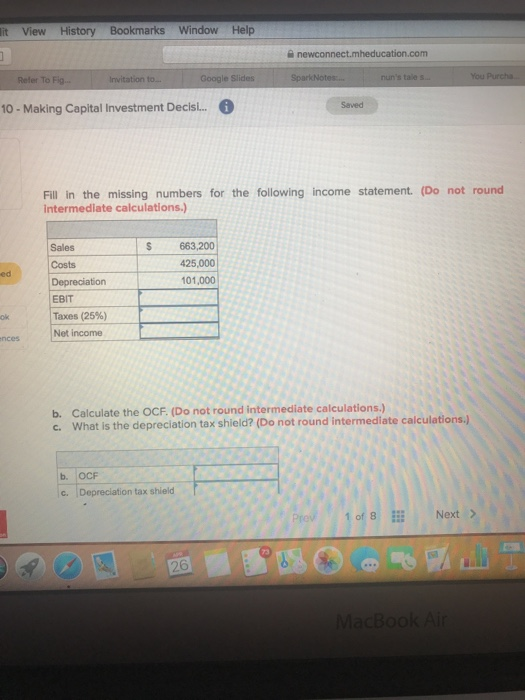

Question: it View History Bookmarks Window Help nun's tale s. Google Slides Refer To Fig... 10 - Making Capital Investment Decis... Saved Fill in the missing

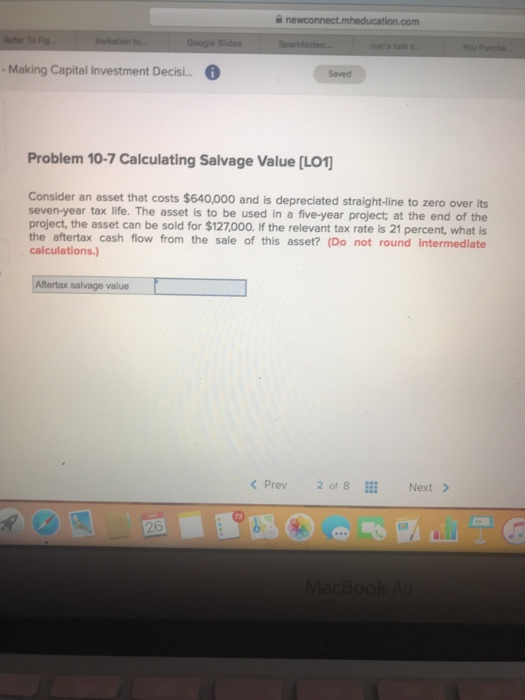

it View History Bookmarks Window Help nun's tale s. Google Slides Refer To Fig... 10 - Making Capital Investment Decis... Saved Fill in the missing numbers for the following income statement. (Do not round intermediate calculations.) S 663,200 425,000 Sales Costs101,000 Depreciation EBIT Taxes (25%) Net income ed ok b. Calculate the OCF. (Do not round intermediate calculations.) c. What is the depreciation tax shield? (Do not round intermediate calculations.) c Depreciation tax shield Next > 1 of 8 26 Making Capital Investment Decis. Saved Problem 10-7 Calculating Salvage Value [LO1 Consider an asset that costs $640,000 and is depreciated straight-line to zero over its seven-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $127,000. If the relevant tax rate is 21 percent, what is the aftertax cash flow from the sale of this asset? (Do not round intermediate calculations.) Aftertax salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts