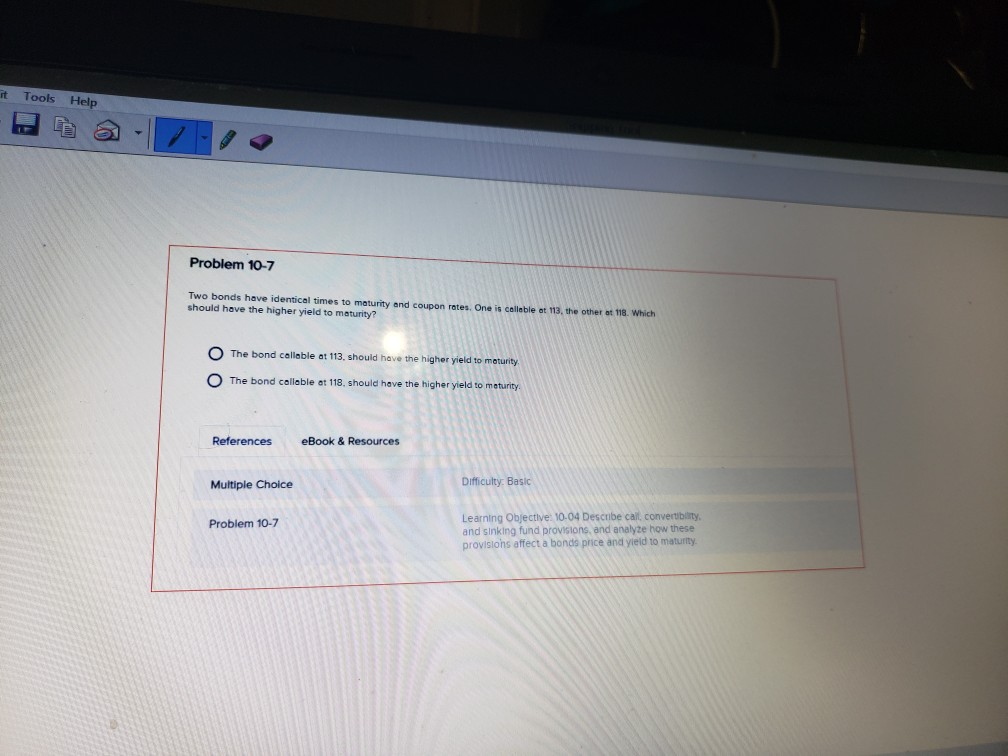

Question: it Tools Help Problem 10-7 Two bonds have identical times to maturity and coupon rates. One is callable at 113, the other at 118. Which

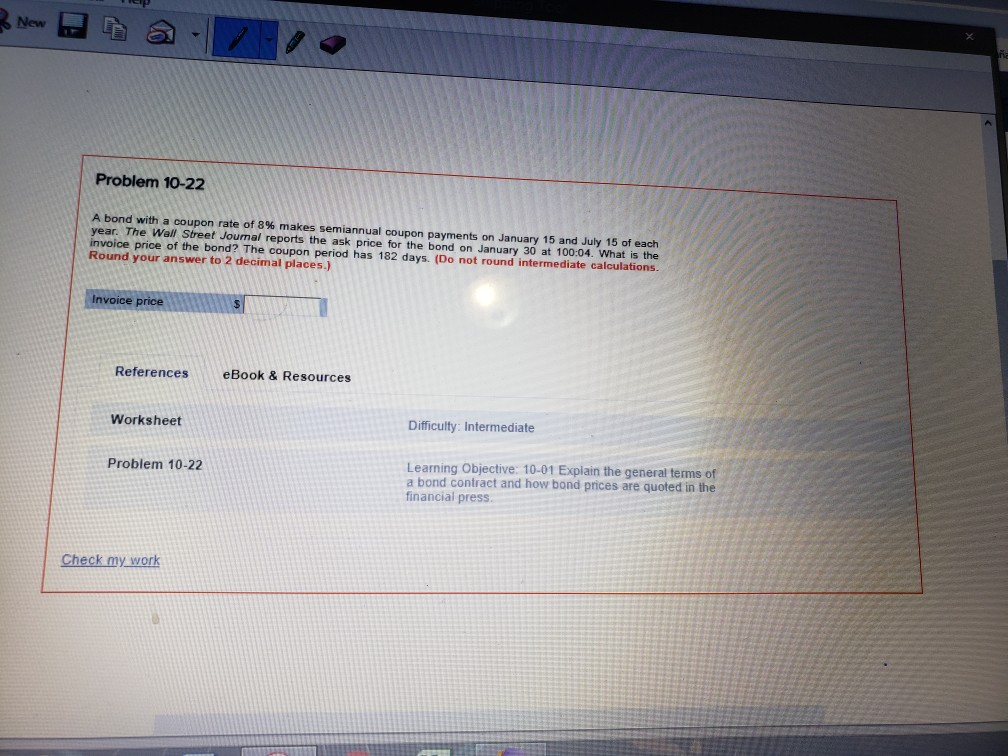

it Tools Help Problem 10-7 Two bonds have identical times to maturity and coupon rates. One is callable at 113, the other at 118. Which should have the higher yield to maturity? The bond callable at 113, should have the higher yield to maturity The bond callable at 118, should have the higher yield to maturity References eBook & Resources Multiple Choice Difficulty: Basic Problem 10-7 Learning Objective: 10-04 Describe call, convertibility and sinking fund provisions, and analyze how these provisions affect a bonds price and yield 10 maturity New Problem 10-22 A bond with a coupon rate of 8% makes semiannual coupon payments on January 15 and July 15 of each year. The Wall Street Journal reports the ask price for the bond on January 30 at 100:04. What is the invoice price of the bond? The coupon period has 182 days. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Invoice price $ References eBook & Resources Worksheet Difficulty: Intermediate Problem 10-22 Learning Objective: 10-01 Explain the general terms of a bond contract and how bond prices are quoted in the financial press Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts