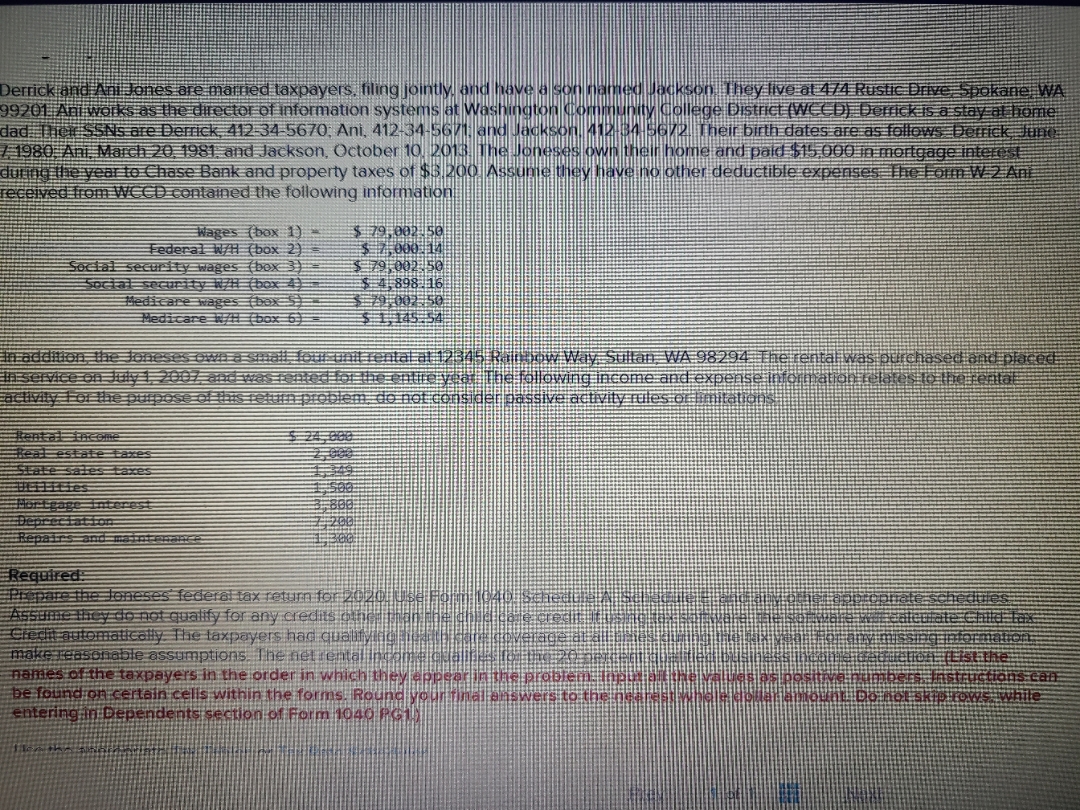

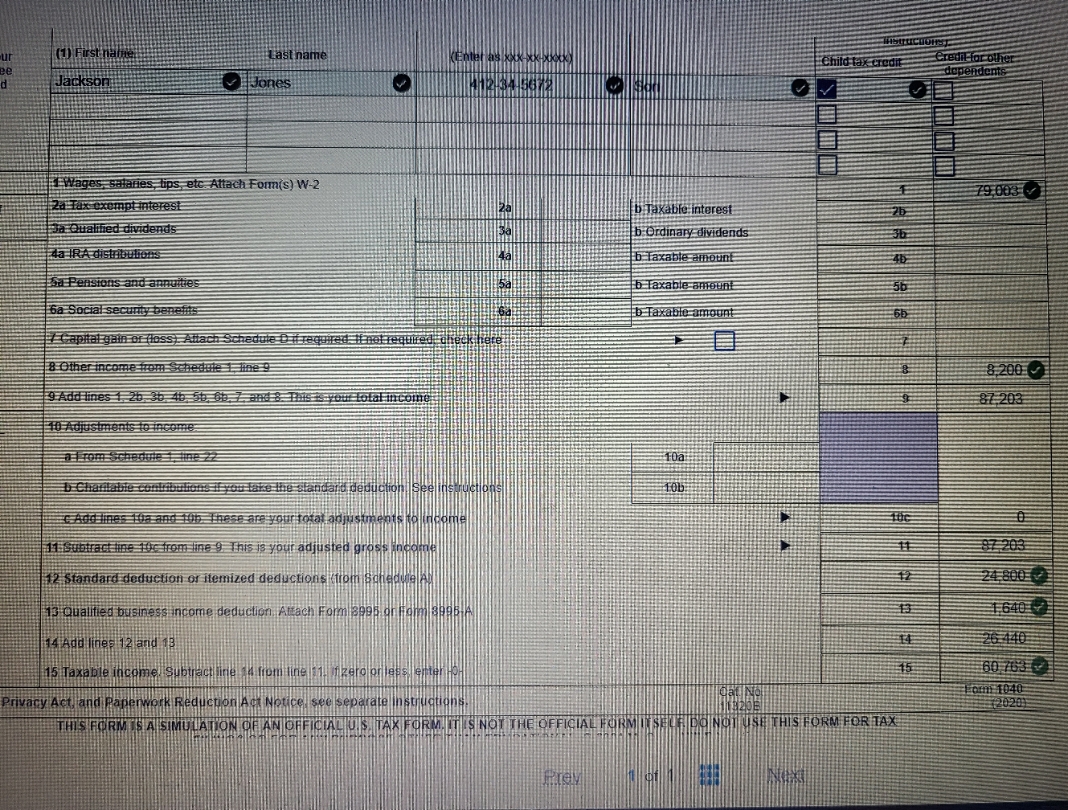

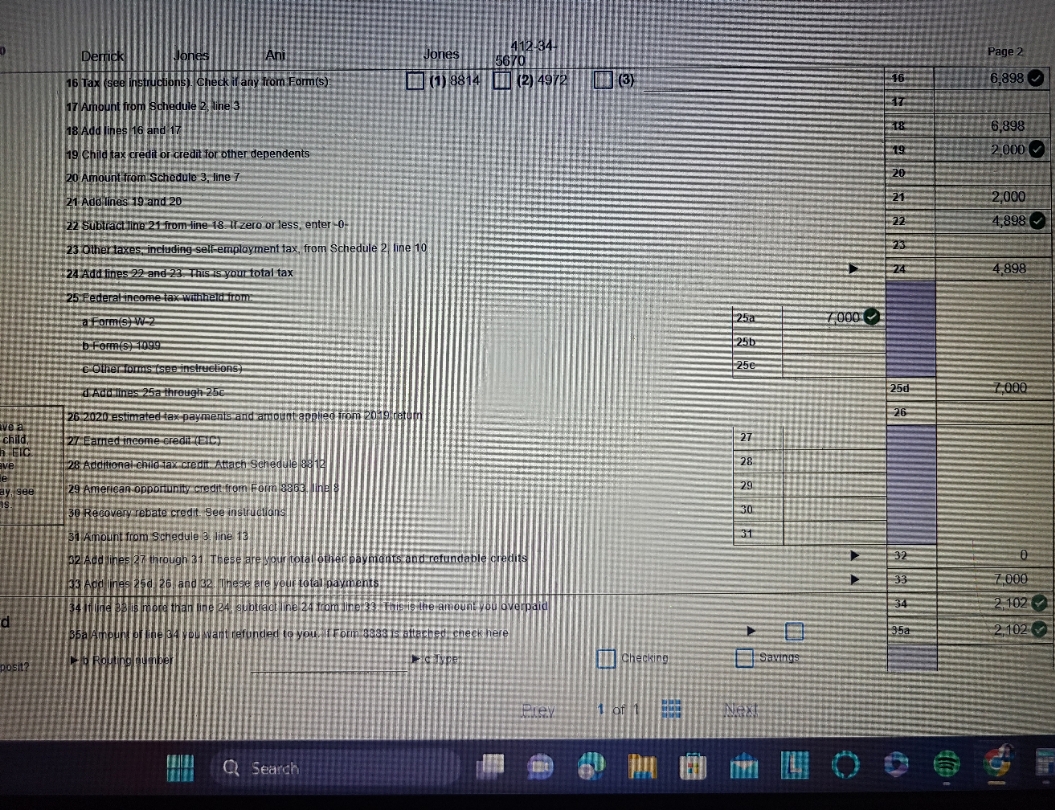

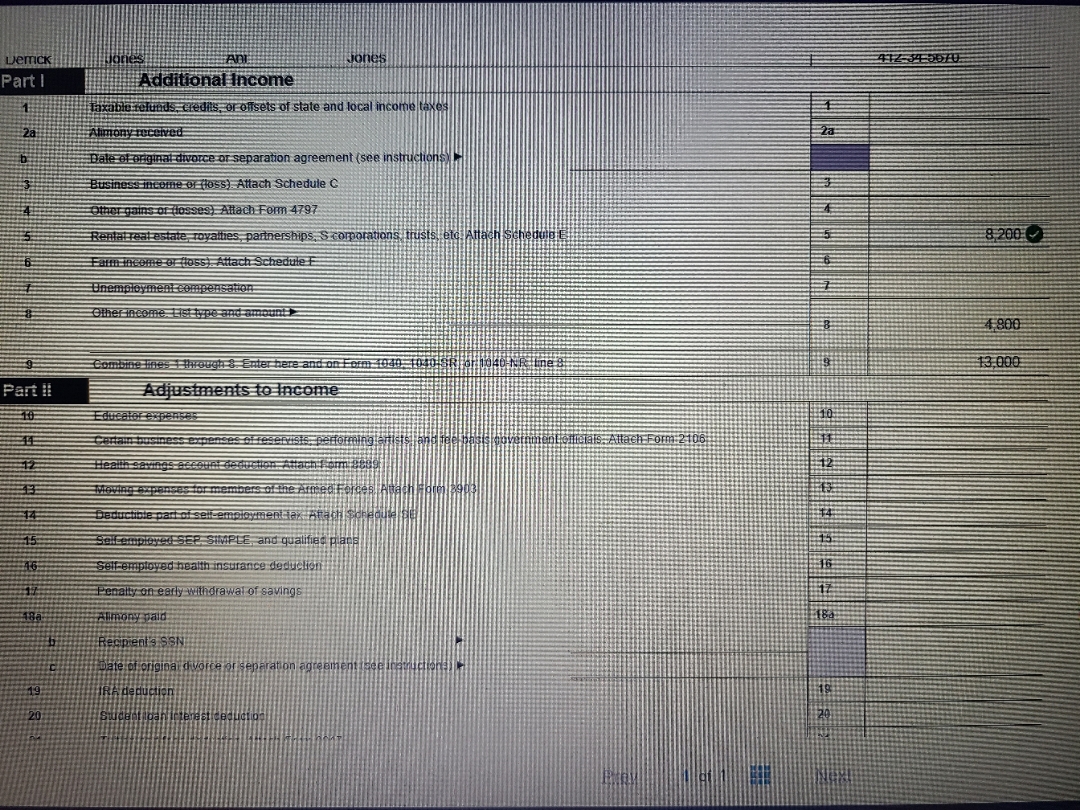

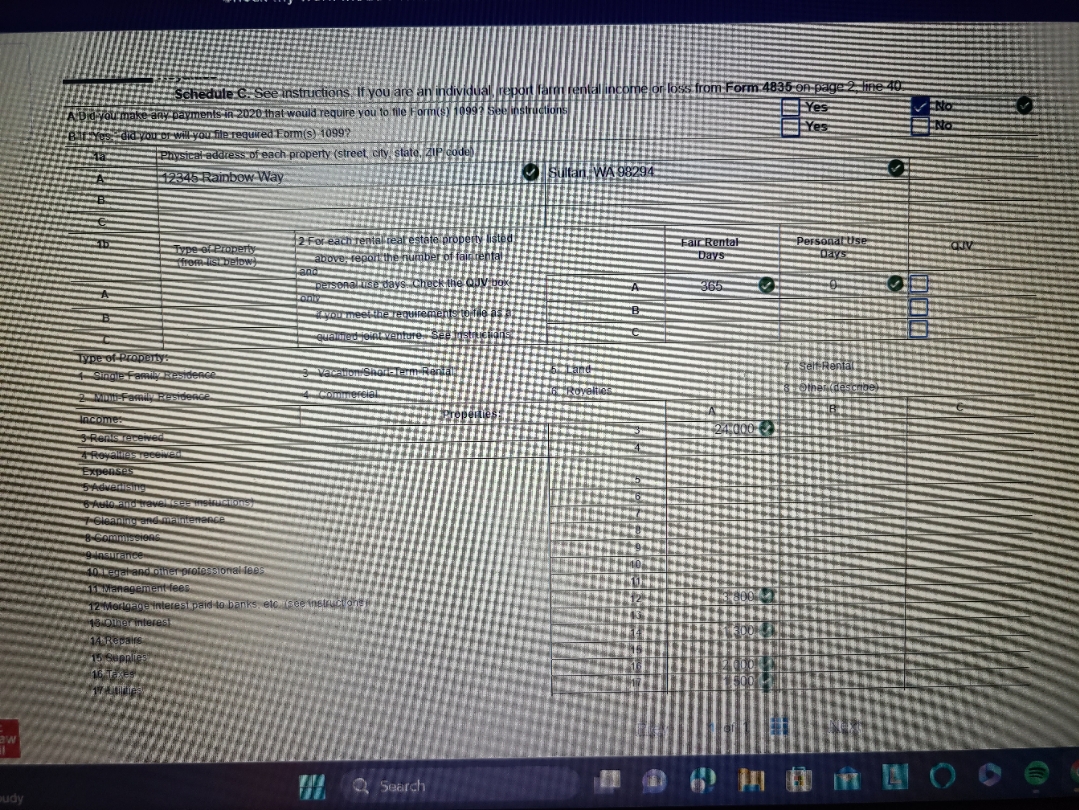

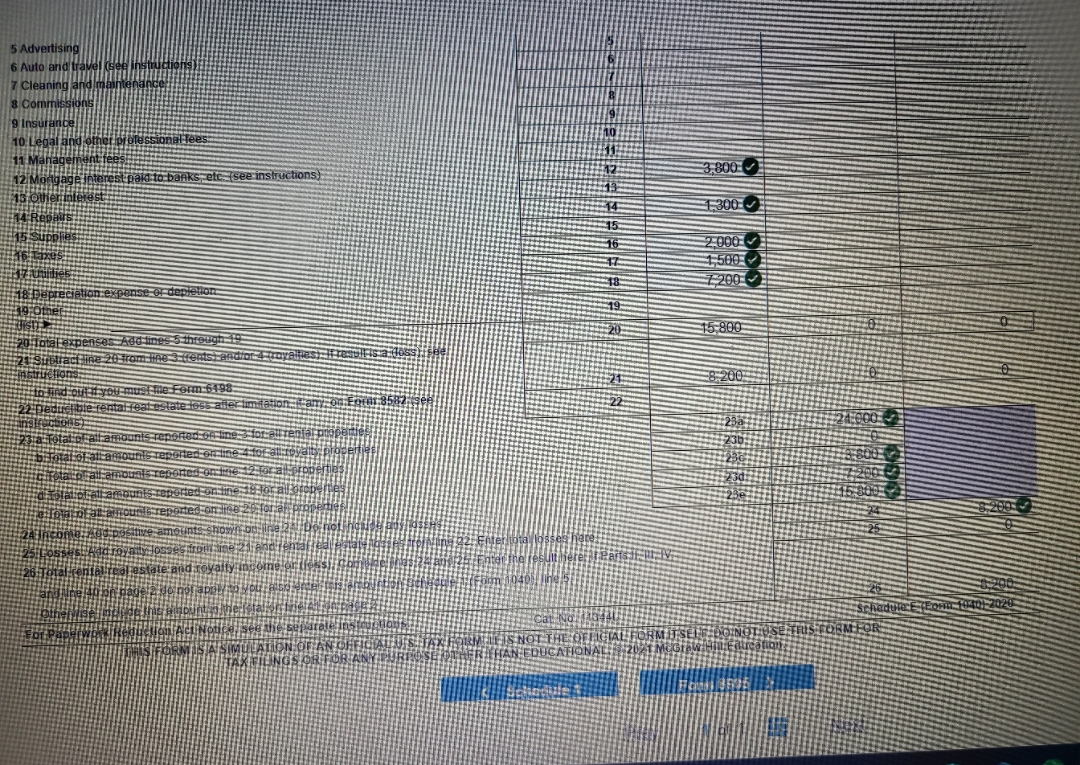

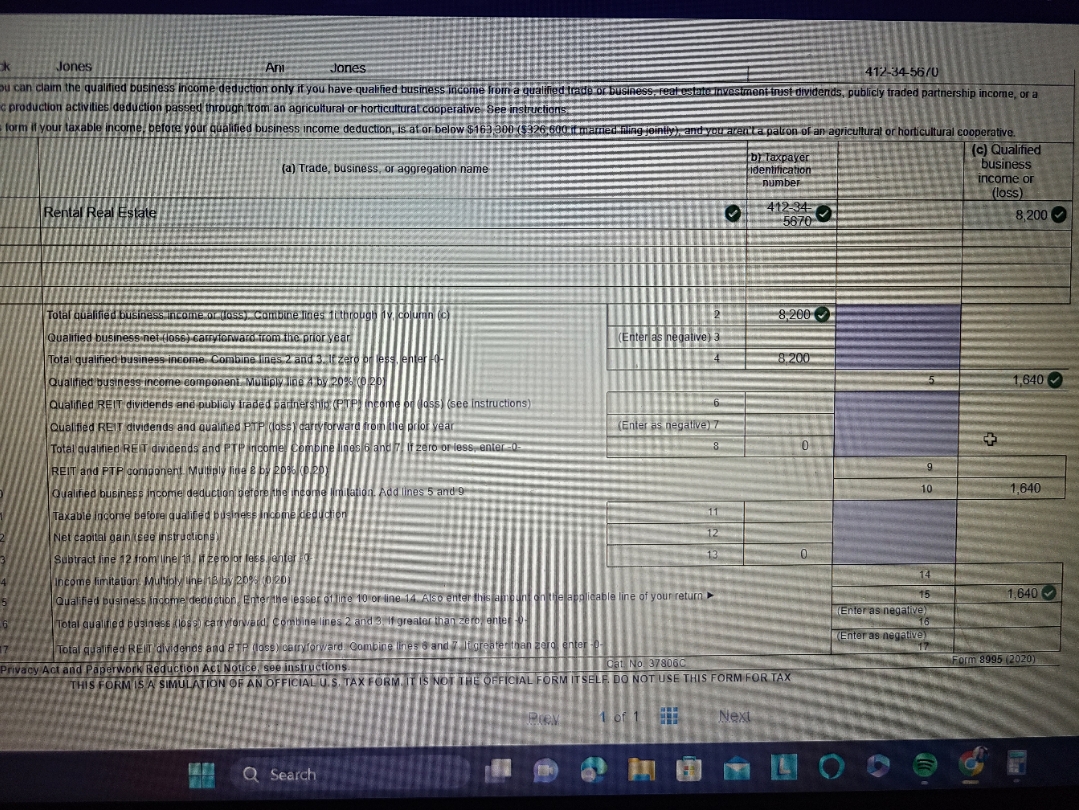

Derrick and Ani Jones are married taxpayers. filing jointly! and have in They live at 474 Rustic Drive, Spokane WA 99201 Ani works as the director of information systems at Washington Community College District (WCCD) Derrick is a stay at home Had Their SSNs are Derrick, 412 34 5670, Ani, 412-34-56/1, and Jackson. (1 84 56/?| Their birth dates are as follows Derrick June 1980 Ani. March 20, 1981. and Jackson, October 10, 2013. The Joneses own their home and paid $15 090 in mortgage interest during the year to Chase Bank and property taxes of $5 200 Assume they have no other deductible expenses the Form W Z Ami eceived from WCCD contained the following information Wages (box 1) 5 79 002 50 Federal W/H (box 2) Social security wages (box $ 795002 50 social security Will (box $ 4, 898 .16 29 092 50 dicare W/I box $ 1, 145 54 addmon rental at 128 i now Way. Sullan, WA 98294 The rental was purchased and placed to yeol The following income and expense information relates to the rental do not consider passive activity fulles of limitations 24.080 Required the Joneses federal tax return for 20210 Assulfite they do not qualify for any credits child Calculate Child tax Credit automatically the taxpayers had qualifyingEll mformat make reasonable assumptions. The net rental ingon names of the taxpayers in the order in which they in the problem be found on certain cells within the forms. Round your final answers to the ned entering in Dependents section of Form 1040 PG1THISUTCHONS (1) First name Last name Child tax credit Credit for other dependent Jackson Jones Wages salaries, tips etc. Attach Form(s) W-2 79:003 Tax exempt interest taxable interest Ja Qualified dividends b Ordinary dividends 43 IRA distabulous 0 taxable amount Su Pensions and annuities b Taxable amount 6a Social security benefits b taxable amount Capital gain of (loss) Attach Schedule D if required If not required check he 8 Other income from Schedule 1 line 9 8,200 9 Add lines 1 26 36 46, 56, 60 7, and & This is your total income 87,203 10 Adjustments to income aI rom Schedule 1, Inez Fora ` Charitable cufflibations if you take the slang fu deduction See Add lines tua and 106 These are your forat adjustments to income Subtract line fuc from line 9. This is your adjusted gross 87 203 2 Standard deduction of itemized deductions from schedwell 24 800 15 Qualified business income deduction Attach Form 3895 8. Him 3985 A 13 640 14 Add lines 12 and 18 26-140 15 Taxable income Subtract line A from line :1. ifkero orless entertol 15 60 763 For 1040 Privacy Act, and Paperwork Reduction Act Notice, see separate instruction (2020 THIS FORM IS A SIMULATION OF AN OFFICIAL UIS TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX5670 Page 2 y from Form(s) (1) 9814 1 (2) 4972 (3) 6,898 18 6.898 credit for other dependents $19 $2,000 I from Schedule 3, line ? 20 19 and 20 21 2,000 Subtract line 21 from line 18. If zero or less, enter o 4,898 "Other taxes, including self employment tax, from Schedule 2 fine 10 23 Add lines 22 and 23. This is your total tax 1898 Federal income tax withheld from 25x 900 25b c'Other forms (see instructions :25e Add lines 25a through 256 25d 7.060 26 2020 estimated tax payments and am 26 child 2/ Earned income credit (Die Additional CNG Tax credit. Attach Schedu 28 American opportunity credit from Form 325 29 covery rebate credit See instructions 30 mount from Schedule 3.1 31 and refundable 32 33 7,000 2,102 -35a 2,102 Ill Checking Savings Q SearchDemck FABI Jones 412-34 5670 Part I Additional Income taxable telunds, credits, of offsets of state and local income taxes Alimony received Dale of original divorce of separation agreement (see instructions) Business income of (loss). Attach Schedule C Other gains of (losses, Attach Form 4797 Rental real estate, royalties, partnerships, $ corporations trusts Schedul 8 200 Faith Income of floss). Attach Schedule Unemployment compensation Other Income, List type and amount $ 800 Combine mes | Hough & Enter here and on Form toan told 13,000 Part !! Adjustments to Income Educator expense 10 gildais Attach Form 2 10b Health savings account decurtis Moving Expenses for member Deductible part of self-employment ex attach Selfemployed 952 SIMPLE, and qualified plans 15 Self-employed health insurance deduction 16 Penalty on early withdrawal of savings Alimony paid Recipient s Say Date of originardworce of separation agreementssee anair deduction dent igan interest seductionSchedule C. from Form 4835 on page 2, line 49 payments in 2020 that would re IT will you mile required Yes Physical address of each property (street, city. st 12345-Rambow Way IS Man WA 98294 2 For each Tenies state pro Fair Rental Personal Use Days sonalused 365 Toyour meet the require Type of Property Incomes and other professional lees agement te nterest paid to banks, elc see instruct Search5 Advertising 6 Auto and trave 7 Cleaning paid to banks, etc (see instructions) 3,800 1,300 2:000 1 500 2 290 15,800 8 200 RITEIS NOT THE OFFICIAL F HAN EDUCATIONALJones Jones 412-34-56/0 u can claim the qualified business income deduction only if you have qualified business income from a qualifed trade o st dividends, publicly traded partnership income, or a production activities deduction passed through from an agricultural or horticultural cooperative See form if your d business income deduction, is at or below $163,300 ($326,600 if manned n ' and you aren't a paton of an agricultural or horticultural cooperative. bi taxpayer (c) Qualified (a) Trade, business, or aggregation name Idemication business number income or (loss) Rental Real Estate 412-34- 5670 8,200 Total qualified business income of (lose). Combine lines it through 8,200 Qualified business net (loss) carrytorwar Total qualified business income. Combine lines 8.200 Qualified business income component, Multiply line a by 2096 (0 201 1,640 Qualified REIT dividends and publicly tra on doss) (see instructions) Qualified REIT dividends and qualified P arry forward from the prior year (Enter as negative) ? Total qualified REIT dividends and nes 6 and 7. if zero or less, enter -0 0 + REIT and PTP component. 9 Qualified business income deduction 10 1,640 Taxable income before qualified bu 11 Net capital gain see instructions) 12 Subtract line 12 from line 11, it zero or less center 13 0 Income limitation Muluply une he by 209: (0120) 14 Qualified business income deduction Enterthe lesser of line 10 or line 14. Also enter this icable line of your return 15 1,640 (Enter as negative) d business ki ombine lines 2 and 3. If greater than zero, er 16 (Enter as negative) ard. Combine line 17 Form 8995 (2020) Privacy Act and Cat No. 378060 THE OFFICIAL FO FORM ITSELF. DO NOT USE THIS FORM FOR TAX Next Q Search 6 cy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts