Question: Items 20 through 28 are based on the following information: You were engaged by Spice Girls Company, whose shares are publicly traded, to conduct an

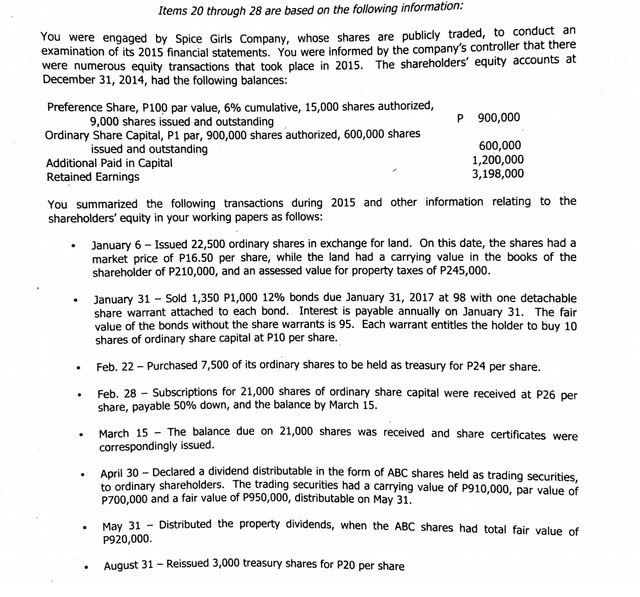

Items 20 through 28 are based on the following information: You were engaged by Spice Girls Company, whose shares are publicly traded, to conduct an examination of its 2015 financial statements. You were informed by the company's controller that there were numerous equity transactions that took place in 2015. The shareholders' equity accounts at December 31, 2014, had the following balances: Preference Share, P100 par value, 6% cumulative, 15,000 shares authorized, 9,000 shares issued and outstanding P 900,000 Ordinary Share Capital, P1 par, 900,000 shares authorized, 600,000 shares issued and outstanding 600,000 Additional Paid in Capital 1,200,000 Retained Earnings 3,198,000 You summarized the following transactions during 2015 and other information relating to the shareholders' equity in your working papers as follows: January 6 - Issued 22,500 ordinary shares in exchange for land. On this date, the shares had a market price of P16.50 per share, while the land had a carrying value in the books of the shareholder of P210,000, and an assessed value for property taxes of P245,000. January 31 - Sold 1,350 P1,000 12% bonds due January 31, 2017 at 98 with one detachable share warrant attached to each bond. Interest is payable annually on January 31. The fair value of the bonds without the share warrants is 95. Each warrant entitles the holder to buy 10 shares of ordinary share capital at P10 per share. Feb. 22 - Purchased 7,500 of its ordinary shares to be held as treasury for P24 per share. Feb. 28 - Subscriptions for 21,000 shares of ordinary share capital were received at P26 per share, payable 50% down, and the balance by March 15. March 15 - The balance due on 21,000 shares was received and share certificates were correspondingly issued. April 30 - Declared a dividend distributable in the form of ABC shares held as trading securities, to ordinary shareholders. The trading securities had a carrying value of P910,000, par value of P700,000 and a fair value of P950,000, distributable on May 31. May 31 - Distributed the property dividends, when the ABC shares had total fair value of P920,000. August 31 - Reissued 3,000 treasury shares for P20 per share