Question: it's a financial mathematics problem 2. (10 pt each) Today is 05/01/20xx. You have a commodity to sell in a month, and you would like

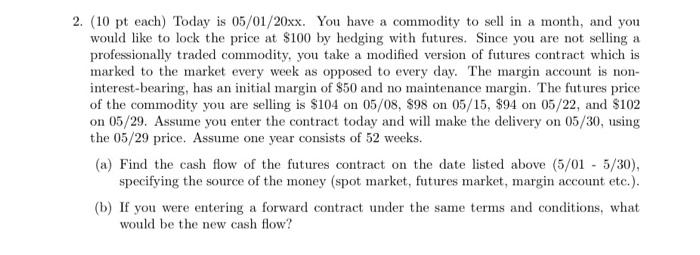

2. (10 pt each) Today is 05/01/20xx. You have a commodity to sell in a month, and you would like to lock the price at $100 by hedging with futures. Since you are not selling a professionally traded commodity, you take a modified version of futures contract which is marked to the market every week as opposed to every day. The margin account is non- interest-bearing, has an initial margin of $50 and no maintenance margin. The futures price of the commodity you are selling is $104 on 05/08, 898 on 05/15, $94 on 05/22, and $102 on 05/29. Assume you enter the contract today and will make the delivery on 05/30, using the 05/29 price. Assume one year consists of 52 weeks. (a) Find the cash flow of the futures contract on the date listed above (5/01 - 5/30), specifying the source of the money (spot market, futures market, margin account etc.). (b) If you were entering a forward contract under the same terms and conditions, what would be the new cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts