Question: It says i am missing something, but i am stuck. Exercise 3-3 (Static) Schedules of Cost of Goods Manufactured and Cost of Goods Sold [LO3-3]

![Sold [LO3-3] Primare Corporation has provided the following data concerning last month's](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e58c6143ab6_71266e58c60e9533.jpg)

It says i am missing something, but i am stuck.

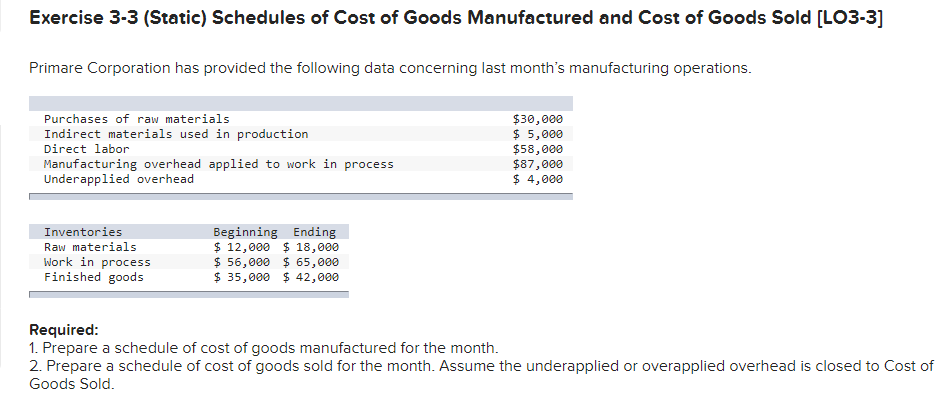

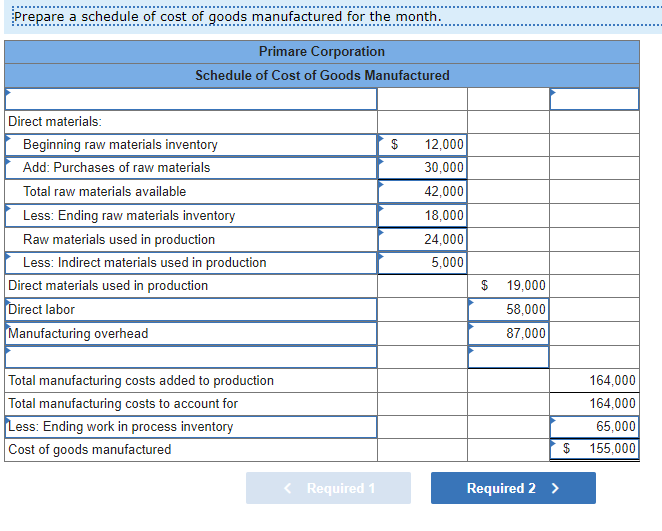

Exercise 3-3 (Static) Schedules of Cost of Goods Manufactured and Cost of Goods Sold [LO3-3] Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor Manufacturing overhead applied to work in process Underapplied overhead $30,000 $ 5,000 $58,000 $87,000 $ 4,000 Inventories Raw materials Work in process Finished goods Beginning Ending $ 12,000 $ 18,000 $ 56,000 $ 65,000 $ 35,000 $ 42,000 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepare a schedule of cost of goods manufactured for the month. Primare Corporation Schedule of Cost of Goods Manufactured Direct materials: Beginning raw materials inventory Add: Purchases of raw materials Total raw materials available Less: Ending raw materials inventory Raw materials used in production Less: Indirect materials used in production Direct materials used in production Direct labor Manufacturing overhead 12,000 30,000 42,000 18,000 24,000 5,000 $ 19,000 58,000 87,000 Total manufacturing costs added to production Total manufacturing costs to account for Less: Ending work in process inventory Cost of goods manufactured 164,000 164,000 65,000 $ 155,000 Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. $ Primare Corporation Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Add: Underapplied overhead Adjusted cost of goods sold 35,000 155,000 190,000 42,000 148,000 4,000 152,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts