Question: it uses the standard normal cumulative distribution function table for these five questions 3 Question 10 (3.7 points) What is the price of a $110

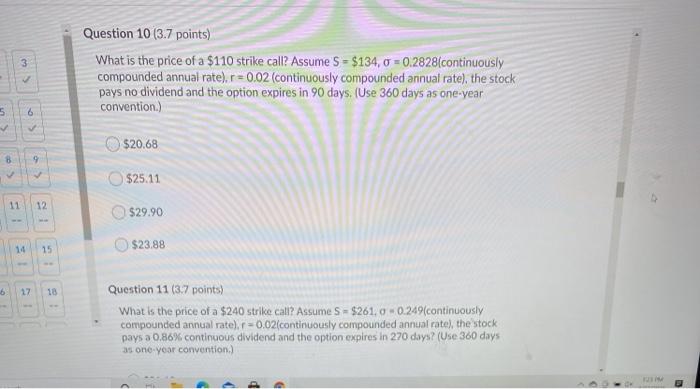

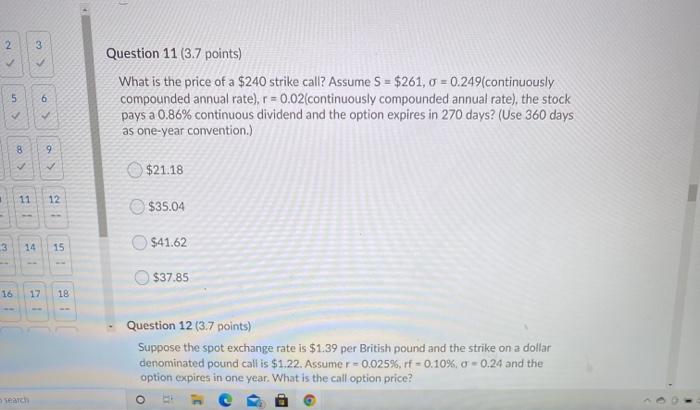

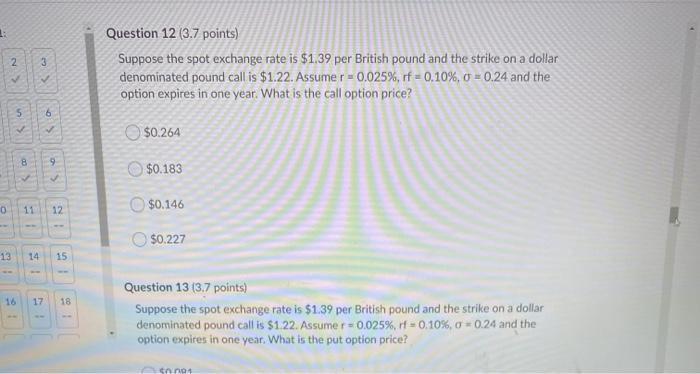

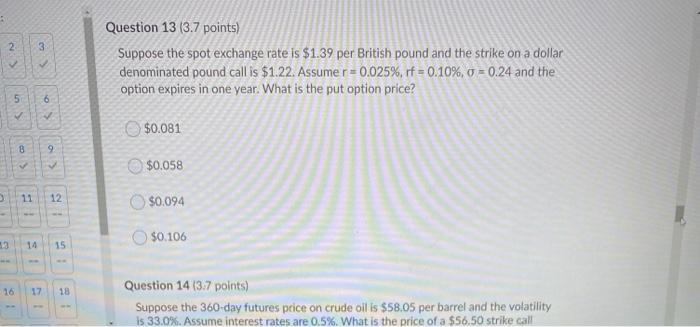

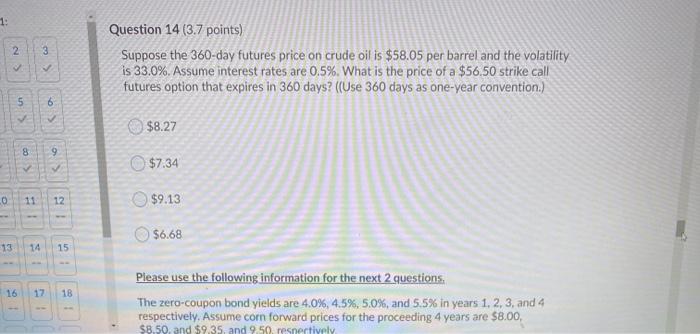

3 Question 10 (3.7 points) What is the price of a $110 strike call? Assume S - $134, 0 = 0.2828(continuously compounded annual rate). r = 0.02 (continuously compounded annual rate), the stock pays no dividend and the option expires in 90 days. (Use 360 days as one-year convention) 6 5 $20.68 8 9 $25.11 11 12 $29.90 15 $23.88 6 27 18 Question 11 (3.7 points) What is the price of a $240 strike call? Assume S - $261.0.0.249 continuously compounded annual rate). -0,02(continuously compounded annual rate), the stock pays a 0.86% continuous dividend and the option expires in 270 days? (Use 360 days as one-year convention. 2 3 Question 11 (3.7 points) What is the price of a $240 strike call? Assume S - $261, 0 = 0.249(continuously compounded annual rate). r=0.02(continuously compounded annual rate), the stock pays a 0.86% continuous dividend and the option expires in 270 days? (Use 360 days as one-year convention.) 5 6 > p> 9 $21.18 11 12 $35.04 3 14 15 $41.62 $37.85 16 17 18 Question 12 (3.7 points) Suppose the spot exchange rate is $1.39 per British pound and the strike on a dollar denominated pound call is $1.22. Assumer=0.025%, rf = 0.10%, 0 -0.24 and the option expires in one year. What is the call option price? Search O . 2 3 Question 12 (3.7 points) Suppose the spot exchange rate is $1.39 per British pound and the strike on a dollar denominated pound call is $1.22. Assume r = 0.025%, rf = 0.10%, 0 = 0.24 and the option expires in one year. What is the call option price? 5 6 $0.264 8 9 $0.183 0 $0.146 11 12 $0.227 13 14 15 16 17 18 Question 13 (3.7 points) Suppose the spot exchange rate is $1.39 per British pound and the strike on a dollar denominated pound call is $122. Assume r = 0.025%, 11=0,10%, 0 = 0.24 and the option expires in one year. What is the put option price? n.no 3 CN Question 13 (3.7 points) Suppose the spot exchange rate is $1.39 per British pound and the strike on a dollar denominated pound call is $1.22. Assume r=0.025%, rf = 0.10%, 0 = 0.24 and the option expires in one year. What is the put option price? 6 5 $0.081 8 9 > $0.058 11 12 $0.094 $0.106 14 15 16 17 18 Question 14 (3.7 points) Suppose the 360-day futures price on crude oil is $58.05 per barrel and the volatility is 33.0%. Assume interest rates are 0.5%. What is the price of a $56,50 strike call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts