Question: I.THE NOMINAL EFFECTIVE EXCHANGE RATE (NEER) INDEX DERIVE THE NEER BY APPLYING THE FOLOWING MODELS, FROM 1997 TO 2007, BY USING YEAR END DATA FROM

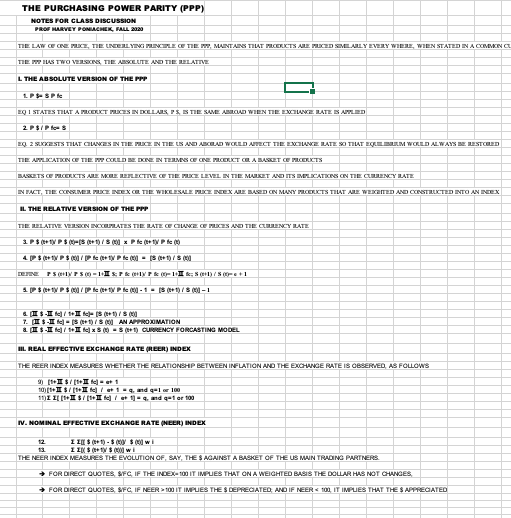

I.THE NOMINAL EFFECTIVE EXCHANGE RATE (NEER) INDEX

DERIVE THE NEER BY APPLYING THE FOLOWING MODELS, FROM 1997 TO 2007, BY USING YEAR END DATA FROM THE SOURCES CITED BELOW::

NEER FC/ $, t+1 =

?[FC / $ n, t+1 / FC/ $ n, t] W n, t

where the variable are defined as follows:

- t goes from 2005 to 2015, with the base year being 2005,

- FC/ $ n, t is the indirect quote of currency n per the $ in year t,

- n is the number of foreign countries (that are listed below),

- Wn is the export share (%) of the U.S. to each country, and

- ? sigma relates to aggregation for country n=1 to N, and each derivation for the N countries is done for each year, from 2005 TO 2015

THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP FOR ALL THE n COUNTRIES TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF THE $ FROM THE PERSPECTIVE OF THE U.S. MAIN TRADING PARTNERS (THAT ARE LISTED BELOW).

1.QUOTES ARE INDIRECT, FC/ $, AND FOR END OF YEAR RATES.

2.Wn MEASURES THE % SHARE OF U.S. EXPORT TO COUNTRY n, and ?Wn=1

3.THE $ INDEX IS SET AT 100 IN 2005, WHICH IS THE BASE YEAR.THE INDEX MEASURES THE VALUE OF THE $ FROM A FOREIGN PERSPECTIVE (FOREIGN TERMS).

4.WHEN THE INDEX IS ABOVE 100, IT IMPLIES THAT THE DOLLAR APPRECIATED; AND WHEN IT IS BELOW 100, IT IMPLIES THAT THE $ DEPRECIATED. WHEN THE INDEX FOR A SPECIFIC YEAR IS 100 IT IMPLIES THAT ON A TRADE WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES,

5.FOR DIRECT QUOTES, $/FC, IF NEER >100 IT IMPLIES THE $ DEPRECIATED; AND IF NEER

6.COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: CANADA, MEXICO, BRAZIL, JAPAN, GERMANY, FRANCE, UK, CHINA, TAIWAN, S. KOREA, SINGAPORE, INDIA. S. AFRICA AND RUSSIA.

7.DATA SOURCES: FC/$ EXCHANGE RATES COULD BE OBTAIONED FROM SEVERAL SOURCES, INCLUDING THE FOLLWING: THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS AVAILABLE IN THE LIBRARY OR ON THE WEB), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, OR WEB BASED SOURCES. (IN PAST ASSIGNMENTS, MANY OF MY STUDENTS DID THEIR RESEARCH ENTIRELY ON THE WEB)

8.U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES, AVAILABLE IN THE LIBRARY), OR THE US STATISTICAL ABSTRACT, OR FROM THE PRESIDENT'S ECONOMIC REPORT (ALL OF THE ABOVE SOURCES ARE AVAILABLE ON THE WEB)

II.REAL EFFECTIVE EXCHANGE RATE ("REER") INDEX[1]

REER FC/$ t+1= ?[(P us, t+1/ P us, t) x (FC/$ n, t+1/ FC/$ n, t) / (P n, t+1/ P n, t ]W n, t

Where the variables are defined as follows:

- t = 2005 to 2015,

- Pus and P fc are the consumer prices indexes (CPIs) for each country in year t+1 or t;

- FC/ $ is the indirect quote of currency n per the $ in year t or year t+1, where t goes from 2005 to 2015, with the base year being 2005,

- n is the number of foreign countries,

- Wn is the export share of the U.S. to each country, and

- ? the sigma applies to each from 2005 through 2015, and the REER is calculated for the sample of countries for each year, from 2005 to 2015

THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF the $ AGAINST A BASKET OF THE US MAIN TRADING PARTNERS. THE MODEL SHOULD BE DERIVED FOR 2005 THROUGH 2015, AND YIELD AN INDEX FOR EACH YEAR. THE INDEX SHOULD BE CALCULATED ON A 1.00 BASIS OR ON A 100% BASIS, WHICH IS MORE COMMONLY DONE.

1.FOR INDIRECT QUOTES, FC/$, IF THE INDEX=100 IT IMPLIES THAT ON A WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES; IF THE INDEX> 100 IT IMPLIES THAT THE $ APPRECIATED ON A REAL EFFECTIVE BASIS; AND IF REER

2.COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: THE SAME COUNTRIES LISTED UNDER THE NEER ABOVE.

3.U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES), OR THE US STATISTICAL ABSTRACT, OR FROM THE PRESIDENT'S ECONOMIC REPORT (ALL OF WHICH ARE AVAILABLE FROM THE WEB)

4.PRICE DATA COULD BE OBTAINED FROM THE IMF (CITED ABOVE), AND SHOULD INCLUDE THE CONSUMER PRICE INDEX (LINE 64 IN EACH COUNTRY DATA PAGE); BUT OTHER PRICE INDEXES COULD BE USED INSTEAD, INCLUDING THE WHOLESALE PRICE INDEX, ETC.

5.DATA SOURCES: FC/$ EXCHANGE RATES COULD BE OBTAIONED FROM THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, ETC. (CURRENCY RATES COULD BE RETRIEVED FROM THE WEB, EXCEPT FOR THE IMF DATA)

[1]SOURCES:

1.SEE OUR TEXTBOOK

2.FEDERAL RESERVE BULLETIN, NEW SUMMARY MEASURES OF THE FOREIGN EXCGANGE VALUE OF THE DOLLAR, OCTOBER 1998, Pp. 811-818

3.LUCI ELLIS, MEASURING THE REAL EXCHANGE RATE: PITTFALLS AND PRACTICALITIES, RESERVE BANK OF AUSTRALIA, AUGUST 2001

![t+1 / FC/ $ n, t] W n, twhere the variable are](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e464519f5b5_92166e4645139d1a.jpg)

CLASSHOLTS FOR DISCUSSION, PROP HARVEY POHLACHEK, FALL 2020 THE APPLICATION OF THE PPP & DERIVATION OF THE REEK INDEX L THEDATA INITIAL YA LATER YAS IFC OSTOTO 1834 RITA LDCAMNG THE YEAR END CIRATEDY APPLYING THE FOLLOWING MODEL: GIPPPOPE PER OROCO THERE THE THEORETICAL RATE THAT SHOULD PAPA. PIR THE PPP MCCAL IDEAMING THE ACER DY APPLING THE FOLLOWING MOOOL: MOOPPPHOLOT P CAMCA1) INFLATION CIT APEC +FLY CATS FO APPRECIATION CHIEFC . INFLATION OFF -1.11% IMPLICATIONS-THE FO APPRECIATED DICEAMELY, THE GUNCERVALUED, THEPPPFALED TOHOLD THE ROTA GLOW 10%REFLECTING THE PAP DECLINE OF THESE. THEFC ALTERNATIVE DERMATION OF THE ROCA WITH NORECT QUOTE-TOLOS MARIARALTS MAFCROGK PERSPECTIVE OF THE ROCA DERMATION 101.254 THE RESULTS EQUMALENT TO THE RECIPROCAL OF THE RITA FOR THE; Y. SHAPIRO (TEXTBOOK) PR. T-T, DERIVATION OF THE BEER FROM THE $ & YEN PERSPECTIVES 1. DATAFROM THE TEXTIRIONAGFOLLOWS INITIAL YA LATER: YAS CAUS CAI Japan R. COPPPHOLOY P CAMCA1)1 RELATION OFF PIPIN1+PI SCHEFC . INFLATION OFF, WHICH MPLE THAT THESE WSTLYUNDERWLUDD & THE YEN OVERVALUED ON APPPIE MDIT SHOULD GROLECTION THEROTA OF THESAID WONFROM THER REPECTME AASPECTME I CERMATION OF THE RITA FROM THE ; PERSPECTIVE A: 0 THE ROTA SUGGESTS THAT THE DECLINE ON APPPOEM TO THE FRONTSECHAWAIAN THE RITUAL PERIOD. . HOW DO THE YEN EVOLVE DURING THE SME PIRIOCT THE YEN RITA SUGGESTS THAT IT APPRECIAT 1TOME THATE MAPPRECIATION OF TONEFROM THE WITH PIRKOTHE PURCHASING POWER PARITY (PPP) NOTES FOR CLASS DISCUSSION PROF CURTLY FONIACHIK, FALL 2020 THE LAW F ONE HIKE, THE KNELL ING PIRTLE OF THE HI, MANTAS THAT FOOLS ME RITE S ALLY EVERY VILLE, WIEN STATED NA COMMINC THE IT HS TWO YELETS THE AXLUTE AND THE BELATTE L THE ABSOLUTE VERSION OF THE PPP LPHOPE I STATES THAT A PRODUCT HIKES NOLLALS FA S THE SAVE ABLOG VIEN THE EXTRAME LATE BUTLED 4 2 MAKESTS THAT CHANCES IN THE HIKE IN THE IS AND ATLAS VOLLD AFFECT THE EXCHANGE LATE SO THAT FCLEELUM WOULD ALWAYS BE RESTORED IL THE RELATIVE VERSION OF THE PPP THE BELATTE WHEN RELATES THE LATE C CARE C ROSS A TIE CRY LATE T. IS - HI K] - 3 0 1)1 8 0) AN APPROXIMATION & IS -I gTHIS : 80 - 8 01) CURRENCY FORCASTING MODEL IL REAL EFFECTIVE EXCHANGE RATE (HEER) INDEX THE PEER INDEX MEASURES WHETHER THE RELATIONSHIP BETWEEN INFLATION AND THE EXCHANGE RATE IS OBSERVED, AS FOLLOWS IV. NOMINAL EFFECTIVE EXCHANGE RATE (HEER) INDEX THE NEER INDEX MEASURES THE EVOLUTION OF, BAY, THE $ AGAINST A BASKET OF THE US MUN TRADING PARTNERS . FOR DIRECT QUOTES, SFC IF THE INDEX-TION) IT IMPLIES THAT ON A WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES, FOR DIRECT QUOTES, SFC IF NEEK TO) IT IMPLIES THE $ DEPRECIATED, AND IF NEER . TOO, IT IMPLIES THAT THE $ APPRECIATED\fCROSS EXCHANGE RATES & EXCHANGE RATE CHANGES PROF. HARVEY PONIACHEK, INT'L FIN MKTS, FALL 2020 THE FOLLOWING EXAMPLE ILLUSTRATES (1) HOW TO DERIVE CROSS EXCHANGE RATES; AND (2) HOW TO DETERMINE EXCHANGE RATE CHANGES FROM DIFFERENT PERSPECTIVES. PART 1: EXCHANGE RATE DERIVATION BASED ON CROSS EX RATES 1 THAILAND'S BAHT (TB) 2 3 TB/SDR 35.8560 4 $/SDR 1.3840 5 6 DERIVATION OF THE TB/$ THROUGH THE CROSS EXCHANGE RATE, AS FOLLOWS: 7 TB/$=TB/SDR/($/SDR)=TB/$ 25.9075 INITIAL TIME PERIOD B 9 TB/$ 32.1000 A YEAR LATER 10 11 PART2, DETERMINATION OF EXCHANGE RATE CHANGES 12 13 FROM THAILAND'S PERCEPTIVE, BY HOW MUCH HAS THE $ CHANGED? 14 %CH TB/$=[(E-ByB]'100=[(32.1-25.9075)25.9075]'100= 23.90% 15 CONCLUSION, THE $ APPRECIATED BY 23.90% 16 17 U.S. PERSPECTIVE, THAT IS, BY HOW MUCH HAS THE TB CHANGED? 18 %CH $/TB=[(E-ByB]*100=[(1/32. 10 - 1/25.9075)(1/25.9075)]*100= -19.29% 19 CONCLUSION, THE TB DEPRECIATED BY 19.29% 20 21 PART 2-A: A SHORT CUT TO DETERMINE THE BT CHANGE BY USING INDIRECT QUOTES 22 %CH $/TB=[(E-BYB]*100, NOW WE INSERT THE RECIPROCAL RATES AS FOLLOWS: 23 %CH $/TB=[(1/E- 1/BY(1/B]*100=B/E - 1 = (B-EVE, THUS, WE CAN DERIVE THE % CHANGE BY 24 APPLYING THE FORMULA ON LINE # 24 AS SHOWN AND UTILIZE INDIRECT EXCHANGE RATES, AS SHOWN BELOW: 25 %%CH $/TB=[(B-EVE]*100= -19.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts