Question: ITICAL THINKING CASES 571 14.1 Comparing Pension Plan Features Linda Calloway and Meredith Perdue are neighbors in Charleston. Linda works as a software engine for

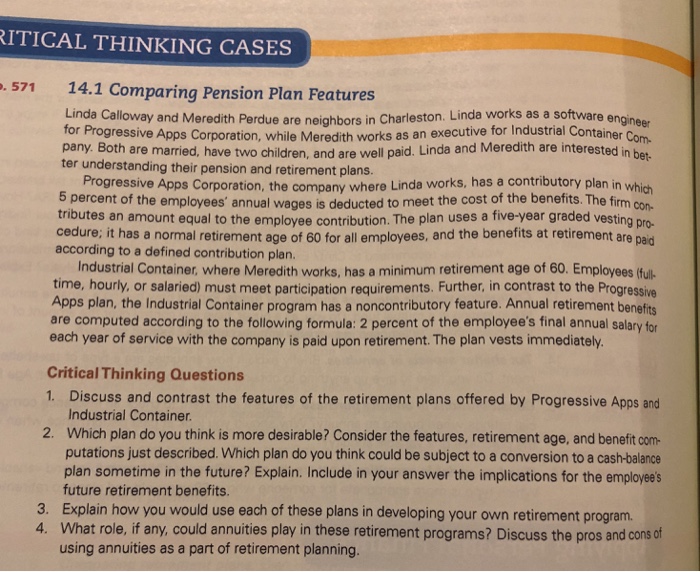

ITICAL THINKING CASES 571 14.1 Comparing Pension Plan Features Linda Calloway and Meredith Perdue are neighbors in Charleston. Linda works as a software engine for Progressive Apps Corpor pany. Both are married, have two ter understanding their pension and retirement plans. ration, while Meredith works as an executive for Industrial Conti children, and are well paid. Linda and Meredith are interest in bet- Progressive Apps Corporation, the company wher e Linda works, has a contributory plan lan in which 5 percent of the employees' annual wages is deducted to meet the cost of the benefits. The firm con- tributes an amount equal to the employee contribution. The plan uses a five-year graded vesting pr cedure; it has a normal retirement age of 60 for all employees, and the benefits at retirement are paid according to a defined contribution plan Industrial Container, where Meredith works, has a minimum retirement age of 60. Employees (ful time, hourly, or salaried) must meet participation requirements. Further, in contrast to the Progressive Apps plan, the Industrial Container program has a noncontributory feature. Annual retirement benefits are computed according to the following formula: 2 percent of the employee's final annual salary for each year of service with the company is paid upon retirement. The plan vests immediately. Critical Thinking Questions Discuss and contrast the features of the retirement plans offered by Progressive Apps and Industrial Container Which plan do you think is more desirable? Consider the features, retirement age, and benefit com putations just described. Which plan do you think could be subject to a conversion to a cash-balance plan sometime in the future? Explain. Include in your answer the implications for the employee's future retirement benefits. Explain how you would use each of these plans in developing your own retirement program What role, if any, could annuities play in these retirement programs? Discuss the pros and cons of using annuities as a part of retirement planning 1. 2. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts