Question: Ith The Abvin Corporation issues long term debt based on quarterly compounding. An investor may purchase a bond for a initial amount and state how

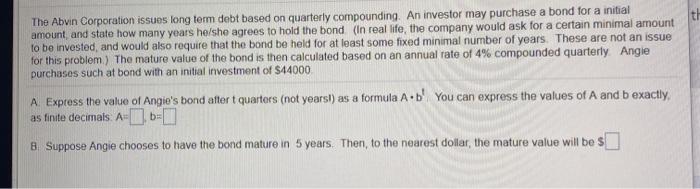

Ith The Abvin Corporation issues long term debt based on quarterly compounding. An investor may purchase a bond for a initial amount and state how many years he/she agrees to hold the bond (in real life, the company would ask for a certain minimal amount to be invested, and would also require that the bond be held for at least some fixed minimal number of years. These are not an issue for this problem) The mature value of the bond is then calculated based on an annual rate of 4% compounded quarterly Angie purchases such at bond with an initial investment of S44000 A Express the value of Angie's bond after t quarters (not years!) as a formula A:b' You can express the values of A and b exactly, as finite decimats. A-0.6= 8. Suppose Angie chooses to have the bond mature in 5 years. Then, to the nearest dollar, the mature value will be s Ith The Abvin Corporation issues long term debt based on quarterly compounding. An investor may purchase a bond for a initial amount and state how many years he/she agrees to hold the bond (in real life, the company would ask for a certain minimal amount to be invested, and would also require that the bond be held for at least some fixed minimal number of years. These are not an issue for this problem) The mature value of the bond is then calculated based on an annual rate of 4% compounded quarterly Angie purchases such at bond with an initial investment of S44000 A Express the value of Angie's bond after t quarters (not years!) as a formula A:b' You can express the values of A and b exactly, as finite decimats. A-0.6= 8. Suppose Angie chooses to have the bond mature in 5 years. Then, to the nearest dollar, the mature value will be s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts