Question: Its a matching exercise. Please find the applicable comment in the Content Section for each item in the IPS Section List and enter the letter

Its a matching exercise. Please find the applicable comment in the Content Section for each item in the IPS Section List and enter the letter of the comment in the Content Section column of the IPS Section List.

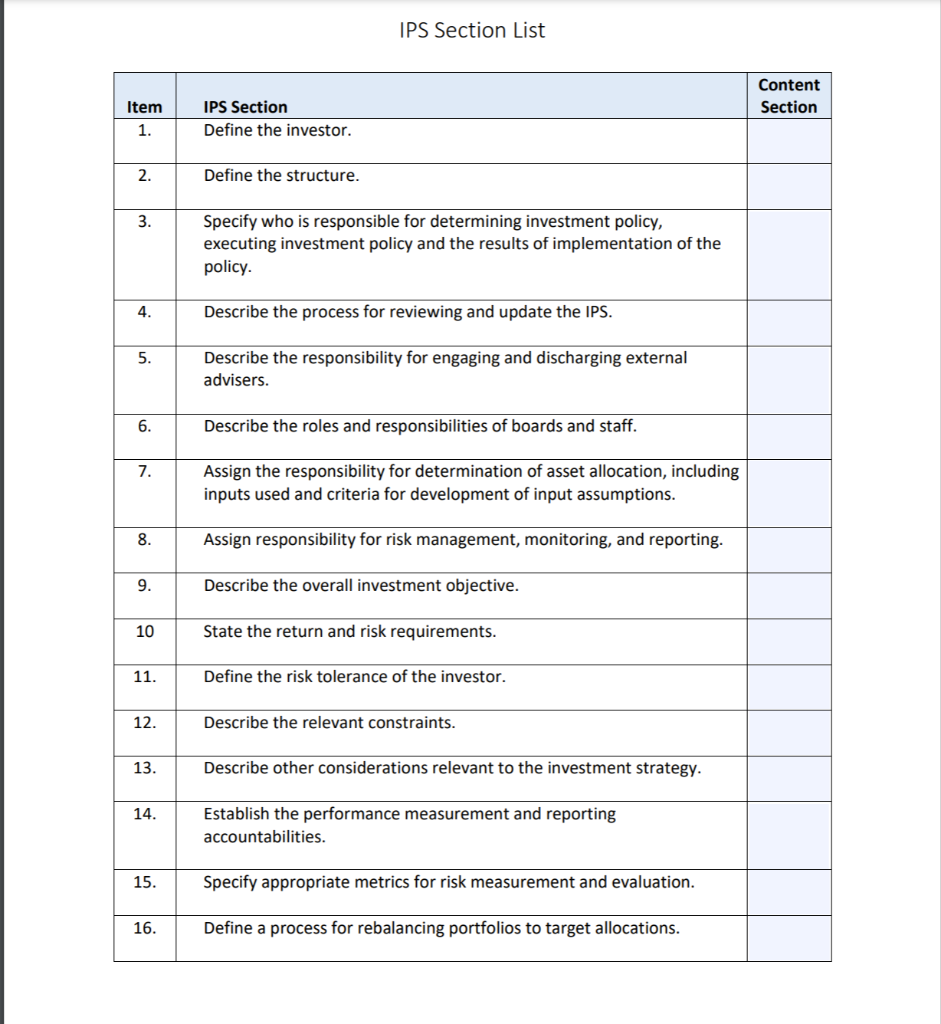

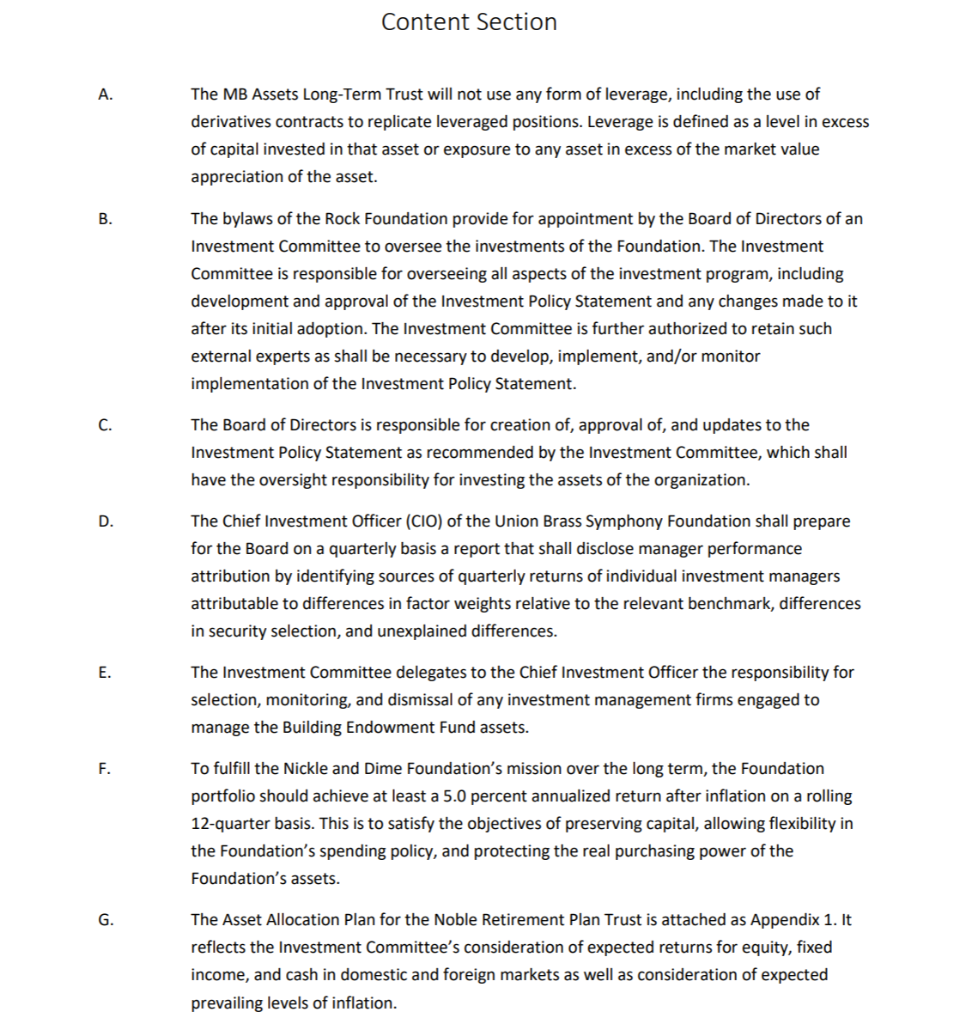

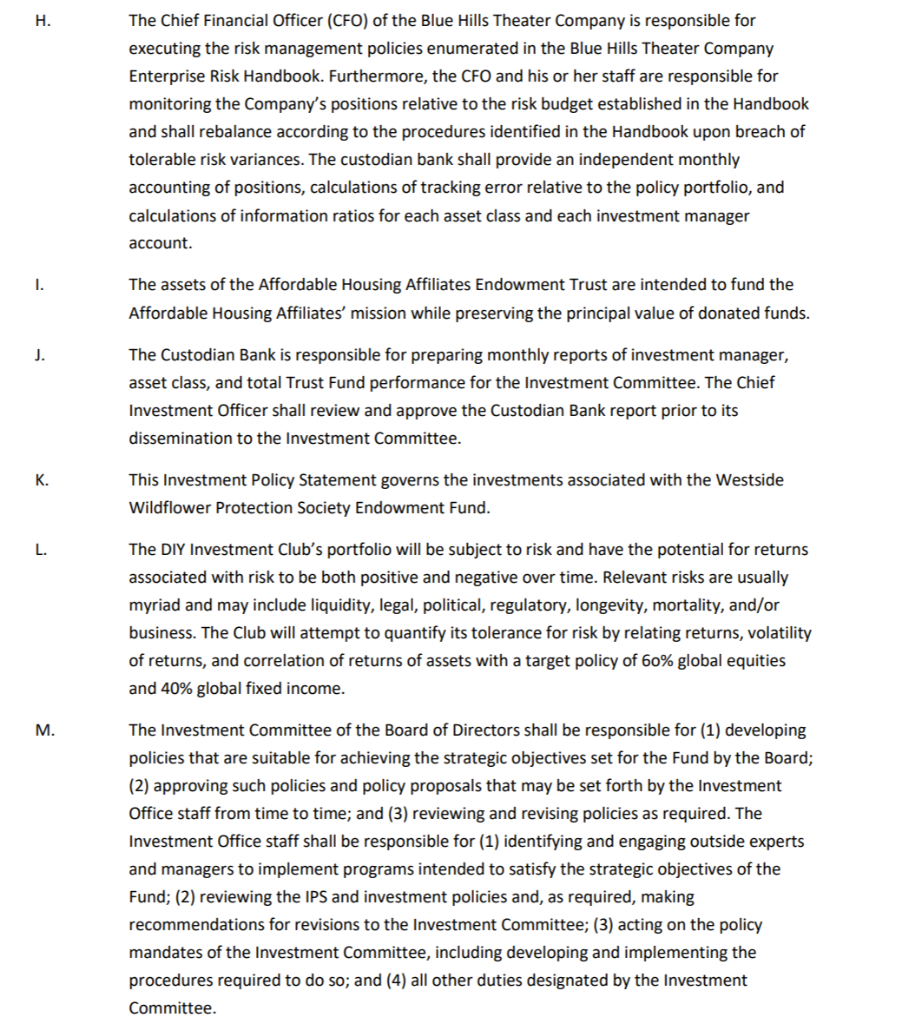

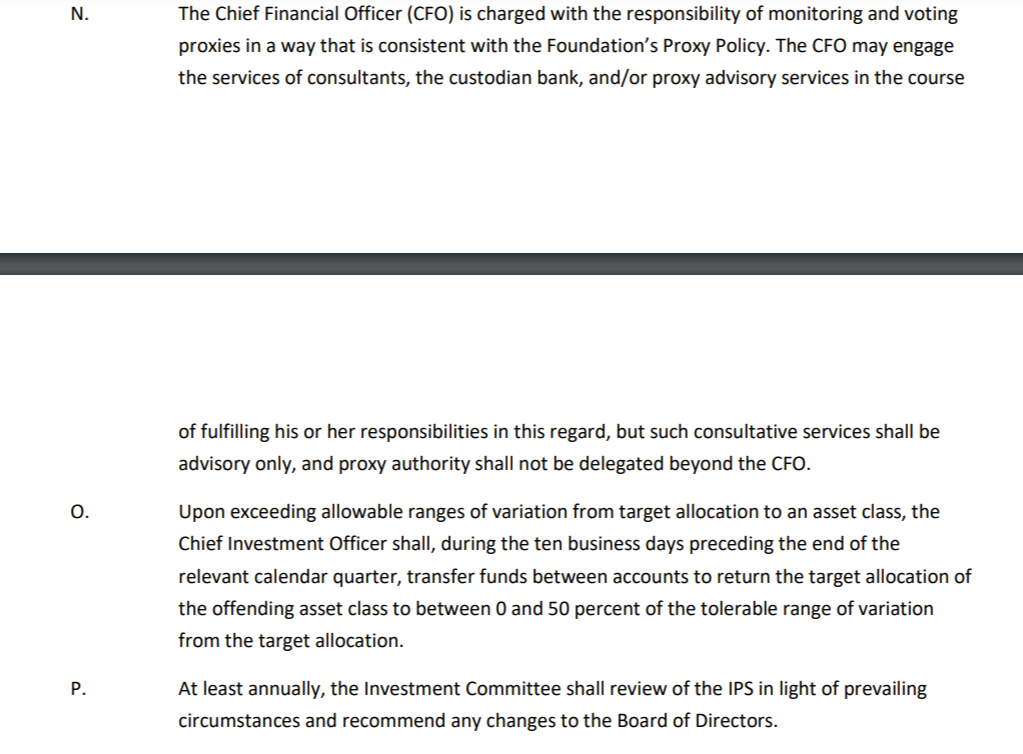

IPS Section List Content Section Item 1. IPS Section Define the investor. 2. Define the structure. 3. Specify who is responsible for determining investment policy, executing investment policy and the results of implementation of the policy. 4. Describe the process for reviewing and update the IPS. 5. Describe the responsibility for engaging and discharging external advisers. 6. Describe the roles and responsibilities of boards and staff. 7. Assign the responsibility for determination of asset allocation, including inputs used and criteria for development of input assumptions. 8. Assign responsibility for risk management, monitoring, and reporting. 9. Describe the overall investment objective. 10 State the return and risk requirements. 11. Define the risk tolerance of the investor. 12. Describe the relevant constraints. 13. Describe other considerations relevant to the investment strategy. 14. Establish the performance measurement and reporting accountabilities. 15. Specify appropriate metrics for risk measurement and evaluation. 16. Define a process for rebalancing portfolios to target allocations. Content Section A. The MB Assets Long-Term Trust will not use any form of leverage, including the use of derivatives contracts to replicate leveraged positions. Leverage is defined as a level in excess of capital invested in that asset or exposure to any asset in excess of the market value appreciation of the asset. B. The bylaws of the Rock Foundation provide for appointment by the Board of Directors of an Investment Committee to oversee the investments of the Foundation. The Investment Committee is responsible for overseeing all aspects of the investment program, including development and approval of the Investment Policy Statement and any changes made to it after its initial adoption. The Investment Committee is further authorized to retain such external experts as shall be necessary to develop, implement, and/or monitor implementation of the Investment Policy Statement. C. The Board of Directors is responsible for creation of, approval of, and updates to the Investment Policy Statement as recommended by the Investment Committee, which shall have the oversight responsibility for investing the assets of the organization. D. The Chief Investment Officer (CIO) of the Union Brass Symphony Foundation shall prepare for the Board on a quarterly basis a report that shall disclose manager performance attribution by identifying sources of quarterly returns of individual investment managers attributable to differences in factor weights relative to the relevant benchmark, differences in security selection, and unexplained differences. E. The Investment Committee delegates to the Chief Investment Officer the responsibility for selection, monitoring, and dismissal of any investment management firms engaged to manage the Building Endowment Fund assets. F. To fulfill the Nickle and Dime Foundation's mission over the long term, the Foundation portfolio should achieve at least a 5.0 percent annualized return after inflation on a rolling 12-quarter basis. This is to satisfy the objectives of preserving capital, allowing flexibility in the Foundation's spending policy, and protecting the real purchasing power of the Foundation's assets. G. The Asset Allocation Plan for the Noble Retirement Plan Trust is attached as Appendix 1. It reflects the Investment Committee's consideration of expected returns for equity, fixed income, and cash in domestic and foreign markets as well as consideration of expected prevailing levels of inflation. H. The Chief Financial Officer (CFO) of the Blue Hills Theater Company is responsible for executing the risk management policies enumerated in the Blue Hills Theater Company Enterprise Risk Handbook. Furthermore, the CFO and his or her staff are responsible for monitoring the Company's positions relative to the risk budget established in the Handbook and shall rebalance according to the procedures identified in the Handbook upon breach of tolerable risk variances. The custodian bank shall provide an independent monthly accounting of positions, calculations of tracking error relative to the policy portfolio, and calculations of information ratios for each asset class and each investment manager account. 1. The assets of the Affordable Housing Affiliates Endowment Trust are intended to fund the Affordable Housing Affiliates' mission while preserving the principal value of donated funds. J. The Custodian Bank is responsible for preparing monthly reports of investment manager, asset class, and total Trust Fund performance for the Investment Committee. The Chief Investment Officer shall review and approve the Custodian Bank report prior to its dissemination to the Investment Committee. K. This Investment Policy Statement governs the investments associated with the Westside Wildflower Protection Society Endowment Fund. L. The DIY Investment Club's portfolio will be subject to risk and have the potential for returns associated with risk to be both positive and negative over time. Relevant risks are usually myriad and may include liquidity, legal, political, regulatory, longevity, mortality, and/or business. The Club will attempt to quantify its tolerance for risk by relating returns, volatility of returns, and correlation of returns of assets with a target policy of 60% global equities and 40% global fixed income. M. The Investment Committee of the Board of Directors shall be responsible for (1) developing policies that are suitable for achieving the strategic objectives set for the Fund by the Board; (2) approving such policies and policy proposals that may be set forth by the Investment Office staff from time to time; and (3) reviewing and revising policies as required. The Investment Office staff shall be responsible for (1) identifying and engaging outside experts and managers to implement programs intended to satisfy the strategic objectives of the Fund; (2) reviewing the IPS and investment policies and, as required, making recommendations for revisions to the Investment Committee; (3) acting on the policy mandates of the Investment Committee, including developing and implementing the procedures required to do so; and (4) all other duties designated by the Investment Committee. N. The Chief Financial Officer (CFO) is charged with the responsibility of monitoring and voting proxies in a way that is consistent with the Foundation's Proxy Policy. The CFO may engage the services of consultants, the custodian bank, and/or proxy advisory services in the course of fulfilling his or her responsibilities in this regard, but such consultative services shall be advisory only, and proxy authority shall not be delegated beyond the CFO. 0. Upon exceeding allowable ranges of variation from target allocation to an asset class, the Chief Investment Officer shall, during the ten business days preceding the end of the relevant calendar quarter, transfer funds between accounts to return the target allocation of the offending asset class to between 0 and 50 percent of the tolerable range of variation from the target allocation. P. At least annually, the Investment Committee shall review of the IPS in light of prevailing circumstances and recommend any changes to the Board of Directors. IPS Section List Content Section Item 1. IPS Section Define the investor. 2. Define the structure. 3. Specify who is responsible for determining investment policy, executing investment policy and the results of implementation of the policy. 4. Describe the process for reviewing and update the IPS. 5. Describe the responsibility for engaging and discharging external advisers. 6. Describe the roles and responsibilities of boards and staff. 7. Assign the responsibility for determination of asset allocation, including inputs used and criteria for development of input assumptions. 8. Assign responsibility for risk management, monitoring, and reporting. 9. Describe the overall investment objective. 10 State the return and risk requirements. 11. Define the risk tolerance of the investor. 12. Describe the relevant constraints. 13. Describe other considerations relevant to the investment strategy. 14. Establish the performance measurement and reporting accountabilities. 15. Specify appropriate metrics for risk measurement and evaluation. 16. Define a process for rebalancing portfolios to target allocations. Content Section A. The MB Assets Long-Term Trust will not use any form of leverage, including the use of derivatives contracts to replicate leveraged positions. Leverage is defined as a level in excess of capital invested in that asset or exposure to any asset in excess of the market value appreciation of the asset. B. The bylaws of the Rock Foundation provide for appointment by the Board of Directors of an Investment Committee to oversee the investments of the Foundation. The Investment Committee is responsible for overseeing all aspects of the investment program, including development and approval of the Investment Policy Statement and any changes made to it after its initial adoption. The Investment Committee is further authorized to retain such external experts as shall be necessary to develop, implement, and/or monitor implementation of the Investment Policy Statement. C. The Board of Directors is responsible for creation of, approval of, and updates to the Investment Policy Statement as recommended by the Investment Committee, which shall have the oversight responsibility for investing the assets of the organization. D. The Chief Investment Officer (CIO) of the Union Brass Symphony Foundation shall prepare for the Board on a quarterly basis a report that shall disclose manager performance attribution by identifying sources of quarterly returns of individual investment managers attributable to differences in factor weights relative to the relevant benchmark, differences in security selection, and unexplained differences. E. The Investment Committee delegates to the Chief Investment Officer the responsibility for selection, monitoring, and dismissal of any investment management firms engaged to manage the Building Endowment Fund assets. F. To fulfill the Nickle and Dime Foundation's mission over the long term, the Foundation portfolio should achieve at least a 5.0 percent annualized return after inflation on a rolling 12-quarter basis. This is to satisfy the objectives of preserving capital, allowing flexibility in the Foundation's spending policy, and protecting the real purchasing power of the Foundation's assets. G. The Asset Allocation Plan for the Noble Retirement Plan Trust is attached as Appendix 1. It reflects the Investment Committee's consideration of expected returns for equity, fixed income, and cash in domestic and foreign markets as well as consideration of expected prevailing levels of inflation. H. The Chief Financial Officer (CFO) of the Blue Hills Theater Company is responsible for executing the risk management policies enumerated in the Blue Hills Theater Company Enterprise Risk Handbook. Furthermore, the CFO and his or her staff are responsible for monitoring the Company's positions relative to the risk budget established in the Handbook and shall rebalance according to the procedures identified in the Handbook upon breach of tolerable risk variances. The custodian bank shall provide an independent monthly accounting of positions, calculations of tracking error relative to the policy portfolio, and calculations of information ratios for each asset class and each investment manager account. 1. The assets of the Affordable Housing Affiliates Endowment Trust are intended to fund the Affordable Housing Affiliates' mission while preserving the principal value of donated funds. J. The Custodian Bank is responsible for preparing monthly reports of investment manager, asset class, and total Trust Fund performance for the Investment Committee. The Chief Investment Officer shall review and approve the Custodian Bank report prior to its dissemination to the Investment Committee. K. This Investment Policy Statement governs the investments associated with the Westside Wildflower Protection Society Endowment Fund. L. The DIY Investment Club's portfolio will be subject to risk and have the potential for returns associated with risk to be both positive and negative over time. Relevant risks are usually myriad and may include liquidity, legal, political, regulatory, longevity, mortality, and/or business. The Club will attempt to quantify its tolerance for risk by relating returns, volatility of returns, and correlation of returns of assets with a target policy of 60% global equities and 40% global fixed income. M. The Investment Committee of the Board of Directors shall be responsible for (1) developing policies that are suitable for achieving the strategic objectives set for the Fund by the Board; (2) approving such policies and policy proposals that may be set forth by the Investment Office staff from time to time; and (3) reviewing and revising policies as required. The Investment Office staff shall be responsible for (1) identifying and engaging outside experts and managers to implement programs intended to satisfy the strategic objectives of the Fund; (2) reviewing the IPS and investment policies and, as required, making recommendations for revisions to the Investment Committee; (3) acting on the policy mandates of the Investment Committee, including developing and implementing the procedures required to do so; and (4) all other duties designated by the Investment Committee. N. The Chief Financial Officer (CFO) is charged with the responsibility of monitoring and voting proxies in a way that is consistent with the Foundation's Proxy Policy. The CFO may engage the services of consultants, the custodian bank, and/or proxy advisory services in the course of fulfilling his or her responsibilities in this regard, but such consultative services shall be advisory only, and proxy authority shall not be delegated beyond the CFO. 0. Upon exceeding allowable ranges of variation from target allocation to an asset class, the Chief Investment Officer shall, during the ten business days preceding the end of the relevant calendar quarter, transfer funds between accounts to return the target allocation of the offending asset class to between 0 and 50 percent of the tolerable range of variation from the target allocation. P. At least annually, the Investment Committee shall review of the IPS in light of prevailing circumstances and recommend any changes to the Board of Directors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts