Question: It's a general perception by accounting professionals, that there is a solution to every accounting problem. It's like living in a denial, but actually there

It's a general perception by accounting professionals, that there is a solution to every accounting

problem. It's like living in a denial, but actually there are many issues that remain unresolved after

having the knowledge of mere accounting. Salim gets admission in a college and advised by his

close friends to take a major in accounting. Accounting will help Salim to acquire knowledge about

the laws that govern business, the ethics of accountancy, statistics, and accounting theory. He will

learn how to prepare the key documents that his job will involve, including business proposals,

financial statements and tax returns.

Like accounting, accounting theory also provides a basis for prediction and explanation of

accounting behaviors and events. It guides the development of new practices and procedures and

help to understand current development in accounting practice. The accounting theory also

provides the knowledge of Generally Accepted Accounting Principles, Contemporary issues and

other developments in the field. Salim, being an accounting student is well aware about all the

latest developments according to the particular guidelines.

a. In your opinion, why Salim should focus on understanding the problems of accounting practices

and profession. Why is there a need of construction of accounting theory? Explain your answer.

(5 Marks)

b. Accounting theory serves as a frame of reference which is used to judge a particular technique

of accounting. As per your understanding, explain how frame of reference would be structured in

accounting theory? (5 Marks)

: Please answer all the questions

1. Considering the value of an audit, which item involves: company

managers will invite the audit so they will be compensated properly

for their work??

a. Capital allocation theory

b. Motivation Theory

c. Principal/Agent theory

d. Professional skepticism theory

2 "A practitioner is engaged to issue a report ... on subject matter,

or an assertion about subject matter, that is the responsibility

of another party." relates to

a. Accounting service.

b. Assurance service.

c. Attest service.

d. Financial audit service.

3. A financial audit is related to which economic factor of

production?

a. Allocation of financial capital

b. Labor

c. Land

d. Manufacturing

4.Which of the following terms is associated with the auditing

standard stating:

In rare circumstances, the auditor may judge it necessary to

depart from a relevant presumptively mandatory requirement.

In such circumstances, the auditor should perform alternative

procedures to achieve the intent of the requirement. AU-C200.26

a. Canc. Must

b. Mayd. Should

5. Consider the charity CARE [assume that it is a USA Not-for-profit

entity]. An audit of CARE would follow auditing standards issued by:

a. AICPA's Auditing Standards Board

b. Financial Accounting Standards Board

c. International Auditing and Assurance Standards Board

d. Public Company Accounting Oversight Board

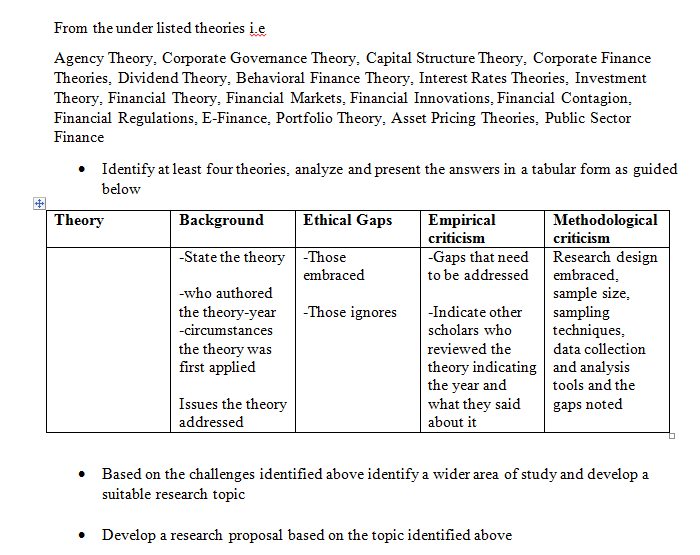

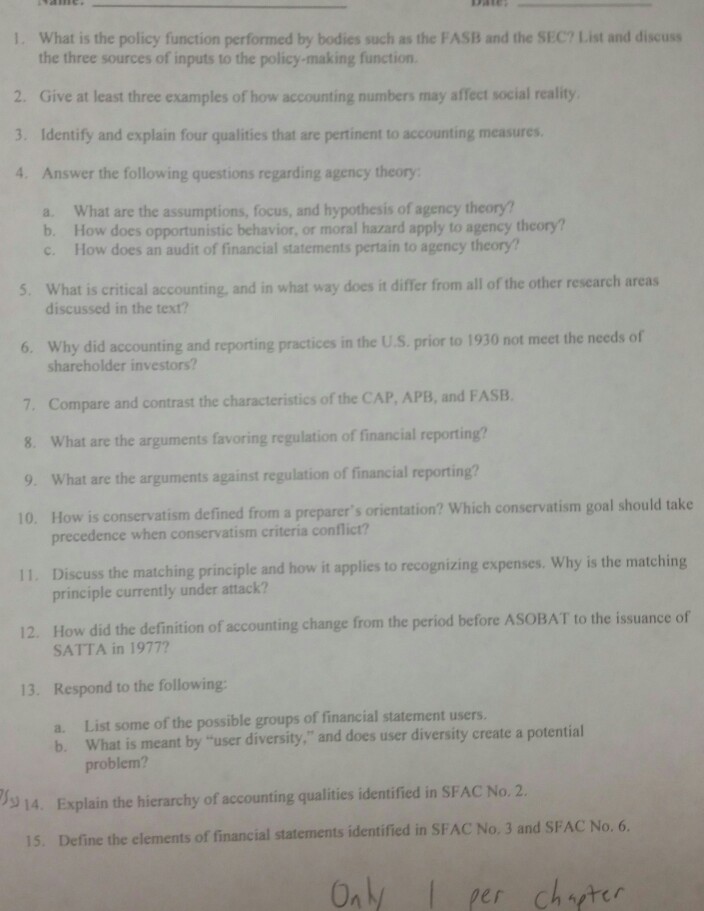

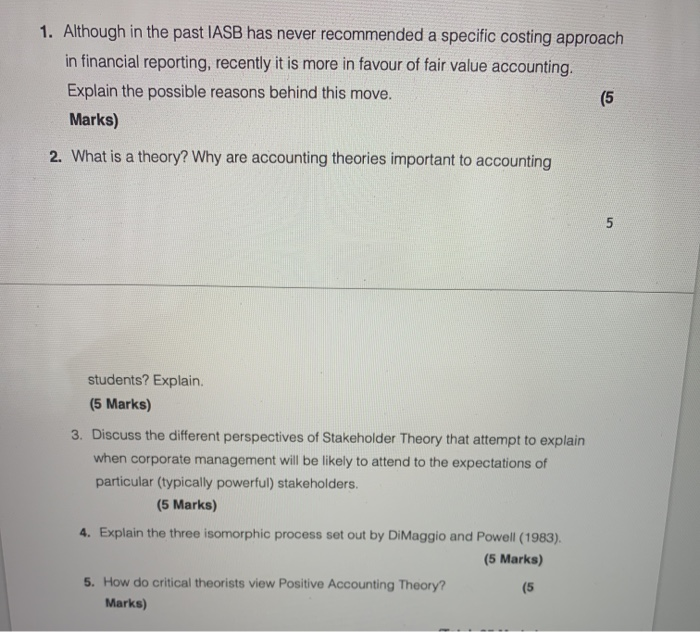

e. Securities and Exchange Commission

From the under listed theories i.e Agency Theory, Corporate Governance Theory, Capital Structure Theory, Corporate Finance Theories, Dividend Theory, Behavioral Finance Theory, Interest Rates Theories, Investment Theory, Financial Theory, Financial Markets, Financial Innovations, Financial Contagion, Financial Regulations, E-Finance, Portfolio Theory, Asset Pricing Theories, Public Sector Finance . Identify at least four theories, analyze and present the answers in a tabular form as guided below Theory Background Ethical Gaps Empirical Methodological criticism criticism State the theory -Those -Gaps that need Research design embraced to be addressed embraced. -who authored sample size, the theory-year -Those ignores -Indicate other sampling -circumstances scholars who techniques, the theory was reviewed the data collection first applied theory indicating and analysis the year and tools and the Issues the theory what they said gaps noted addressed about it . Based on the challenges identified above identify a wider area of study and develop a suitable research topic . Develop a research proposal based on the topic identified above1. What is the policy function performed by bodies such as the FASB and the SEC? List and discuss the three sources of inputs to the policy-making function. 2. Give at least three examples of how accounting numbers may affect social reality 3. Identify and explain four qualities that are pertinent to accounting measures. 4. Answer the following questions regarding agency theory: a. What are the assumptions, focus, and hypothesis of agency theory? b. How does opportunistic behavior, or moral hazard apply to agency theory? c. How does an audit of financial statements pertain to agency theory? 5. What is critical accounting, and in what way does it differ from all of the other research areas discussed in the text? 6. Why did accounting and reporting practices in the U.S. prior to 1930 not meet the needs of shareholder investors? 7. Compare and contrast the characteristics of the CAP, APB, and FASB. 8. What are the arguments favoring regulation of financial reporting? 9. What are the arguments against regulation of financial reporting? 10. How is conservatism defined from a preparer's orientation? Which conservatism goal should take precedence when conservatism criteria conflict? 1 1. Discuss the matching principle and how it applies to recognizing expenses. Why is the matching principle currently under attack? 12. How did the definition of accounting change from the period before ASOBAT to the issuance of SATTA in 1977? 13. Respond to the following: . List some of the possible groups of financial statement users. b. What is meant by "user diversity," and does user diversity create a potential problem? 14. Explain the hierarchy of accounting qualities identified in SFAC No. 2. 15. Define the elements of financial statements identified in SFAC No. 3 and SFAC No. 6. Only I per chapter1. Although in the past IASB has never recommended a specific costing approach in financial reporting, recently it is more in favour of fair value accounting. Explain the possible reasons behind this move. (5 Marks) 2. What is a theory? Why are accounting theories important to accounting 5 students? Explain. (5 Marks) 3. Discuss the different perspectives of Stakeholder Theory that attempt to explain when corporate management will be likely to attend to the expectations of particular (typically powerful) stakeholders. (5 Marks) 4. Explain the three isomorphic process set out by DiMaggio and Powell (1983). (5 Marks) 5. How do critical theorists view Positive Accounting Theory? (5 Marks)