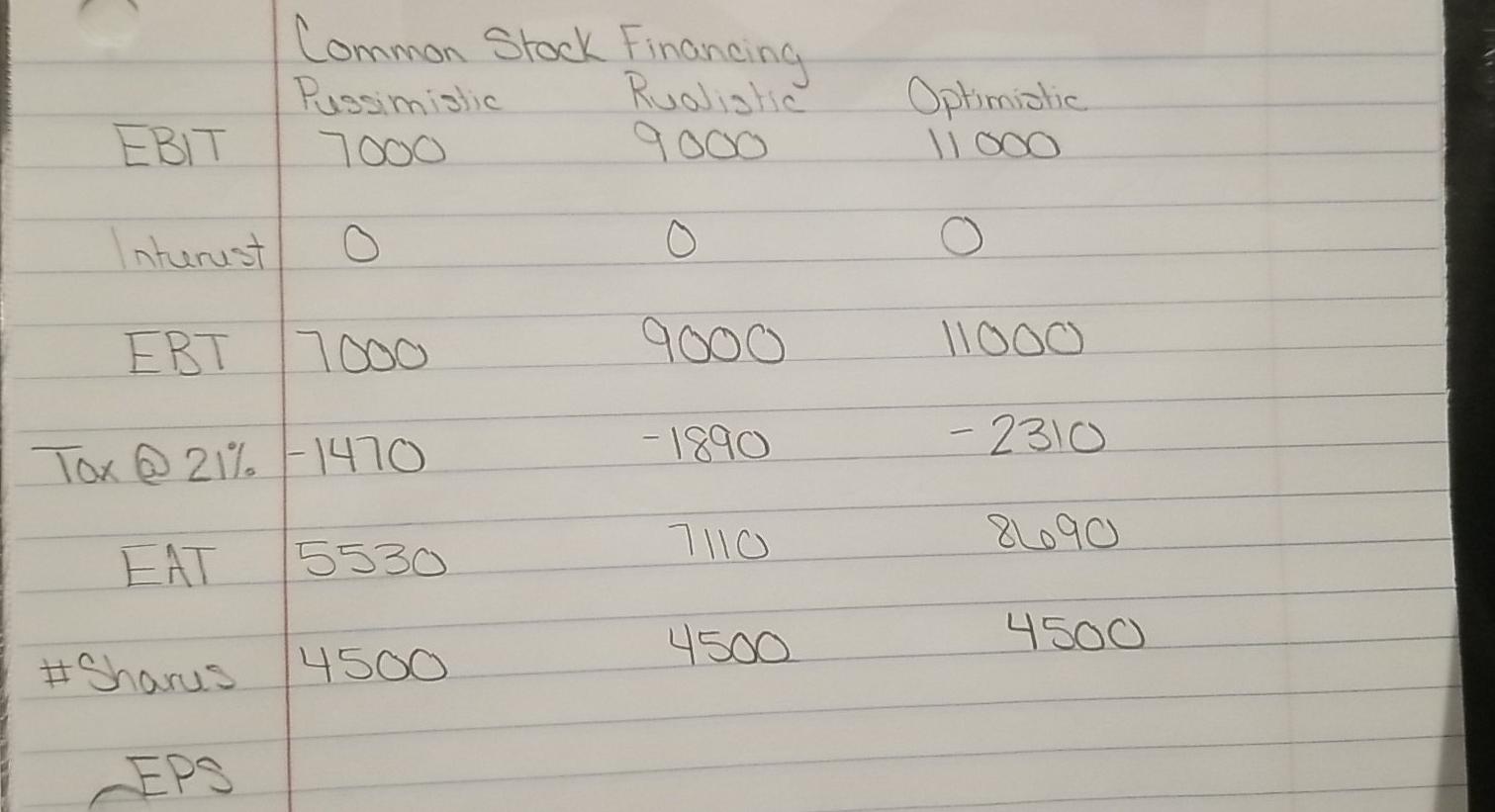

Question: Items that are highlighted are the information for the problem. First picture (hand written)is my attempt at the problem. I am unsure how to find

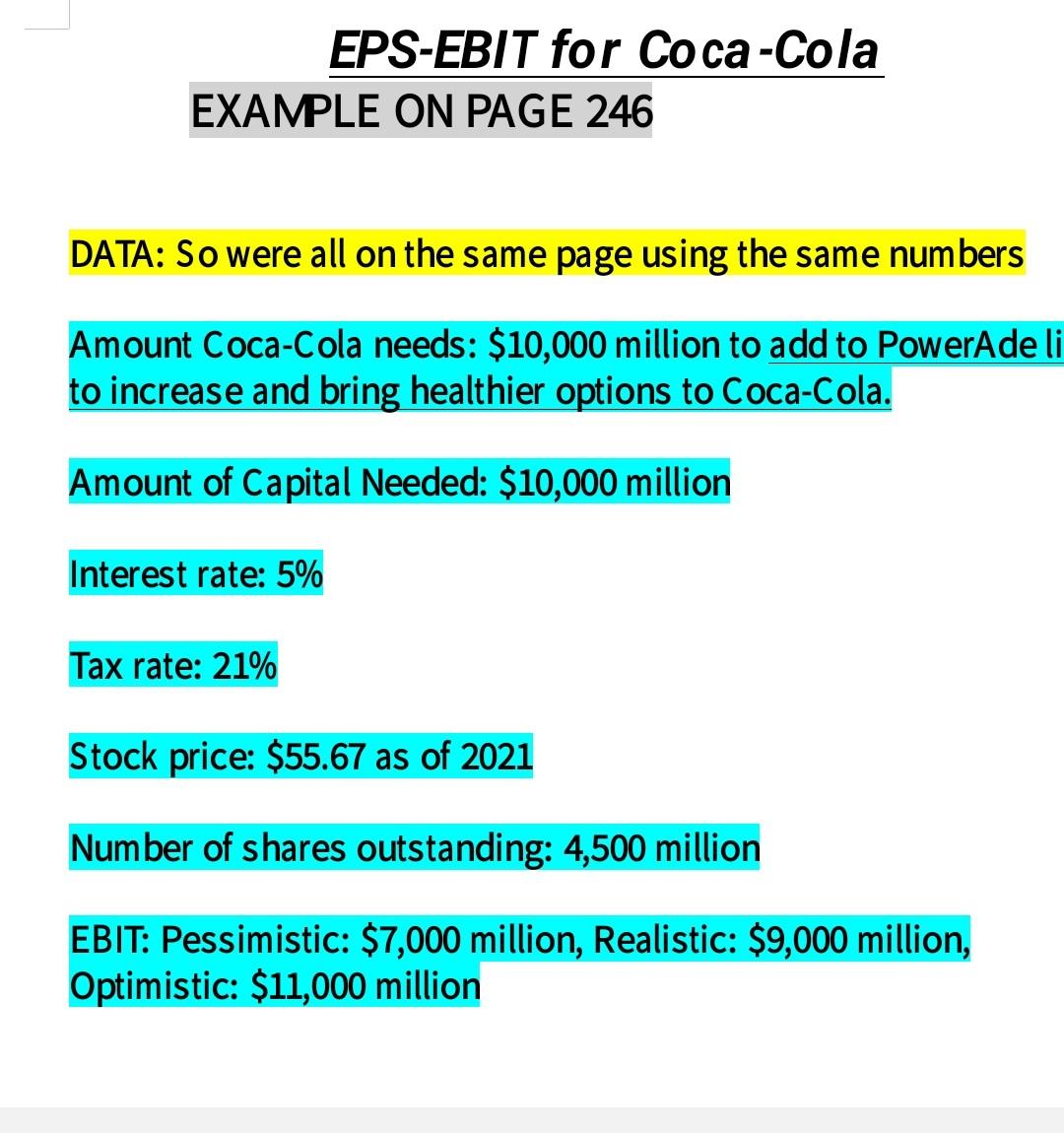

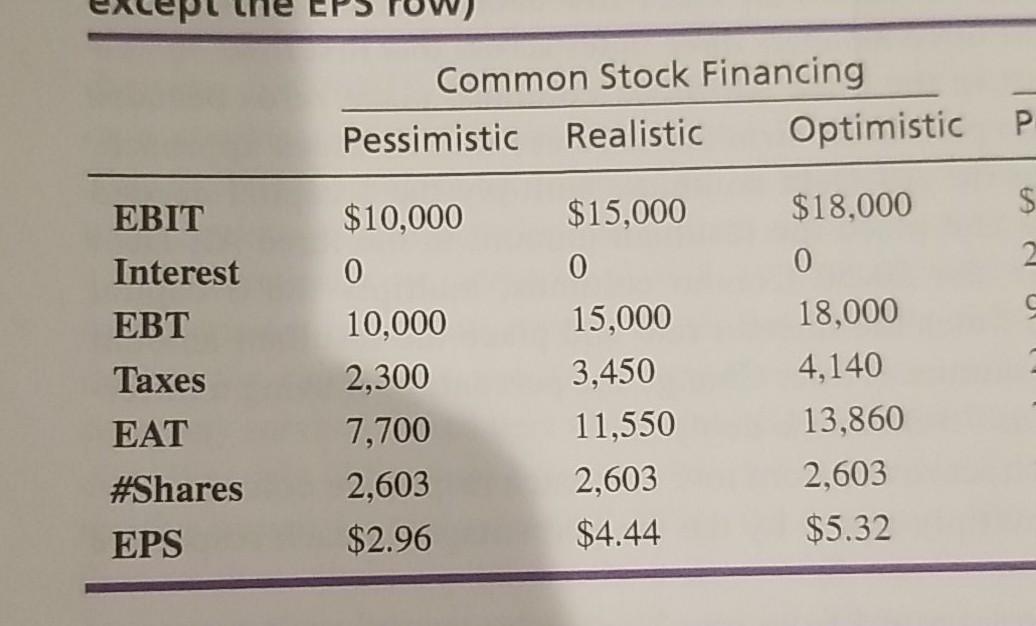

Items that are highlighted are the information for the problem. First picture (hand written)is my attempt at the problem. I am unsure how to find out the EPS or if I am doing it correctly. Third photo is an example from the textbook. I need to do a common stock financing table for EPS/EBIT Analysis.

Common Stock Financing Pussimistic Ruolistic Optimistic 11ooo EBIT Interest o EBT 17000 9000 11ooo - 1890 - 2310 Tox @ 21% -1470 7110 82690 5530 EAT 4500 4500 Sharus 45oo EPS EPS-EBIT for Coca-Cola EXAMPLE ON PAGE 246 DATA: So were all on the same page using the same numbers Amount Coca-Cola needs: $10,000 million to add to PowerAde li to increase and bring healthier options to Coca-Cola. Amount of Capital Needed: $10,000 million Interest rate: 5% Tax rate: 21% Stock price: $55.67 as of 2021 Number of shares outstanding: 4,500 million EBIT: Pessimistic: $7,000 million, Realistic: $9,000 million, Optimistic: $11,000 million Common Stock Financing Pessimistic Realistic Optimistic P. a $ EBIT 2 Interest EBT Taxes EAT #Shares EPS $10,000 0 10,000 2,300 7,700 2,603 $2.96 $15,000 0 15,000 3,450 11,550 2,603 $4.44 $18,000 0 18,000 4,140 13,860 2,603 $5.32Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts