Question: IThe following information applies to the questions displayed below.] Melr, Benson, and Lau are partners and share income and loss in a 3.2:5 ratio. The

![IThe following information applies to the questions displayed below.] Melr, Benson,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eaee027f66d_38566eaee01d96d1.jpg)

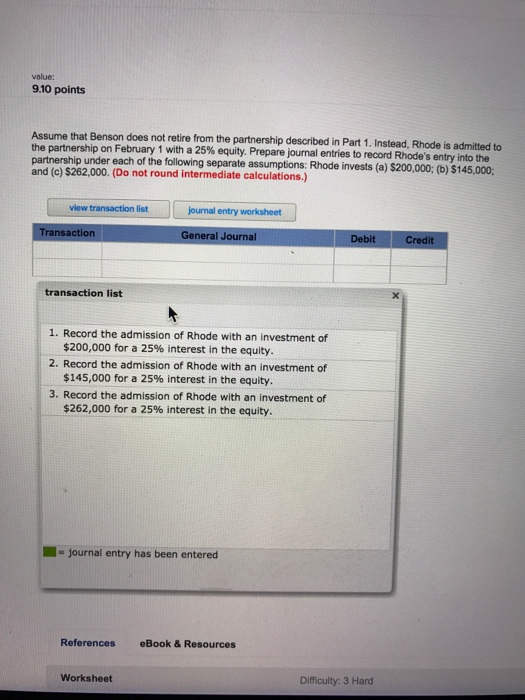

IThe following information applies to the questions displayed below.] Melr, Benson, and Lau are partners and share income and loss in a 3.2:5 ratio. The partnership's capital balances are as follows: Meir, $168/ooo; Benson, $138,000; and Lau, $294.000 Benson decides to withdraw from the partnership, and the partners agree not to have the assets revalued upon Benson's 10 9.09 points 1. Prepare the journal entry to record Benson's withdrawal from the partnership under each of the following independent assumptions. (Do not round intermediate calculations.) Benson (a) sells her interest to North for$160,000 after Meir and Lau approve the entry of North as a partner, (b) gives her interest to a son-in-law, Schmidt, and thereafter Meir and Lau accept Schmidt as a partner (c) is paid $138.000 in partnership cash for her equity. (d) is paid $214,000 in partnership cash for her equity and paid S30,000 in partnership cash plus equipment recorded on the partnership books at $70,000 less its accumulated depreciation of $23.200 view transaction list journal entry worksheet Transaction General Journal Debit Credit transaction list 1. Benson sells her interest to North for $160,000 after Meir and Lau approve the entry of North as a partner. 2. Record the withdrawal of Benson on the assumption that she gives her interest to a son-in-law, Schmidt and thereafter Meir and Lau accept Schmidt as a partner. 3. Record the withdrawal of Benson on the assumption that she is paid $138,000 in partnership cash for her equity. 4. Record the withdrawal of Benson on the assumption that she is paid $214,000 in partnership cash for her equity. 5. Record the withdrawal of Benson on the assumption that she is paid $30,000 in partnership cash plus equipment recorded on the partnership books at $70,000 less its accumulated depreciation of $23,200 for her equity. journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts