Question: It will be helpful if I could get the answer and working for the questions from No 4 to No 6. I U ~ abe

It will be helpful if I could get the answer and working for the questions from No 4 to No 6.

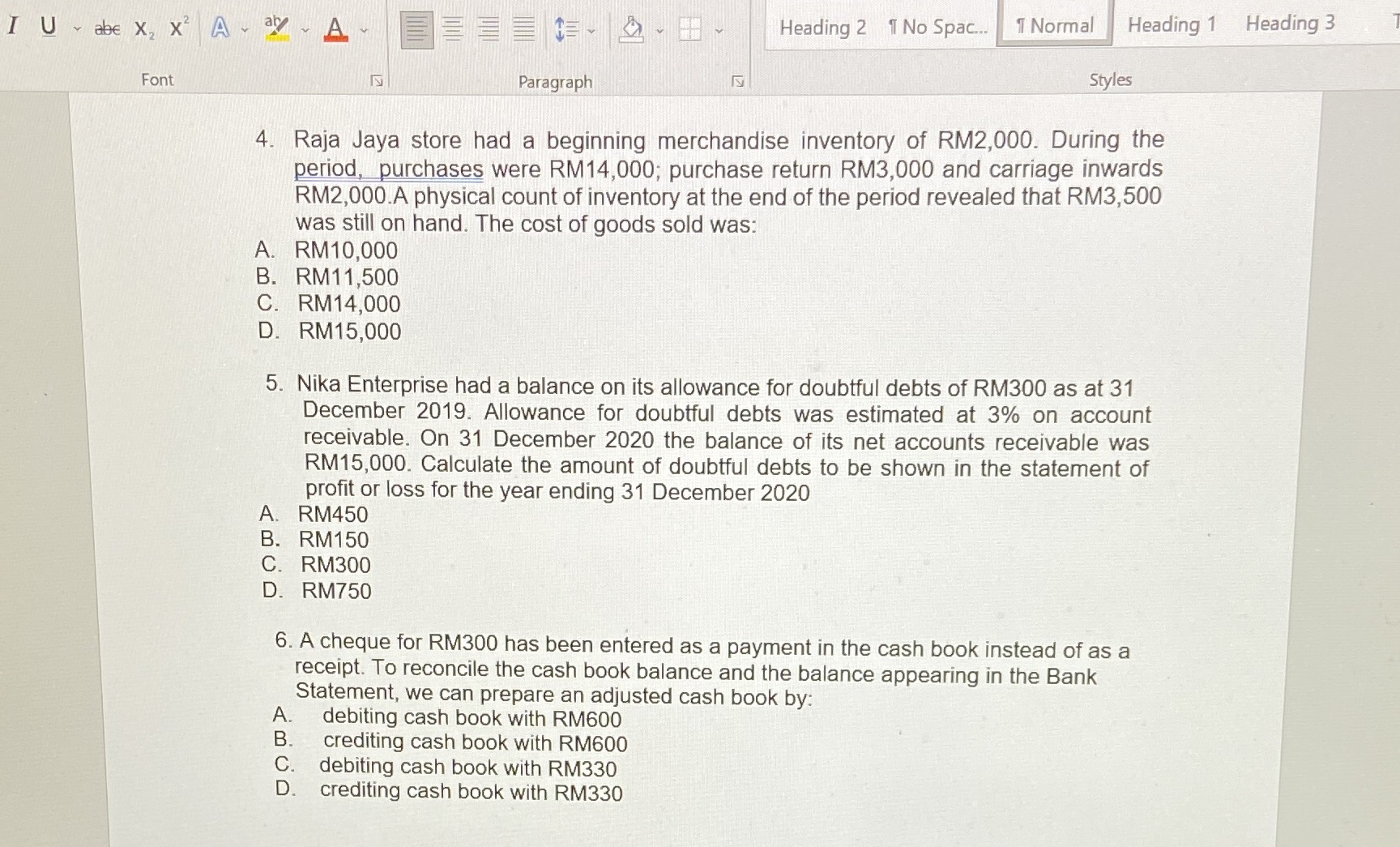

I U ~ abe X, X A . a A Heading 2 1 No Spac.. 1 Normal Heading 1 Heading 3 Font Paragraph Styles 4. Raja Jaya store had a beginning merchandise inventory of RM2,000. During the period, purchases were RM14,000; purchase return RM3,000 and carriage inwards RM2,000.A physical count of inventory at the end of the period revealed that RM3,500 was still on hand. The cost of goods sold was: A. RM10,000 B. RM11,500 C. RM14,000 D. RM15,000 5. Nika Enterprise had a balance on its allowance for doubtful debts of RM300 as at 31 December 2019. Allowance for doubtful debts was estimated at 3% on account receivable. On 31 December 2020 the balance of its net accounts receivable was RM15,000. Calculate the amount of doubtful debts to be shown in the statement of profit or loss for the year ending 31 December 2020 A. RM450 B. RM150 C. RM300 D. RM750 6. A cheque for RM300 has been entered as a payment in the cash book instead of as a receipt. To reconcile the cash book balance and the balance appearing in the Bank Statement, we can prepare an adjusted cash book by: A. debiting cash book with RM600 B. crediting cash book with RM600 C. debiting cash book with RM330 D crediting cash book with RM330

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts